CATEGORY

ATM Services

Includes market overview of ATM maintenance services, trends in industry and key supplier profiles region-wise

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like ATM Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

DIEBOLD NIXDORF INVESTS ON A NEW MANUFACTURING FACILITY

December 08, 2022BRINKS Strategic Move ? Will this bring consolidation in the ATM market?

October 06, 2022NCR takeover in play

July 04, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on ATM Services

Schedule a DemoATM Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in ATM Services category is 6.20%

Payment Terms

(in days)

The industry average payment terms in ATM Services category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

ATM Services Suppliers

Find the right-fit atm services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the ATM Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoATM Services market report transcript

Global ATM Service Industry Outlook

-

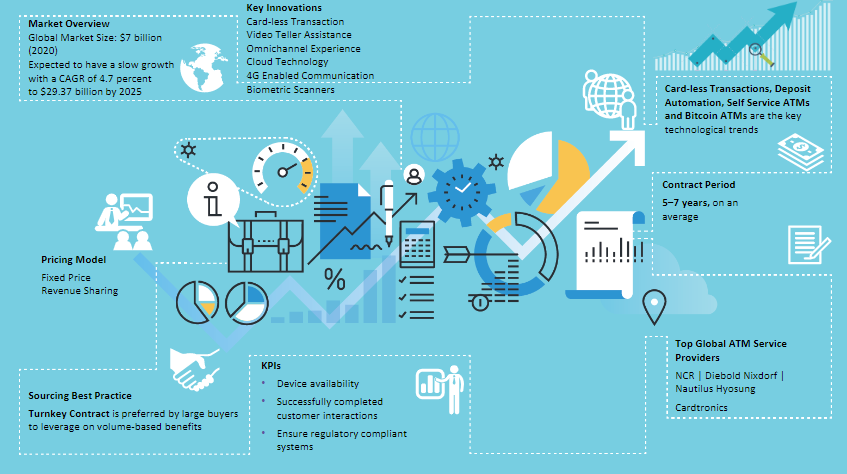

In 2021, the global ATM industry market size is at $14 billion at a CAGR of 5 percent

-

APAC is the fastest growing market in the industry, with India and China leading, in terms of the number of deployments, this is because the countries are taking fast phase in moving to digital economy

-

The US and Europe are the major matured markets for the ATM industry is now facing a slow growth as Bitcoin ATMs and self-service ATMs are increasing even though countries are moving into cashless society, increase in digital payments and COVID-19 effects on rental rates. For the LAMEA region, there is a vacuum in the supply landscape, as the major global suppliers have a less presence in these regions

Global ATM Services Market Maturity

-

Due to COVID-19, ATM services began seeing a decrease in transaction volumes of varying degrees across its network, depending on location. As the pandemic reduced and travel restrictions and social distancing orders are withdrawn, the demand for ATM industry is slowly increasing.

Global ATM Service Industry Trends

-

The adoption of outsourced ATM services is a key driver of this industry, as the awareness of potential cost-savings grow among the buyers

-

The ATM industry is characterized by spate of mergers and acquisitions, with suppliers looking to increase their service capability to fulfil the requirements of large buyers

Global ATM Industry Drivers and Constraints

Drivers

-

Increasing Competition: The major factor driving the industry is the competition among the banks to provide service to customers' convenience

-

Increasing Bankable Population: In developing markets, such as India, China, and Brazil, there has been a significant surge in opening new bank accounts. 200 million plus new bank accounts were opened in India in the last three years

-

Cost of Building Branches: Creating presence around city is very important for banks to attract customers. But it is not possible nor cost-efficient to set up branches around all the locations. Hence, the ATM industry is driven by this factor, as it does not require heavy real-estates nor other related costs

-

Low-cost ATMs by IADs: Deployment of low-cost ATMs and cheaper IP-based communication by IADs push the initial investment costs down

-

Proliferation of Off-site ATMs: Convenient location of ATMs ranks high among the needs of consumers and has propelled the growth of off-site ATMs

Constraints

-

High operational and maintenance costs (CIT) in developed markets

-

Security concerns

– Including embedded cameras, GPS systems as well as seismic and heat sensors, leading to additional cost for banks -

Cost of new technology for updating ATMs has become a large issue in the market today. E.g., upgradation of operating systems from Windows XP to Windows 7 or 10 across all ATMs

– Card Skimming: With card skimming, there is a need for physical security and monitoring of ATMs -

Wide Adoption of Cashless Transactions: The proliferation of payment options other than cash, including credit cards, debit cards, stored- value cards, mobile payments, and online purchase activity, could result in reduced need for cash in the marketplace

ATM Services Technological Trends

Self Service ATMs

-

Self Service ATM is a breakthrough technology that combines multiple features into a single machine. Serves as a one stop solution for functions such as cash deposit, withdrawal, cash recycling, check deposit, coin dispense, internet banking, banking products and solutions such as credit cards & loans, opening and changing of bank accounts, options for video assisted remote teller so that the bank could step forward towards branch automation. Widely adopted in American & European Market, certain countries in Asia such as India, China, Japan, Korea & Singapore are also adhering towards such a technology

Deposit Automation and Recycling ATM‘s

-

In the recent times, deposit automation has made the biggest impact on the technological advancements in ATMs. Cash recycling machines, which earlier were seen as an expensive investment by the banks, are now in prime demand with the banks optimizing their cash management to compensate for the high investment costs

Card-less ATM Transaction

-

Card-less ATM transaction is expected to be a breakthrough innovation and major ATM manufacturers are now offering this service. With enhanced security and a robust model, the service is expected to be a key area of development in the ATM market space

Value-added Services

-

Multi-functional ATMs with value-added services, such as ticketing, bill payment, mobile airtime top ups, etc., are expected to drive major innovations as well

-

These services are expected to enhance the customer experience by offering convenience and availability

Software Migration for ATMs

-

Microsoft's decision to stop providing updates on Windows XP means that the ATMs with XP operating system face greater risks from malware and network intrusions

-

The industry is expected to witness the migration of ATMs operating systems to Windows 7 or Windows 10

Crypto currency ATMs

-

Crypto currency (Bit coin) ATMs (money transfers through ATMs), offering digital currencies, were seen as a risky investment when they were launched a year ago. However, the trend has changed with Bitcoin ATMs making profit at a rapid pace and enabling the operators to recover their investment within three to nine months only. The adoption has increased with more than 2000 machines deployed world wide. the adoption is high in American & European market while the rest of world is yet to adhere.

Video Banking/Remote teller machines

-

Using Interactive Teller machines, customers can perform 95 percent of activities performed by branch through real time communication with remote teller.

-

This is an optimal and efficient solution in order to establish and expand their services in areas where feasibility of opening of branch is minimal and also allows banks to add value to the customers by providing extended access to banking services and financial experts to its customers.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now