CATEGORY

Anti-Money Laundering Software

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Anti-Money Laundering Software.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoAnti-Money Laundering Software Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Anti-Money Laundering Software category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Anti-Money Laundering Software category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

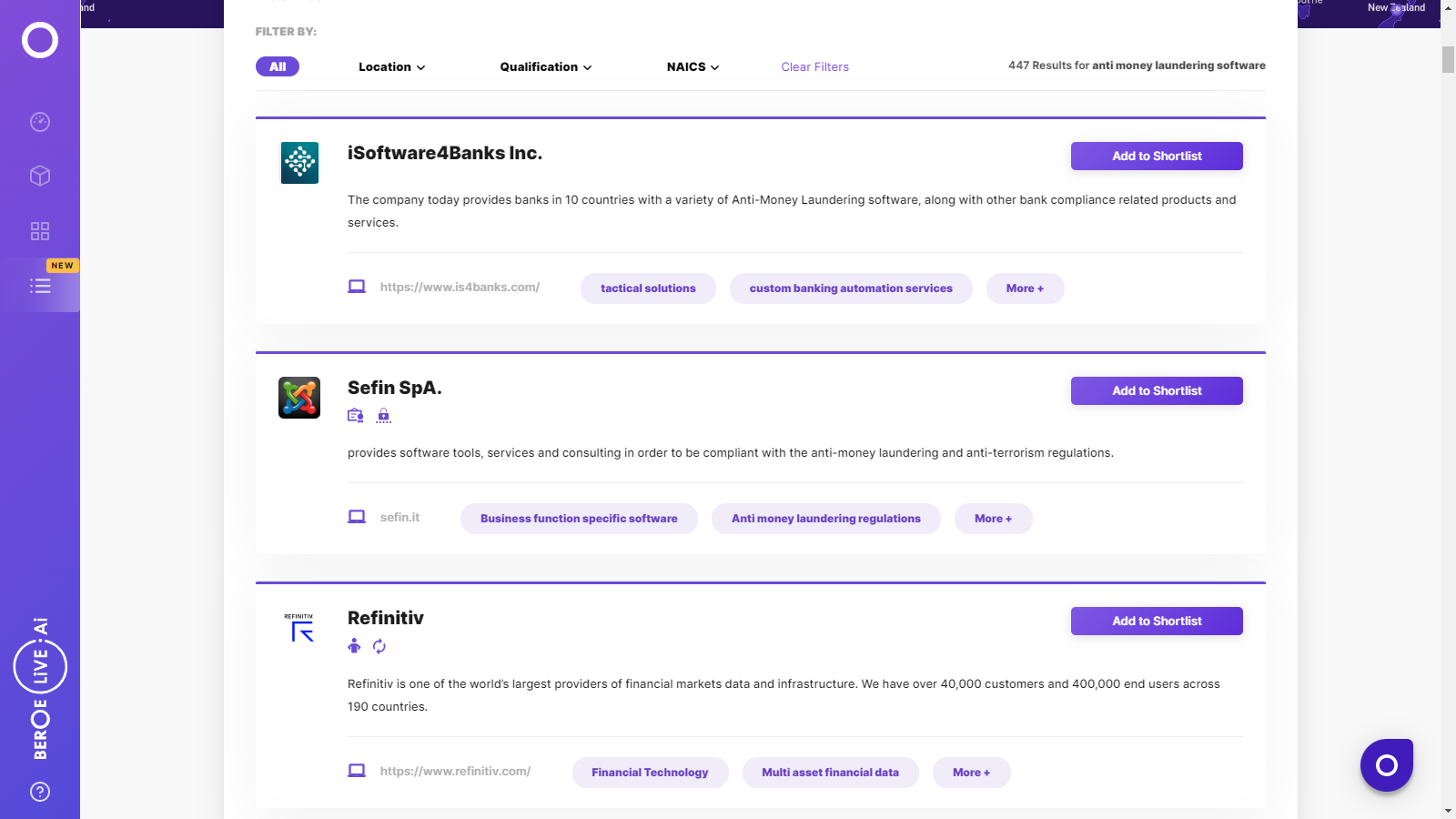

Anti-Money Laundering Software Suppliers

Find the right-fit anti-money laundering software supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Anti-Money Laundering Software market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAnti-Money Laundering Software market report transcript

Anti-money laundering software Global Market Outlook:

