CATEGORY

Cash in Transit Services

Report on cash collection services and cash alternatives in Latin America.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Cash in Transit Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCash in Transit Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Cash in Transit Services category is 3.40%

Payment Terms

(in days)

The industry average payment terms in Cash in Transit Services category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

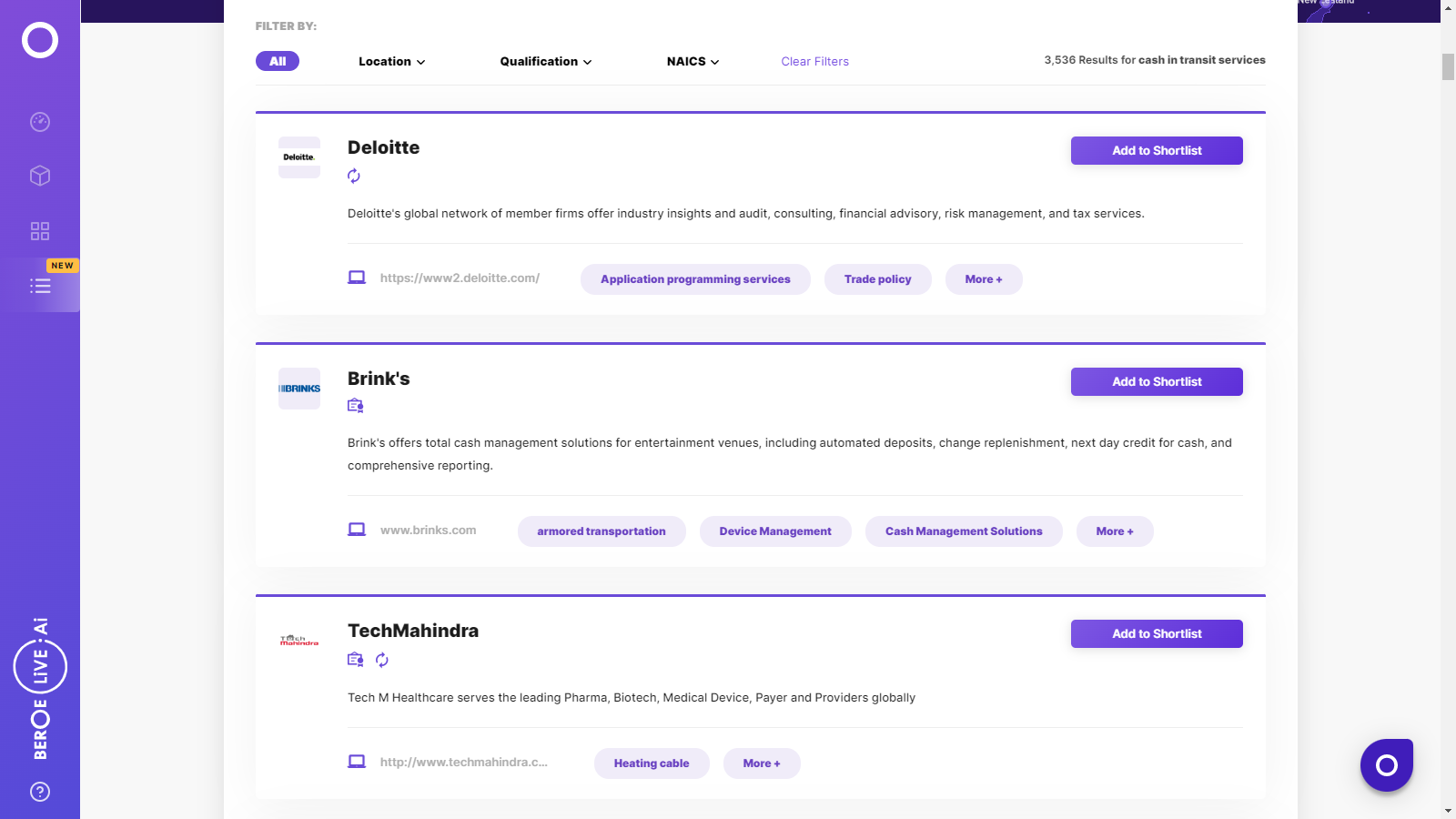

Cash in Transit Services Suppliers

Find the right-fit cash in transit services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Cash in Transit Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCash in Transit Services market report transcript

