CATEGORY

Urea

Urea represents half of the total nitrogen output and will contribute to two-thirds of the projected ammonia capacity increment over the next five years.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Urea.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Meghmani Crop Nutrition Ltd (MCNL) to set up a Nano/liquid urea plant in India by 2024.

February 01, 2023Plant Shutdown

July 19, 2022Meghmani Crop Nutrition Ltd (MCNL) to set up a Nano/liquid urea plant in India by 2024.

February 01, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Urea

Schedule a DemoUrea Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoUrea Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Urea category is 4.70%

Payment Terms

(in days)

The industry average payment terms in Urea category for the current quarter is 25.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Urea market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoUrea market report transcript

Global Market Outlook on Urea

-

The urea market is set to experience a soft balance in the short term, moving to potential growing surpluses in the long term (until 2025). Surplus situation is expected to persist during the next four years.

-

The balance in the short term is resulting from China’s contraction in capacity and decline in export share, owing to “zero growth” policy in place for fertilizer demand, which largely impacts urea, since China has always been the dominant demand center (33 percent of the global demand); however, recent developments of poor economies of scale (high input coal costs) and tax reform (13 percent VAT on fertilizer) are keeping the global urea market in balance

Demand Market Outlook for Major Urea Markets

-

N-Fertilizer value drivers have a profound impact on the urea market. Some of the major drivers that result in having an effect on urea:

-

Chinese coal prices à Supply-driven price for urea

-

Change in grain inventory/price à Urea demand

-

Active value drivers of urea will impact other nitrogen fertilizer prices, since urea and its derivatives are the most commonly used fertilizers across major markets, like India, North America, and Brazil.

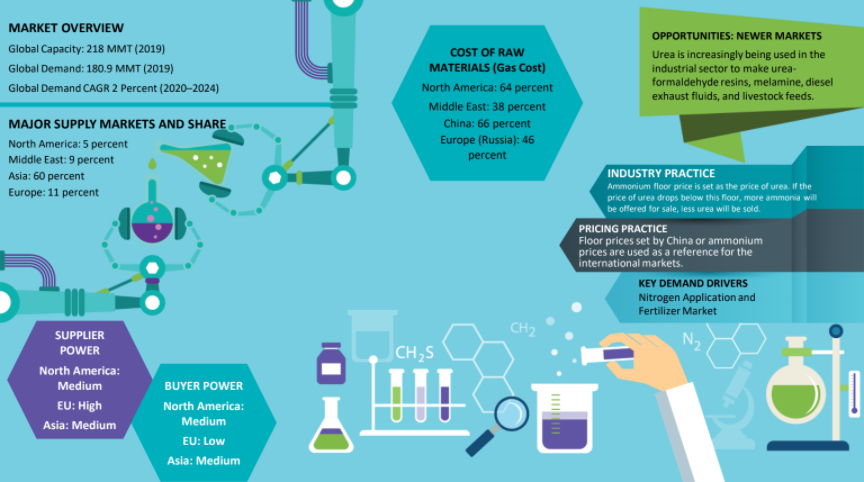

Industry Best Practices: Pricing Dynamics

-

While energy costs for the ammonia swing, producers set a price floor for ammonia and the ammonia price sets a price for urea.

-

If the urea price drops below this floor, more ammonia will be offered for sale, less urea will be sold, and the relationship will be restored

-

In a tight supply–demand scenario for nitrogen, where there is a demand-driven urea margin, the correlation is low. Such a scenario is often witnessed during the period with strong prices for agricultural soft commodities

Global Market Size: Urea

-

The global urea market is expected to reach ~ $71.9 billion by 2025, growing at a CAGR of 1-2 percent from 2022 to 2025.

-

The fertilizer segment to drive the demand: Significant demand is expected from the fertilizer segment with the growing population in the developing region. NPK/NP fertilizer contributes to a major portion of the demand

-

Key drivers for growth in urea’s market size will be strategic alliances and acquisitions among the global leaders, which will determine the future growth of the urea market through consolidation; however, growth in urea will be offset by other N-fertilizer types, like nitrate, which is more environmental friendly. For instance, in Europe, demand for urea is paling, owing to its impact on the environment (long carbon footprint life cycle), and there are alternatives to urea, which have significantly lower impact than urea-based products

Global Supply–Demand Analysis : Urea

Urea capacity growth

-

During the last one and half decade, China added capacity at a rapid pace that totally outpaced the global demand. Currently, the trend is getting reversed with other regions adding more capacity and China idling its capacity, due to stringent environmental norms and higher production cost. This is expected to bring some balance in global supply–demand dynamics.

Urea represents half of the total nitrogen output and will contribute to two-thirds of the projected ammonia capacity increment over the next five years.

-

The global urea capacity is projected to reach 231 MMT in 2025. On a regional basis, Africa, North America, and EECA will account for 70 percent of the overall capacity growth.

Supply and demand outlook:

-

Global urea demand is estimated to be at 201 MMT in 2025, growing at 2 percent annually over 2022–2025

-

Developing nation to push the demand: Sustained annual growth of urea demand, owing to rise in consumption from the LATAM and South Asian markets

Industry Drivers and Constraints : Urea

Drivers

Correlation between long-term grains and fertilizer prices

-

Variations in grain prices (corn or wheat) explain approximately 50 percent of the variation in the urea price, making grain prices one of the most important factors driving fertilizer prices

-

GDP growth, Chinese imports, the strength of the dollar are some of the other major drivers of the urea market

The urea market to be driven by non-food/fertilizer-end application

-

There has been a boost in non-food urea applications in the recent years

-

Innovative applications from spheres of biofuels toward UF, MUF, and melamine production

-

With stringent environmental regulation for nitrogen oxides in diesel engines, there is an uptick in demand for urea in this category

Constraints

Nitrate as a substitute is gaining strength: urea prices determine the price range for nitrates

-

Urea and nitrate prices are strongly correlated, as they are substitutes for each other. For agronomic reasons linked to the effectiveness of the nitrogen form, farmers are willing to pay a higher price per unit nitrogen from nitrates than for urea

-

The correlation is stronger in the medium to long term than within a season; however, crop prices are also an important factor, which impact the nitrate price and the nitrate premium. The higher the crop value is, more willing the farmer is to pay a premium for a product, which gives a high yield and quality

-

This phenomenon has become a constraint and posing a marginal threat over the urea’s position as a most favored N-Fertilizer

Supply growth to exceed growth in nitrogen: excess supply situation in the short term

-

Global urea capacity is projected to reach 231 million MT by 2025 due to increase in capacity across Africa, North America, and EECA; however, demand is expected to grow only at a CAGR of 2 percent

Why You Should Buy This Report

- The report contains urea cost structure breakdown and urea price forecast.

- It gives the market outlook, supply-demand trend analysis and trade dynamics of the regional and global urea market.

- The report does the Porter’s five force analysis of the North American, Asian and European urea market.

- It lists the various industry drivers and constraints.

- The report gives an exhaustive supplier list and does the SWOT analysis of key suppliers like SABIC, Sinofert Holdings, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.