CATEGORY

Banking Self-service Channel & Payment Solutions Africa

Focuses on instant issuance and other self service channels of banking, costs associated and market trends such as drivers/constraints, etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Banking Self-service Channel & Payment Solutions Africa.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

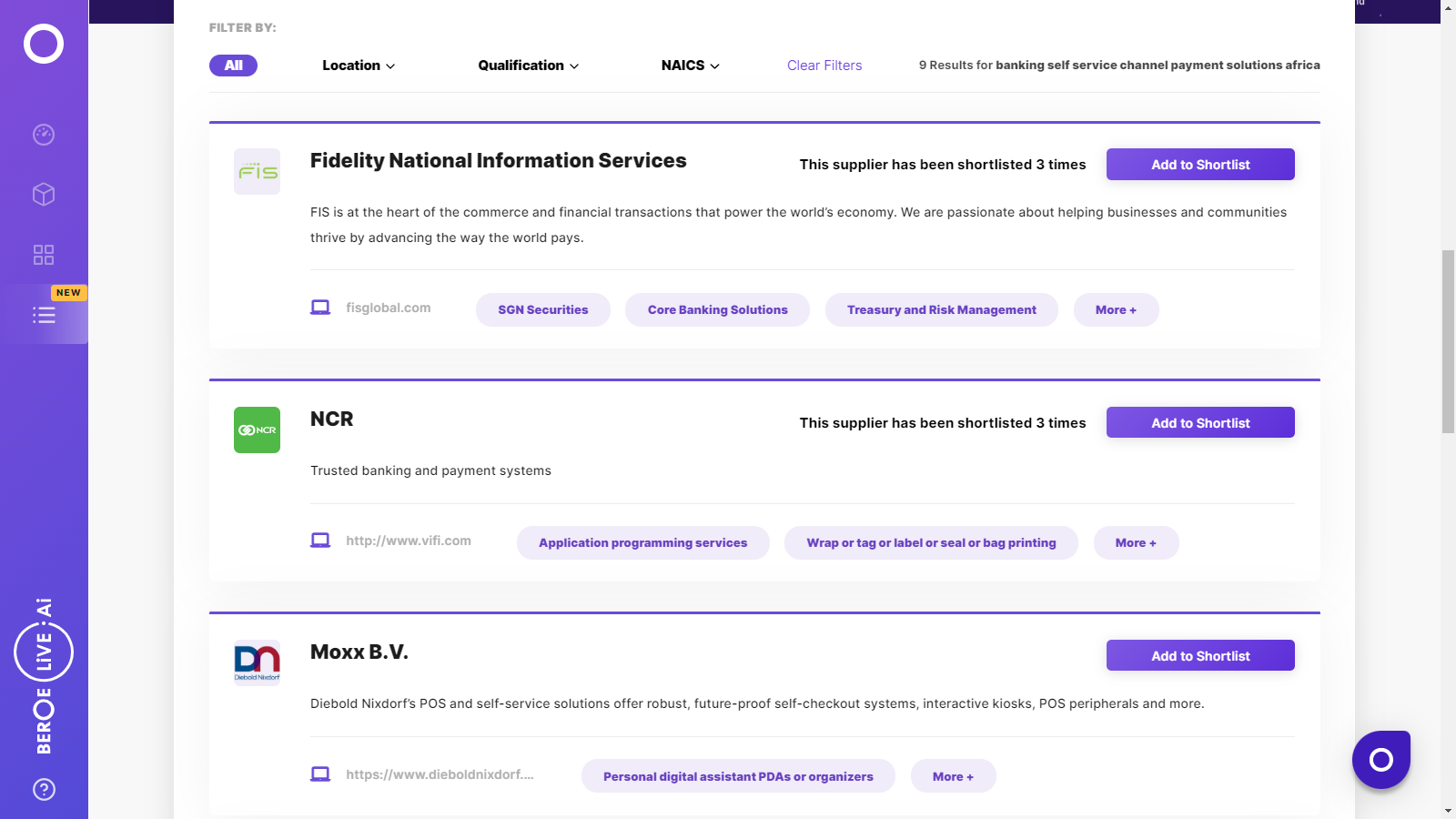

Banking Self-service Channel & Payment Solutions Africa Suppliers

Find the right-fit banking self-service channel & payment solutions africa supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Banking Self-service Channel & Payment Solutions Africa market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBanking Self-service Channel & Payment Solutions Africa market report transcript

Regional Market Outlook on Banking Self-service Channel & Payment Solutions

The global POS terminal market is gaining a significant momentum compared to the previous years and is expected to grow at a CAGR of 13 percent until 2018. This positive turnaround is due to the increased use of cashless transactions and advanced mobility services that is fueling the growth of retail markets. Compared to the global POS market, MEA POS market is growing at much higher pace by holding a market share of 35 percent.

The growth of MEA market share grew from 9.23 percent to 10.08 percent in 2016 and its POS shipments crossed 5.3 million units, which has the highest growth rate in the global market. The MEA market surpassed both Latin America and Caribbean regions, in terms of shipment of new POS terminals.

Key Market Trends

Increasing Contactless Transactions using mPOS Devices

- The growth of contactless transaction is expected to be in double digit by 2018 because of the increasing use of mobile device and evolving mobile payment solutions

Growing Need of Tablet POS Devices

- Though the end operations remain the same, tablet POS is gaining much higher traction than the other POS devices. This is due to the increasing additional features, like user interactions and mobility services

Growing Adoption of SaaS-based and Android POS Systems

- Android and SaaS-based POS systems are growing largely, as manufactures are focusing to easily integrate online mobile app solutions and also to provide better user experience

Expansion of Cloud POS Systems

- Cloud PoS is usually compatible with most point of sale hardware, including printers, cash register drawers, etc. Cloud POS systems are increasing, as it eliminate the high infrastructure usage, which, in turn, reduces the TCO

Non-cash Payments in Africa

Preference of cash in Africa

- Cash is still the most preferred payment across the world. In Africa, cash is more preferred than rest of the world

- Even in e-commerce payments, bank transfers (25 percent) and cash on delivery (24 percent) are still the most preferred payment methods in Africa, unlike rest of the world

- Only South Africa has witnessed rapid payment innovation, with only 10 percent of its ecommerce payments are in cash

- The remaining countries still lag behind global average in financial penetration and card usage

Growth in Non-Cash Transaction

- Global non-cash transaction is estimated to have grown by 11.6 percent in 2016, against 11.2 percent in 2015

- In CEMEA region, non-cash transaction growth is estimated to have slowed down to 8.9 percent in 2016, against a sharp growth of 16.5 percent in 2015

- In terms of share of non-cash transactions, CEMEA region accounted for 10.3 percent of total global non-cash transactions

- Rising internet penetration and resultant rise in mobile payments are the key drivers behind this growth in Africa

Key Market Trends-Issuance & Embossing

Increasing printer demand

- Global market for card printers to surpass $72 billion by 2019

- Increasing usage of cards for payments and withdrawal is a key driver for the growth of this market

Increasing instant card issuance

- In October 2017, First bank of Nigeria, became 1st bank in West-Africa sub-region, and 2nd bank in Africa to issue 10 million cards to customers

- Increased adoption of instant issuance solution, is a major driver in this market

Lowering cost of ownership

- TCO of instant issuance printers has decreased significantly in recent years, due to technology advances

- In Africa, current average price per printer is R20,000–R35,000

Increasing demand for color - embossing

- Inkjet card printers and color laser card printers are expected to continue dominating the market with 52 percent of the market share in 2021

- Ultra-high-volume inkjet printer technology has reduced the average cost per color impression

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now