CATEGORY

Credit Bureau Services

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Credit Bureau Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCredit Bureau Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Credit Bureau Services category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Credit Bureau Services category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

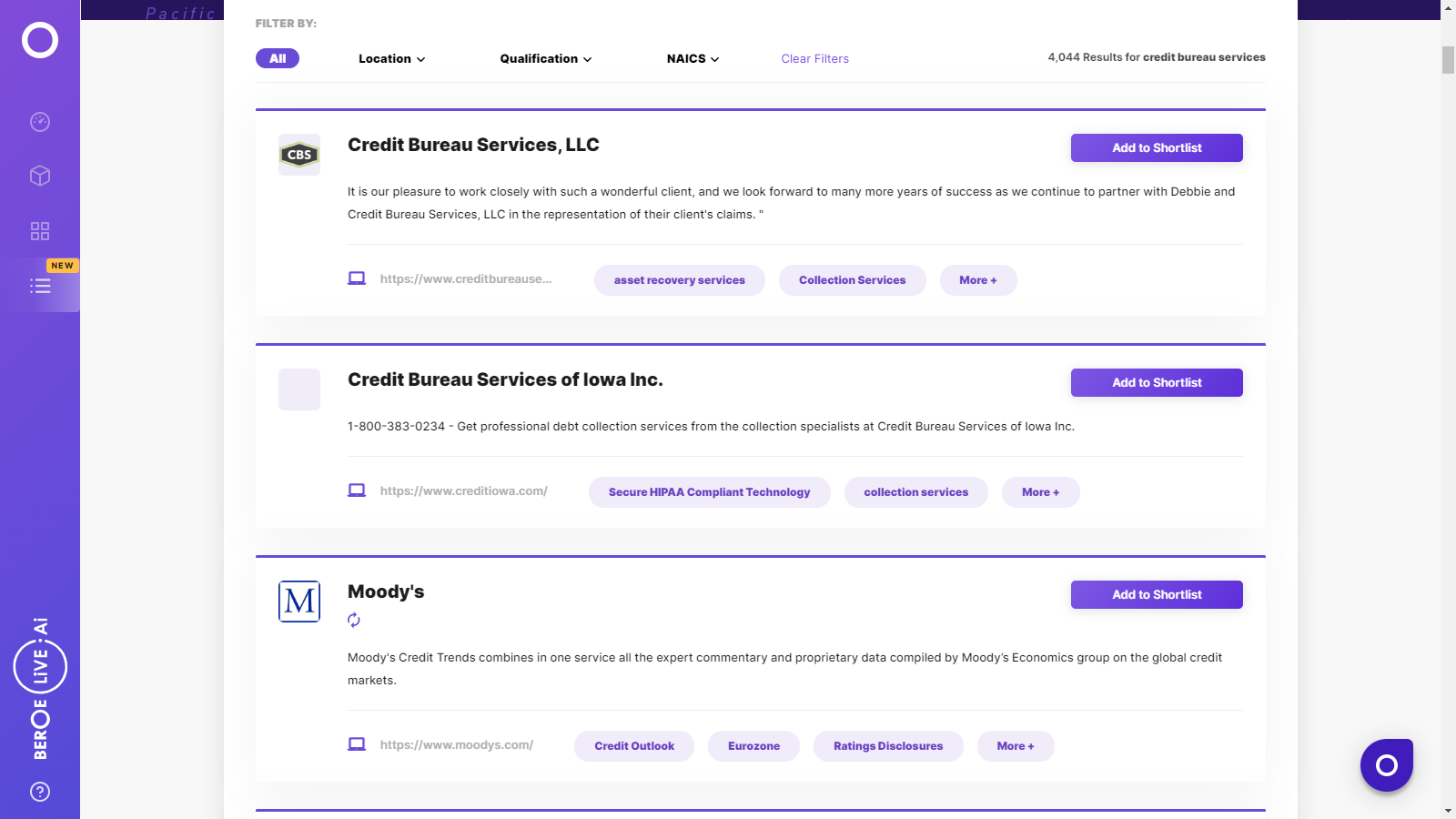

Credit Bureau Services Suppliers

Find the right-fit credit bureau services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Credit Bureau Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCredit Bureau Services market report transcript

Credit Bureau Global Market Outlook:

-

The global credit bureau services market is highly mature and competitive with top players vying for market share gain through mergers and acquisitions

-

Increased demand is likely to increase prices in this industry in the next 3-5 years

-

Credit bureaus have responded to COVID-19 by altering the criteria used for rating. However, despite these changes, several corporates are facing an increased cost of capital as a direct impact of rating downgrades

-

Regulatory scrutiny on credit bureaus is increasing across countries, due to the potential economical impact of their response to the COVID-19 crisis, at individual, corporate as well as the country level of economic recovery

Porter's Analysis on Credit Bureau Industry

The barriers to new entrants are high since established players have a higher strength, in terms of capability and reach. Buyers have less power, due to the lack of options and market dominance of global leaders.

Supplier Power

-

Large global players dominate the market and determine market prices to a large extent

-

Regulatory caps on cost at the consumer level protect consumers requiring their credit information to some extent

-

Service differentiation is only based on the number of members in the information-sharing group, specific to a credit bureau and the value-added service capabilities

Barriers to New Entrants

-

The credit bureau industry is highly regulated, as it involves sensitive consumer credit information

-

Apart from investments required, heavy licensing requirements are a major barrier to new entrants

-

Significant cost associated with shifting suppliers, due to existing platforms and data integrations, is also a major barrier for new entrants

Intensity of Rivalry

-

Industry is marked with intense competition among the top global players trying to gain market share through the acquisition of smaller players and the introduction of new products and service offerings

-

Competition results in better quality, cheaper, and increased consumer credit coverage in the database

Threat of Substitutes

-

Regulators are increasingly stressing the importance of not relying too much on credit information for the financial lending process

-

It is too ingrained into both primary and secondary debt markets to be substituted with any alternative product in the near future

Buyer Power

-

Buyers have limited choice and corporates face a steep increase in prices for memberships

-

Buyers have limited negotiation power at local and global levels, due to a less fragmented supply market, high reliance on credit information, and regulatory pressure/compliance needs

Key Technology Trends : Credit Bureau

Global leaders have already adopted data analytics and algorithmic credit scoring. deep learning, neural networks, biometrics, and blockchain are some of the recent innovations in the industry.

-

Data Analytics : With the growing demand for credit from new-to-credit (NTC) customers, credit bureaus are increasingly focusing on custom data analytics and alternative data partnerships with fin-tech companies.

-

Algorithmic Credit Scoring :Higher availability of data has led to more extensive use of multivariable algorithms in the credit scoring process, making traditional logistic regression models with restricted number of variables.

-

Machine Learning, Deep learning, and Neural Networks : Data collected from technology-enabled devices are being used as alternative data sources, to aid in credit evaluation.

-

Biometrics & Block Chain : Biometrics and block chain are expected to play a key role in authenticating identity of consumers, as credit becomes increasingly digital.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now