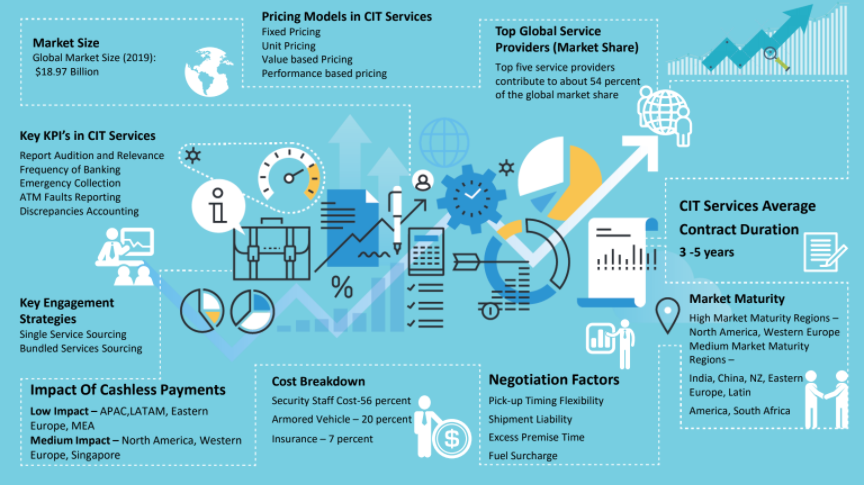

CIT Cash-in Transit Services Market Analysis and Global Outlook

-

The global CIT service market is valued at $19.03 billion in 2022. The market is forecasted to grow at a CAGR of 5.5 percent until 2025, with a valuation of $57.09 billion

-

CIT growth in the emerging markets, which includes APAC, MEA, LATAM is expected to outperform the global market growth, expected to grow at three times more than in Europe and North America

-

Factors, such as cash circulation, increasing demand on safe and vault cash management, new ATM installation, and banking regulations drive the need for CIT services across the globe

Global Cash-in-Transit Industry trends

-

The major driver for the CIT industry is the growing number of ATMs across the globe. By early 2022, it was estimated that there were around 3.5 million ATMs globally, and the number of installations is expected to decline in the coming years. This in turn would affect the growth of CIT market during the forecasted period.

-

China and India are the fastest growing markets for CIT services where the ATM market is expected to grow at a healthy rate during 2022–2025. However, this is well established in developed markets like South Korea, Japan and Australia.

-

Around 80–85 percent of consumer transactions across the globe are still performed through cash. Banks, financial institutions, large retailers, governments are the major buyers of CIT services

Global Cash-in-Transit market analysis

Drivers

Increasing Crime Rate

-

Increase in crime rates has driven the outsourcing of cash handling services to specialist service providers, who can perform the transaction in a more secured process

-

One of the other major reasons to outsource the operation to a specialist service provider is continuous technology implementation

–For Example: “CIT Tracker” is a device, which is hidden covertly during cash transit process, which supports by alerting the security personnel during an act of theft. It also supports in asset recovery and criminal apprehension

Increasing ATM Service Expansion

-

Rapidly increasing ATM installation in the developing regions is a major driver of the CIT service. For instance, only in the APAC region, the installation rate is expected to grow at a CAGR of 8–10 percent between 2022 and 2025

Laws and Regulations

-

Complying with laws and regulations, related to CIT, has driven the outsourcing of these services to specialist service providers

-

Stringent regulations from bank authorities in moving cash from one place to another will give more impetus for CIT service

Constraints

Increasing Cashless Payment in Developed Regions

-

It is estimated that cashless payments will account for about 45 percent of the total transactions in the North America and Europe

-

The non-cash transactions were estimated to accelerate at a CAGR of 42.3 percent globally, with developing/emerging markets growing at 57 percent between 2022 and 2025

Highly Competitive Market

-

The CIT industry is highly competitive with competition, primarily based on pricing

-

The undifferentiated nature of services force the suppliers to reduce prices to beat competition

Supplier Analysis: Market Share of Key Global Suppliers

-

The global CIT market is highly consolidated with the top five suppliers constituting to more than 50 percent of the market

-

Brink’s, being the pioneer in the CIT industry, is estimated to be leading, in terms of global supplier market share, with 19 percent, followed by Prosegur Cash and Loomis, each with 13 percent and 11 percent, respectively

-

GardaWorld and G4S are the other major players, who hold 7 percent and 6 percent, respectively

-

The remaining 44 percent of the market is crowded with more than 500 players, who are mostly regional or local suppliers

-

Such supply landscape with a few big players and large number of small players makes it favorable for further industry consolidation

Global Cash-in-Transit Pricing Models

Cash in transit companies use different pricing models:

Fixed Cost Pricing Model

-

Under the fixed price contract, the buyer is entitled to pay the service provider a fixed fee for the contracted specifications, based on the number of locations to be catered, frequency of the service provided, and the contract period. The buyer is charged a fixed fee for a specific value of transaction.

-

The fixed fee pricing model is the widely adopted model in the cash collection services market

Unit Pricing Model

-

A unit price contract can be used when there is a clear understanding on the frequency on the service is needed. This type ofcontract is in place only where the frequency of the service required is minimal

-

In a unit price contract, the volume of job to be completed is estimated by the buyer and the service provider quotes a rate forlabor and equipment by the unit of work (for e.g., price for weekly collection per location)

Value Based Pricing Model

-

The service providers charge the buyers on a tiered manner, based on the value of cash that is being collected from the collection points.

-

The value based pricing is one of the pricing strategies whose adoption levels are steadily increasing in the recent past for cash collection service

Performance Based Pricing Model

-

The performance based pricing model is used when there are certain lists of KPIs in place, measuring the performance levels agreed with the service provider. This model is not widely adopted because it increases the workload of the buyer and the supplier.

-

The payment for the service provider is directly linked to the performance standards as decided in the contract agreement. The service provider may be fined upon not meeting agreed performance levels.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now