CATEGORY

Veterinary Healthcare Services

Trials on Animal Health for the vertirinary market.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Veterinary Healthcare Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoVeterinary Healthcare Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Veterinary Healthcare Services category is 5.40%

Payment Terms

(in days)

The industry average payment terms in Veterinary Healthcare Services category for the current quarter is 73.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Veterinary Healthcare Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoVeterinary Healthcare Services market report transcript

Global Market Outlook on Veterinary Healthcare Services

-

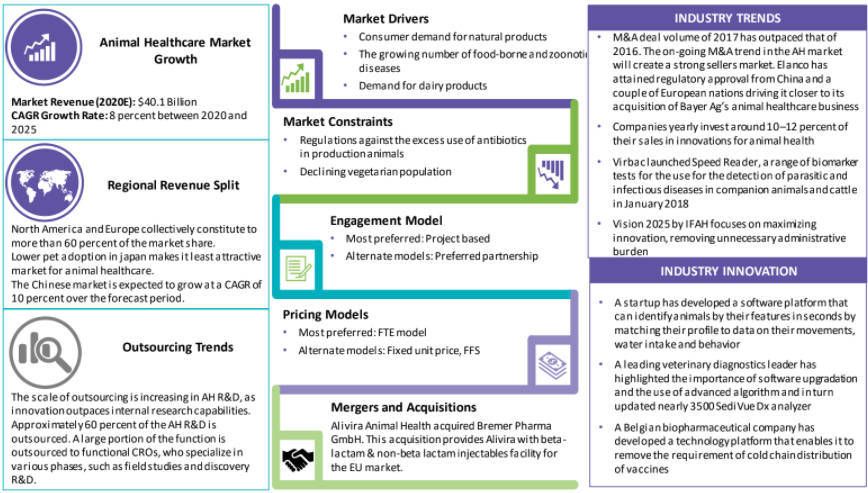

The global demand is expected to grow at approx. 8–9 percent CAGR through 2022–2028F

-

Increased upsurge in the number of animal ownership, awareness about animal health, and few requirements for the drug approval are continuously improving the market

-

Several welfare associations, along with governmental organizations, have been continuously expanding their supply through acquisitions and partnerships to provide integrated services for animal health awareness

Veterinary Healthcare Services Regional Analysis

The Veterinary Healthcare market is Latin America is expected to grow at a growth rate of 8–9 percent for the next five years. The pandemic change the focus to adapt business more towards digital. Latin America holds a wealth of opportunity for businesses growth in both petcare and livestock.

-

Pharma companies prefer engaging with contract labs closer to their manufacturing facilities, as they can avoid delay in transportation

-

Contract testing service providers (e.g., Catalent) are expanding their facilities in emerging markets, such as China and India

Global Market Share by Application Area

Market Scenario

-

The global animal health market is expected to grow at a compound annual growth rate (CAGR) of 8-9% from 2022 to 2028

-

The global demand for both commercial and companion animals is increasing and many AH solutions are relevant to both markets. E.g., the growing middle classes in China are increasing after a protein-rich diet that includes meat, eggs, and milk

-

But to meet demand, this often entails problematic farming practices, such as cramming animals into smaller spaces, which inevitably leads to the spreading of contagious diseases

-

To increase their margins, farmers are heavily reliant on feed additives and administering vaccines

-

That’s why finding innovative solutions to AH have become vital for combatting the drawbacks of modern industrial farming

-

Pet adoption rates are increasing, as people are increasingly opting for animal companionship. This may lead to the growth of the pet animal market over the coming years

-

Indian market growth is propelled by animal husbandry. About 10 percent of global livestock population belongs to India, and India is among the largest producer of cattle, chicken, and fish

Growth Drivers and Constraints : Veterinary Healthcare Services

Drivers

-

Consumers’ demand for natural products and food processor’s demand for transparent labeling would drive the demand of Animal Healthcare categories

-

Development in micro-encapsulation techniques and packaging innovation would give thrust to carotenoid market

-

The growing number of foodborne and zoonotic diseases is also fueling the animal healthcare market

-

Extensive implementation of animal vaccination programs and mandatory animal vaccination in some countries will propel the market growth

-

Growing pet adoption and spend on their healthcare by people, due to favorable government initiatives and increasing disposable incomes in emerging economies

-

Increased incidence of zoonotic-related diseases in the coming months and the better understanding of COVID-19 infection toward companion animals from better research/clinical trial is bound to drive the overall animal healthcare market

Constraints

-

Regulations against the excess use of antibiotics in production animals, and legislations and protest of animal activists and institutions against animal research

-

Declining veterinarian population is also posing a challenge to the animal healthcare industry

-

As a result of the COVID-19 pandemic, veterinarians are trying to limit contact with patients and providing services only to critically ill animals. With addition burden on social distancing and expenditure to acquire PPE veterinarians are increasingly feeling the pressure monetary wise and struggling to be viable financially

-

The misconception among the general population that animals could be at a higher risk of contracting COVID-19 has resulted in the abandonment of companion animals, which is also posing a threat to the animal healthcare industry overall

Key Outsourcing Trends

-

The scale of outsourcing is increasing in AH R&D, as innovation outpaces internal research capabilities

-

A large portion of the functions are outsourced to functional CROs, who specialize in various phases, such as field studies and discovery R&D

-

Off-shoring to the emerging markets, unlike human health R&D, is restricted, owing to that fact that field studies ought to be done in the target commercial markets and the poor track record of discovery/innovation in the developing markets

-

Hence, the US and the EU would be the leading destinations for contracted work and are likely to account for over 50 percent of the AH CRO market

Veterinary Healthcare Services Market Trends

Innovation: A competitive landscape among the top companies has led to the introduction of new products and vaccines with a view to strengthen their position in the market. Companies yearly invest around 10–12 percent of their sales in innovations for animal health. However, the low research and development returns might shift their focus into mergers and acquisition, leading to market consolidation. Rise in popularity of eHealth and telehealth apps amid the COVID-19 pandemic is fueling the market sales in this space.

-

The AH market is currently fragmented with the top 10 AH companies accounting for less than ~75 percent of the global sales. Industry consolidation over the last decade has resulted in high market share concentration

-

However, the market is volatile because of the large number of mergers and acquisitions taking place in the market. In June 2020, Elanco has been successful in getting approval from certain EU markets and China for its acquisition of Bayer AG’s animal healthcare business

-

Approximately 3.2 million shelter animals are adopted each year in the US

-

Globally, the adoption of animals has increased, thereby fueling the growth of AH market

-

Harmonization with other countries is the sole focus in the US regulatory systems with regards to the animal healthcare sector

-

Vision 2025 by IFAH focuses on maximizing innovation, removing unnecessary administrative burden. As countries, like Finland, do not have many authorized vet medicines, the vision will improve available drugs on market

-

Zoonotic diseases in humans are mostly transferred through livestock. Thus, there is a widespread implementation of animal vaccination programs. Some countries are also adopting mandatory animal vaccination, which might propel business growth

-

The increase in zoonotic diseases and compulsory animal immunization by regulatory authorities might fuel growth of the companion animal market

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.