CATEGORY

Titanium Dioxide

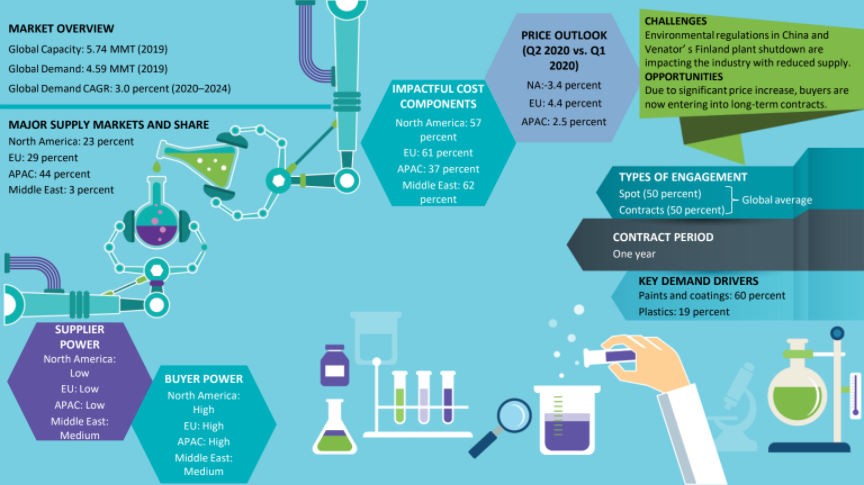

Titanium dioxide market demand is driven primarily by the Paints and coatings industry. In terms of supply base, North America and Europe supply base is consolidated, while Asia supply base is fragmented

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Titanium Dioxide.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

The makers of Skittles sued over the claims that the Candy contains unsafe amount of Titanium Dioxide

July 19, 2022The makers of Skittles sued over the claims that the Candy contains unsafe amount of Titanium Dioxide

July 19, 2022The makers of Skittles sued over the claims that the Candy contains unsafe amount of Titanium Dioxide

July 19, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Titanium Dioxide

Schedule a DemoTitanium Dioxide Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoTitanium Dioxide Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Titanium Dioxide category is 10.00%

Payment Terms

(in days)

The industry average payment terms in Titanium Dioxide category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Titanium Dioxide market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoTitanium Dioxide market report transcript

Global Titanium Dioxide Market Overview

-

Global demand for TiO2 was reduced in 2020 due to COVID-19, however demand trends recovered in 2021. Buying trends dropped from Q2 2022, post Russia-Ukraine crisis in line with lower consumer confidence index

-

Lower buying trends to continue predominately in 2023 and demand to improve from 2024

Titanium Dioxide Demand Market Outlook

-

Supply remained low from Q2 2022 amid the Russia-Ukraine crisis and the operating rates were in the range of 70-80 percent, a 5-10 percent decline from normal levels. Demand from downstream industries declined due to high inflation and weak macro economic fundamentals.

Titanium Dioxide Global Market Size

-

The global market size is estimated to reach $19.4 billion by 2026, mainly driven by the demand from the paints and coatings sector

-

Market size dropped in 2020 due to weak demand and drop in prices. However, the market revived in 2021 and firm demand and prices were observed. The trend continued in 2022 which increased the market size

-

Prices in 2023 to remain stable in line with recession fears which is expected to trigger weak buying sentiments. The market is expected to witness an uptrend from 2024.

Global Capacity–Demand Analysis

There is enough installed capacity in the market at present. Major global players would push for price increase and increase the profit margins.

Capacity

-

No major capacity additions are witnessed in all the regions during 2019–2021. However, it is estimated that the capacity will show a slight uptrend in the upcoming years, as major players have already declared capacity additions during the period

-

Tronox has declared to increase its capacity by 40,000 tons in by 2023/2024

-

Meghmani Organics, which is into White Pigment TiO2 and has planned to set up a 33,000 MT production facility at Gujrat, India in 2023/2024

-

South Africa Nyanza Light Metal Mining Company to build a new 80,000 MT TiO2 plant in 2023

Demand

-

Demand is expected to follow the trend of global GDP and grow at the pace of 2-4 percent until 2026, mainly driven by the automobile, paints & coatings and construction sectors

-

Uneven and inconsistent recovery in the global construction market is expected to impact the titanium dioxide market in 2023

-

With expectations of modest global growth until 2023, demand for titanium dioxide is likely to follow the same pace

Global Capacity by Production Process : Titanium Dioxide

Setting up sulfate process plants is highly regulated in North America and Europe. Hence, top producers have set up sulfate process plants in the APAC region to take advantage of the demand for anatase-grade TiO2 from both their existing and new customers.

Chloride process: Proprietary technology whose license is held by the top producers in the US and Europe.

-

Both ilmenite and rutile ores can be used as feedstock in the chloride process

–Rutile ore is the most used feedstock, as ilmenite ore generally yields very low output and is not ideal for continuous production

–Anatase grade is not majorly supplied by manufacturers, who follow chloride process. Anatase grade is produced, when ilmenite ore is used as a feedstock, where rutile grade is produced by using rutile ore

-

About 95 percent of the capacity in North America and more than 70 percent of capacity in Europe are based on chloride process

-

The per unit profit of established chloride-based TiO2 producers is high, as the waste treatment and operating costs are low

Sulfate process: More polluting process, with easy access to technology

-

Both ilmenite and rutile ores can be processed using the sulfate process. 98 percent of the Chinese TiO2 capacity is based on sulfate process

-

Waste treatment costs are high, however, other input costs, like the cost of ilmenite ore, is cheaper compared to rutile ore

Global Demand by Application : Titanium Dioxide

-

Paints and coatings constituted for more than 65 percent of the total TiO2 demand

-

The seasonal demand for these commodities has historically impacted the TiO2 prices

-

CPG pigment inputs, such as printing inks, packaging products, and cosmetic ingredients, are expected to maintain a steady growth rate of 2-4 percent until 2026

Global Trade Dynamics : Titanium Dioxide

-

Price and quality have been major determinants of the TiO2 trade globally

-

North America: Imports from Asia has been stable with no major increase, mainly to the increased tariffs and competitive domestic pricing

-

Europe: EU’s reliance on Asia (especially China) sourced material has continued to increase from 2020.

-

APAC: China continued to expand its export volumes from 2020.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.