-

The AML software industry market size is estimated to reach USD 2.8 billion in 2022 and is expected to reach USD 5.9 billion by 2027

-

The global AML software industry was dominated by North America and accounted for over 33.02% share of the global revenue

-

Europe is expected to witness a robust revenue growth rate over the forecast period (2021-2030) owing to early adoption to early adoption of new technologies and increasing regulations for deploying AML solution

-

Increased need for automated transaction monitoring systems and compliance with regulatory norms have been major demand drivers globally

-

Despite regulatory frameworks, the US Treasury Department estimates 2.7 percent of GDP or $1.6 Trillion to be involved in money laundering and other fraudulent activities

Anti-money Laundering Software Market: Regional Analysis

-

Asia-pacific segment is expected to have the highest growth rate of 17.96% between 2021 and 2026, due to the untapped potential of developing economies, like China and India.

-

Europe will continue to account for growth in the coming years, due to well-established end-user industries and early adoption of new technologies

-

North America has the highest market share, in terms of revenue (33% in 2021), is technologically advanced and has a presence of major players

COVID-19 Impact on Anti-money Laundering Software Market

-

COVID-19 has brought huge financial risk with increase in fraudulent activities such as online scams involving medical supplies, personal protective equipment, essential items, and illegal activities in terms of COVID-19 donations thus increasing the need for AML solution creating a huge opportunity for the industry. However, more scrutiny of transactions will be required from the Bank’s end, since the ultimate responsibility for this risk lies with the bank.

Anti-money Laundering Software Market

Procurement Centric Five Forces Analysis on Anti-money laundering software

Supplier Power

-

Market is quite fragmented with a number of regional and global players

-

Larger financial institutions prefer solution providers that offer customized solutions to cater to their requirements

-

Increase in the compliance requirements also increase the bargaining power of suppliers

Barriers to New Entrants

-

Industry is marked with number of new entrants, due to increasing demand and low cost needed to develop software

-

Technology innovations are paving way for new entrants, who position themselves as low-cost alternatives to traditional players

-

Increasing compliance requirements and a complex regulatory environment mean that the need for established industry experience and trust is a significant barrier for new entrants vying for the market share

Intensity of Rivalry

-

Significant amount of service differentiation among players has led to intense competition among global leaders

-

Competition results in better quality, cheaper, and increased consumer credit coverage in database

Threat of Substitutes

-

New entrants, such as commercial workflow and advanced analytics vendors, pose a threat, to traditional players, such as packaged solution vendors

-

The industry continues to evolve strongly with changing regulations, and new players are unlikely to challenge incumbents in their core area of case management

Buyer Power

-

Buyers have limited choice, and corporates face a steep increase in prices for memberships

-

Buyers have limited negotiation power at local and global levels, due to less fragmented supply market, high reliance on credit information, and regulatory pressure/compliance needs

Why You Should Buy This Report

-

Accurate projection of the anti-money laundering software market size and its contribution to the parent industry.

-

Detailed insights into factors that will favor the growth of the global anti-money laundering software market over the coming five years.

-

Precise estimations on upcoming changes and trends in consumer patterns to help market players strategize and utilize all the potential growth prospects.

-

Industry footprint of the anti-money laundering software across Europe, North America, APAC, Latin America, and MEA.

-

Deeper dive into the factors that will pose challenges for the market vendors.

-

A comprehensive assessment of the market’s competitive scenario and in-depth information on anti-money laundering software vendors to help customers enhance their competitiveness.

FAQs

-

What are the factors driving the anti-money laundering software market?

Factors such as the increasing demand for know-your-customer (KYC) analytics, the integration of anti-money laundering software into visualization solutions, and the fusion of anti-fraud and AML solutions are favoring the market growth. Furthermore, significant investments in the information technology (IT) sector across the globe will create several growth opportunities for vendors. -

How big is the anti-money laundering software market?

The global market value of anti-money laundering software reached around $1 Bn in 2020. As per the industry analysis report, the market revenue is projected to grow at a CAGR of 13.6% during 2020-2025. -

How competitive is the anti-money laundering software market?

The anti-money laundering software market is highly fragmented with the presence of various established players and new entrants. Tech innovations and large-scale service differentiation is resulting in high market competitiveness. -

Which region will offer lucrative business opportunities over the forecast period?

North America and Europe continue to hold a significant revenue share of the global anti-money laundering software market, given the strong presence of established players and continuous changes in the regulatory norms controlling the BFSI industry.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now