CATEGORY

Corporate Cards

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Corporate Cards.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCorporate Cards Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCorporate Cards Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Corporate Cards category is 4.50%

Payment Terms

(in days)

The industry average payment terms in Corporate Cards category for the current quarter is 30.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

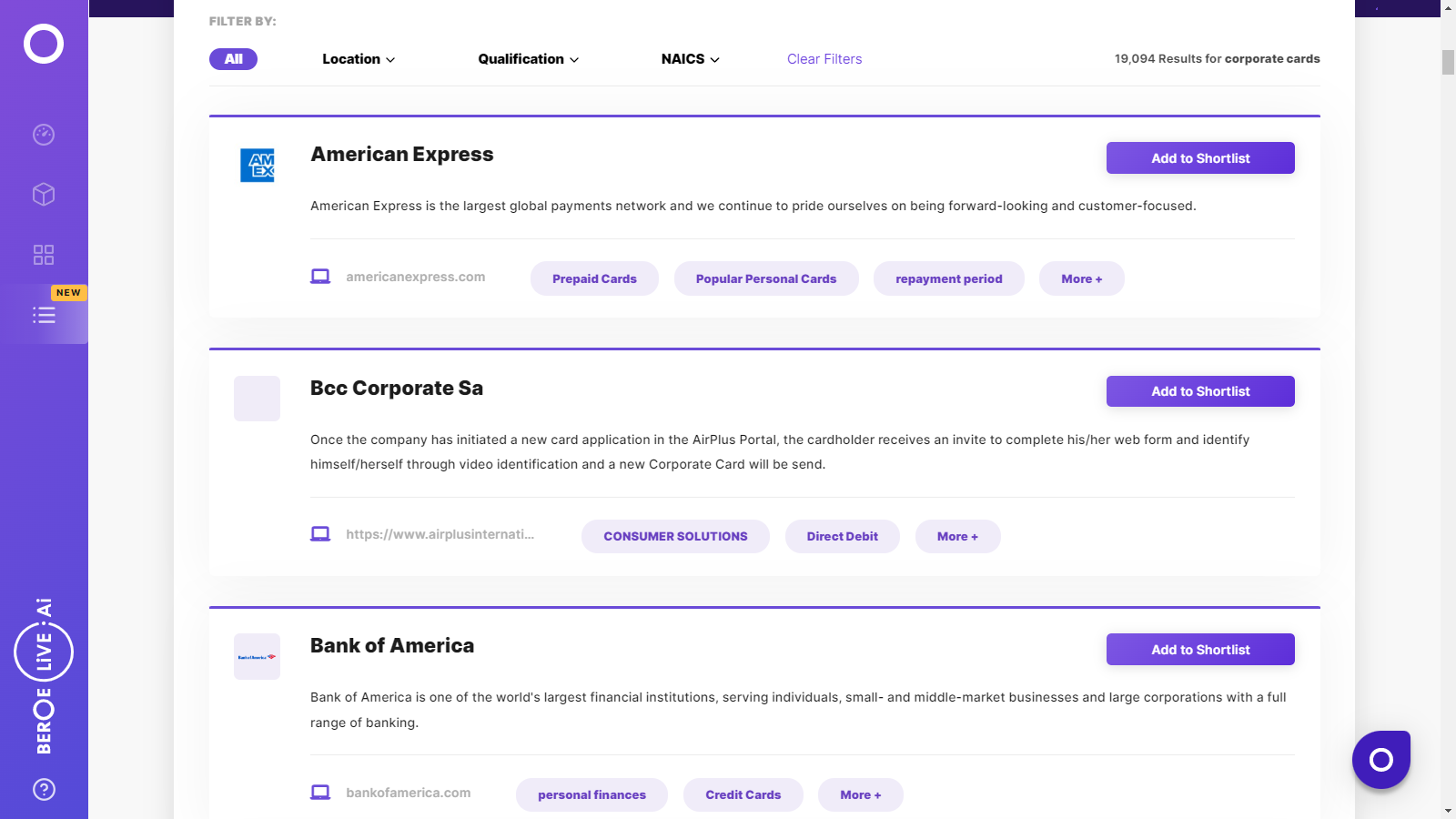

Corporate Cards Suppliers

Find the right-fit corporate cards supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Corporate Cards market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCorporate Cards market report transcript

Corporate Cards Global Market Outlook:

Market Size (2022) : Approximately $40 Billion

Growth Rate (Until 2026) : Approximately 7.3%

Corporate Card Industry Outlook

-

The corporate card market is mature in North America and Europe; more than 70 percent of global non-cash corporate card transactions take place in these two regions. Card use and card program maturity are still low in Asia Pacific and Latin America.

-

In the North American region: the United States and Canada are Mature markets

-

In Europe region: Mature markets are Western European markets namely, the UK, Ireland, France, Germany, Spain, Italy, and Switzerland

-

In APAC region: Mature markets are Australia, New Zealand, Hong Kong, and Singapore

-

In Latin America, Middle East Africa region: Mexico and Brazil are the two most mature markets in Latin America followed by Argentina while South Africa is the most mature market in the EMEA region.

-

As per Amex Global Commercial Billed Business Growth (Quarterly reporting): Commercial billing in the T&E space saw a 64 percent decline in the Quarter due to the Covid-19 impact. The Corporate Card Industry would experience a growth rate at a slower pace due to a gradual increase in the Adoption of contactless payments especially digital payments to ensure safety and security from Coronavirus infection and online fraud risk respectively.

Porter's Analysis on Corporate Cards

Supplier Power

-

The bargaining power of suppliers in the commercial or corporate card services market is Medium

-

There are several regional-level corporate or commercial card providers in the market who try to lure card subscribers through attractive deals.

-

On the other hand, it is observed that there are very limited suppliers/card issuers, who could provide corporate cards program at a global scale to global clients. In such cases, supplier/card issuers observed to have upper hand in the negotiation

Barriers to New Entrants

-

The threat of new entrants is low in the market, as it is unlikely for a new entrant to succeed against the current major players who have a large customer base in the market

-

Large capital and regulatory requirements and traditional already established big firms dominate the market which in turn gives less room for new entrants to break into the oligopoly state of the industry and compete with the incumbents.

Intensity of Rivalry

-

The commercial or corporate card services market is concentrated. The network providing Companies such as Visa, American Express, MasterCard, and Discover dominate the commercial or corporate card services market

-

Moreover, across the entire payment processing industry, the Network providing Companies such as Visa, American Express, MasterCard, and Discover make up 85 percent of the industry’s revenue

-

Among payment card firms, competition is high to create partnerships with banks so that a company’s cards will be offered to the bank’s corporate customers/clients

Threat of Substitutes

-

The threat of substitutes is expected to be medium in the market soon

-

There are several alternate payment modes such as mobile wallets, fund transfers through bank websites, and other mobile-based payment solutions, which can replace the payments made through corporate or commercial cards

Buyer Power

-

The bargaining power of buyers in the commercial or corporate card services market is high

-

Buyer companies have strong buying power as they can negotiate well on rebates/incentives based on their volume of spend and has multiple global level supplier as an option such as Citi, Amex, AirPlus, Barclaycard, US Bank, etc.,

-

Customers demand the best deals on the cards and subscribe to the company, which gives the best deals on their cards

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now