CATEGORY

Underground Mining Equipment

Underground mining equipment are used for underground mining operations such as loading, hauling, excavating, etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Underground Mining Equipment.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Sandvik to establish new production unit in Malaysia

March 30, 2023Sandvik wins fleet order for AngloGold Ashanti's Obuasi Mine in Ghana

March 30, 2023Sandvik to take next mining productivity leap with automated battery-electric loaders

March 30, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Underground Mining Equipment

Schedule a DemoUnderground Mining Equipment Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoUnderground Mining Equipment Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Underground Mining Equipment category is 8.80%

Payment Terms

(in days)

The industry average payment terms in Underground Mining Equipment category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Underground Mining Equipment market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoUnderground Mining Equipment market report transcript

Global Market Outlook on Underground Mining Equipment

-

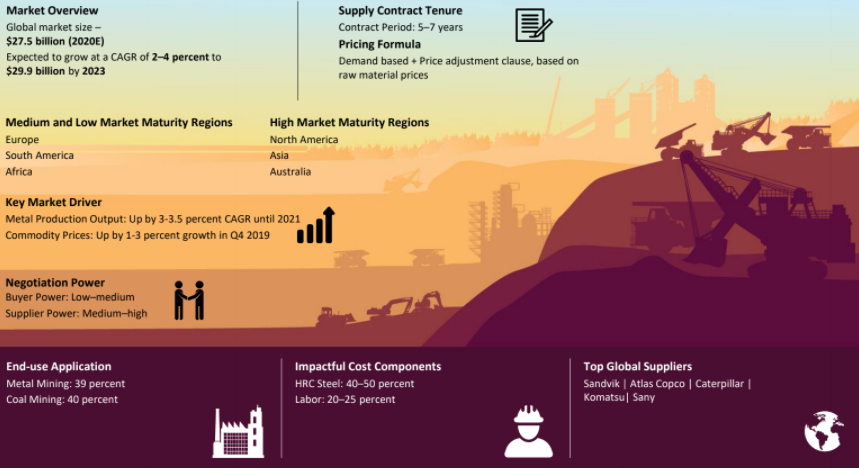

The global UGME market is expected to grow at a CAGR of 2-4 percent between 2022 and 2024. Rise in mineral production output, decreasing ore grades in surface mines, combined with forecasted economic growth in developing regions of Asia, are expected to be key drivers of demand

-

Demand for new technologies, such as electric equipment, autonomous equipment, shall drive the demand over the long term, at a global level especially in developed nations

-

Major underground mining equipment include hydraulic excavators, mining dozers, underground haulers, bolters, continuous miner, longwall system etc.

-

Demand for underground mining activities is expected to increase over the next couple of years, due to the decreasing ore grades in open cast mines and shift to underground mining, thereby supporting the global market for UGME during 2021–2024.Underground haulers is expected to be fastest growing sector followed by excavators

-

With miners ramping up production at mines and UGME’s like LHD and trucks having average life span of around 5-7years, the need to replace these will drive the sales market. UGME’s like LHD and trucks have share of around 25% in underground mining equipment market

-

Even though capital costs for battery-electric mobile fleets are 25-75% higher than their diesel counterparts, underground miners are increasingly preferring electric equipment due to reduced operating, fuel and ventilation costs

Regional Outlook on Underground Mining Equipment

-

The APAC, Latin America and African regions are expected to drive the UGME demand during 2022–2024. Increased infrastructural development projects, mineral exploration activities, improving economic scenario primarily in countries like China, India, Australia, and the US are expected to support the growth in UGME during the period

-

Recovery of construction and industrial activity across major economies will potentially drive the demand for metals, thereby supporting the UGME market

Industry Drivers and Constraints : Underground Mining Equipment

Drivers

Increase in Mining Activity

-

An increase in mining activities in the key global markets, such as Indonesia, China, US, India, and Australia, is expected to support the demand for UGME.

-

Increase in capital expenditures to boost efficiency, productivity, and reduce carbon footprint of equipment. Capital expenditure by the top 40 mining companies is estimated to rise by 14 percent Y-o-Y in 2022 to around 82 billion dollars

Declining Ore Grade in Open Cast Mines

-

Major mining companies are expected to switch to underground mining, owing to the deteriorating grades of ores extracted from surface mining. The same is expected to drive the demand for UGME.

Adoption of new technologies

-

Focus of major mining companies on sustainable mining is driving R&D and collaboration with major OEMs to develop electric/alternate fuel-based equipment

Constraints

Economy & Regulations

-

Volatile commodity prices, environmental regulations, community relations, political risks, regulatory issues are some of the factors which affect the Underground mining equipment market.

Resource Nationalism & Trade wars

-

Resource nationalism poses the biggest threat to mining companies and OEM manufacturers alike. Resource nationalism is a potential risk in various regions, including Canada, and is a constraint against capital investment adversely impacting UGME suppliers.

Lower Spending in Developing countries

-

Developing countries mostly prefer used mining machinery since they have a reliable life cycle if maintained properly and lower cost which is an hindrance to new sales.

Market Driver- Commodity Price

-

Prices of key commodities are the best indicators of mining activities, which, in turn, evinces the demand for mining equipment.

-

Iron ore prices have increased by 19.5% and averaged at 111 USD/MT due to the improved demand from the end users.

-

LME Nickel prices averaged at 13.17 USD/lb in December 2022, a monthly rise of around 12.2% compared to 11.56 USD/Lb in Nov 2022.

Cost Structure Analysis on Underground Mining Equipment

-

Some of the key raw material used to manufacture key components in Underground mining equipment include steel for strength and durability, steel-nickel-chromium alloys for light weight and corrosion resistance, copper wiring etc..

-

Rubber is used in OTR for wheeled equipments while fluids used include lubricants,anti freeze liquids, cooling liquids, power steering fluid etc.

-

The manufacturing of UGME are characterized by long lead times and cross sourcing of components.

-

Raw materials accounts for more than 60 percent of the total manufacturing cost globally

-

UGME includes complex components and the process of production of these components are power & labor intensive.

-

OEM’s generally have assembly plans in major mining countries.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.