CATEGORY

Third party administrator services

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Third party administrator services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThird party administrator services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoThird party administrator services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Third party administrator services category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Third party administrator services category for the current quarter is 120.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

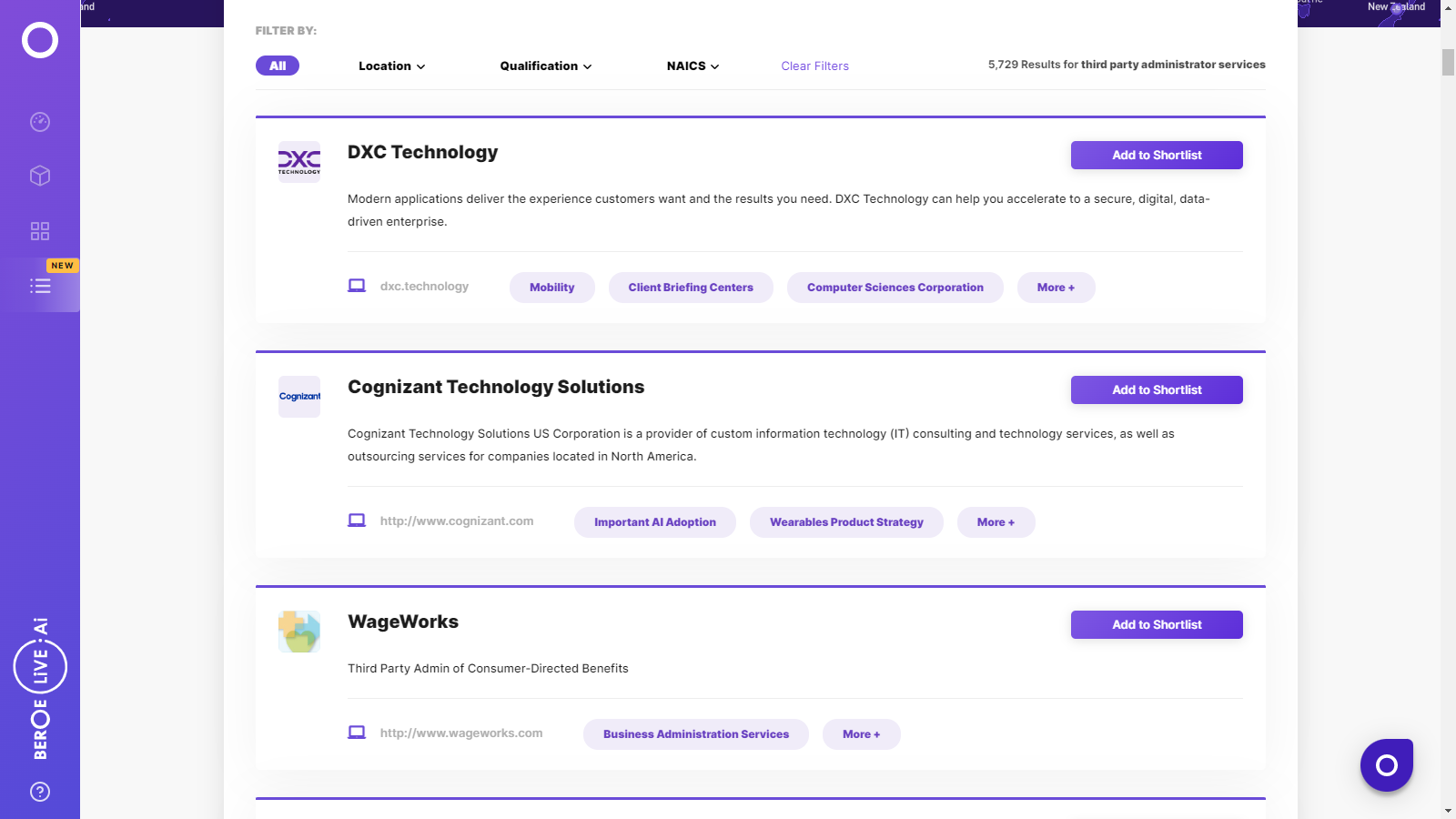

Third party administrator services Suppliers

Find the right-fit third party administrator services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Third party administrator services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoThird party administrator services market frequently asked questions

At present, the global third-party administrator services market values around $271 Bn. Beroe’s market intelligence study reveals that the figure will multiply at a 5.8% CAGR over the forecast period.

