CATEGORY

Threads

Industrial threads are used to sew strong, long lasting seams in fabric, leather, canvas and other materials. The most common type of industrial thread is for sewing on heavy duty materials, such as canvas, leather, vinyl, and duck cloth. Industrial threads come in different sizes, different fiber types and in different colors. Commercial and industrial sewing threads are strong, smooth, and are commonly used on projects that have special thread requirements.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Threads.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Coats Group acquires Texon, a global leader in premium structural components and materials

July 15, 2022Coats Group acquires Texon, a global leader in premium structural components and materials

July 15, 2022Coats Group acquires Texon, a global leader in premium structural components and materials

July 15, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Threads

Schedule a DemoThreads Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Threads category is 3.00%

Payment Terms

(in days)

The industry average payment terms in Threads category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Threads Suppliers

Find the right-fit threads supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Threads market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoThreads market report transcript

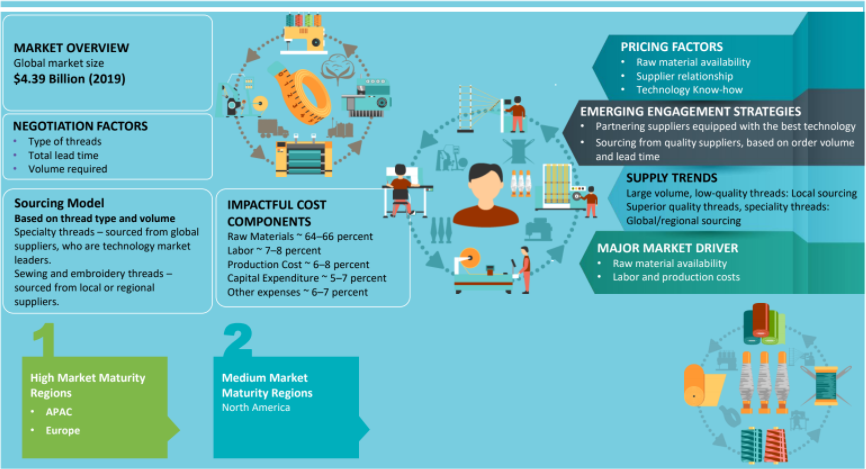

Global Market Overview –Threads

-

The global market for industrial threads is estimated to be $5.06 billion in 2023, and it is expected to grow at a CAGR of 3.6 percent, to reach about $5.62 billion by 2026

-

The APAC will continue to dominate the market, in terms of global production and sales of threads by region

-

China is the major producer of industrial threads, due to high availability of primary raw material (synthetic fibers) required for thread production

Global Trends : Threads

-

Threads are used in the upholstery industry, including automotive interiors, home furnishings, luggage and travel. This trend is increasing in North America and Western Europe, due to increase in quality demanding customers

-

Economic growth and rapid urbanization in South American regions drive the demand for high-quality threads

-

APAC is the major producer of industrial threads, due to high availability of primary raw material (synthetic fibers) required for thread production. Top suppliers have manufacturing locations in Asian countries, due to low cost of production and raw material availability, which drive local sourcing and more value-added services.

Global Drivers and Constraints : Threads

Rapid urbanization, economic growth, and increase in customer awareness are driving the demand for superior quality thread production. The technological adoption differ with developed and emerging regions, which act as a constraint in sourcing operations to meet the specification for different geography.

Drivers

Economic growth

-

Consumer purchase for superior quality products and apparels have increased, due to which, demand for specialty threads has increased for leisure goods, automobile airbags, fast moving consumer goods (e.g., tea bags)

Urbanization

-

Pace of urbanization in developing countries, like China, India, Brazil, Mexico, is increasing, due to which, consumer demanding more innovative quality products from suppliers

Awareness

-

Increase in public sector spending by governments (public and military) and protective safety clothing (industry and military) are helping the demand for innovative and quality thread products

Constraints

Technological adoption

-

The quality and compliance (environmental, labor) of the product differ for developed regions (U.S. and Western Europe) and emerging regions (e.g., India, China, Brazil), due to which, the sourcing operations differ with geographical regions

-

New technologies, such as anti-microbial threads, fibre optic threads, composite technology threads are used more in the U.S. and Western Europe markets than emerging markets

Cost Drivers : Threads

Raw material is the most important contributor to cost. Production output, lead time, and quality of the product are all dependent on the raw material.

Raw Materials

-

Polyester staple fiber and polyester filament yarn are the main raw materials of thread

-

It also depends on twist of threads, the number of turns per unit length required to hold the fibers together to give the yarn the required strength and flexibility

Labor

-

The factors that drive labor include the average time required for machinery erection

-

The process efficiency level will also have a greater impact on labor cost

Dyeing Process

-

During the process of manufacturing threads, yarns are produced through twisting fibers or continuous filaments

-

Twisted yarns are prepared to undergo dyeing process under controlled condition, which is standardized. Standardized process leads to low impact

Product Customization

-

When the threads of the same color of the apparel are to be produced and the threads are not readily available, manufacturers order the threads on demand

-

In such cases, the price depends on order volume. If the order is placed for a smaller quantity, threads suppliers keep a margin above the usual price

Machinery and Energy

-

The type of advanced machines used in the production of threads is also a factor while arriving at the cost

-

The utility prices in a country also affect the cost of production

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now