The global third-party administrator services market is characterized by several established and emerging players, with the former capturing over 3/5 of the overall revenue. To remain competitive, various medium-scale players are teaming up with niche players to offer integrated services. In addition, market players are betting on improving their service delivery capabilities backed by technology.

Elevating tech and process sophistication and the strong presence of established players are keeping barriers high for new entrants. Moreover, customers prefer approaching select service providers, having excellent domain knowledge and the ability to serve diverse needs. Furthermore, competing with market leaders requires high initial investments and skilled labor.

The buyers have relatively medium negotiating power regarding regional engagements or end-to-end services due to the dearth of service providers offering competitive category expertise, end-to-end service delivery capabilities, and geographic reach.

Third-party administrator service providers are armed with a trained workforce and deliver best-in-class offerings. Above all, they enable customers to focus on core activities, thus boosting their adoption. In addition, the umpteen benefits of outsourcing make third-party administrator services less prone to the threat of substitutes.

Third party administrator services market report transcript

Third Party Administrator Services Global Market Outlook:

Market Overview

TPA Service Market Size (2023 Estimate) : ~$337.15 billion

Annual Growth Rate (2023 Estimate) : 6.3 percent

Key Third Party Administrator (TPA) Outsourcing Service Delivery Locations

-

The Asian locations are still ahead of others when it comes to low-cost offshore delivery. Manila, in the Philippines recently overtook Mumbai, based on various criteria, indicating the attractiveness of a location

-

The high adoption locations of Latin America support the operations for the whole of the Americas, while the European locations support nearshore requirements for the Europe-based buyers

-

Latin America supports all European languages currently, as the service providers have invested heavily in strengthening this capability

Third Party Administrator Services Demand Market Outlook

-

India is currently the cheapest offshore location for Third Party Administrator BPO with strong specialist talent, the requisite language skills, and good infrastructure facilities

-

Poland and Romania have cost advantage over their European peers and serve as a best-fit near shore location for clients in Europe, and offshore location for clients in North America, considering their language skills and cultural affinity, as compared to the Asian locations

-

Out of all the countries in scope under APAC and EMEA region, India, Philippines, China, Poland, Romania, China etc., noted to be the most cost-effective locations for Third Party Administrator Outsourcing.

-

Property and casualty (P&C), workers’ compensation insurance, employee benefits—both life and pension (L&P) and health insurance are some of the common areas where Third Party Administrator Service Providers plays an important role in managing the end-to-end claims management operations like processing of claims and settlement for Insurance and Self-insured companies

Porter's Analysis on Third Party Administrator Services

-

The barriers to new entrants is high in the TPA market since established players have a higher strength in terms of capability and reach

-

Supplier Power, the intensity of rivalry, and the buyer power are only medium since the market is fragmented and most of the leading service providers have similar technologies and service offerings

Supplier Power

-

The TPA industry is currently dominated by market leaders like DXC Technology and Cognizant. The industry is fragmented in terms of service providers and their industries, with only a few being category-specific to TPA.

-

As a result, it limits the service provider power to medium

Barriers to New Entrants

-

Increasing process complexity, technology sophistication and established service providers are high barriers for new entrants

-

Currently, buyers prefer working with preferred service providers having strong domain expertise and able to cater to a wide range of requirements

-

It requires high initial investments and skilled labour to cater to the needs of mature buyers

Intensity of Rivalry

-

Top players including DXC Technology, EXL, Cognizant, Capgemini and Genpact account for more than 60% of the overall market. The latest trend is that medium-sized players combine with niche players to provide integrated services.

-

All players compete on the similar platforms, such as technology and service delivery capabilities, and not pricing exclusively. Hence, the intensity of rivalry is medium.

Threat of Substitutes

-

The cost of carrying out Claim management services in-house is high and its process efficiency is less compared to outsourcing

-

The access to world class delivery, a trained workforce, increase in spend visibility and most importantly the focus the buyer gets on core activities because of outsourcing makes sourcing in TPA less susceptible to the threat of substitutes

Buyer Power

-

For global/regional engagements, and/or end-to-end services with market leaders like DXC Technology, Cognizant, WNS, EXL, Capgemini, Accenture and Genpact, the buyers have relatively medium bargaining power, as there are no service providers that match them in end to end service delivery capabilities, category expertise and geographic reach

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now