CATEGORY

Debt Collection Software

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Debt Collection Software.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoDebt Collection Software Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Debt Collection Software category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Debt Collection Software category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

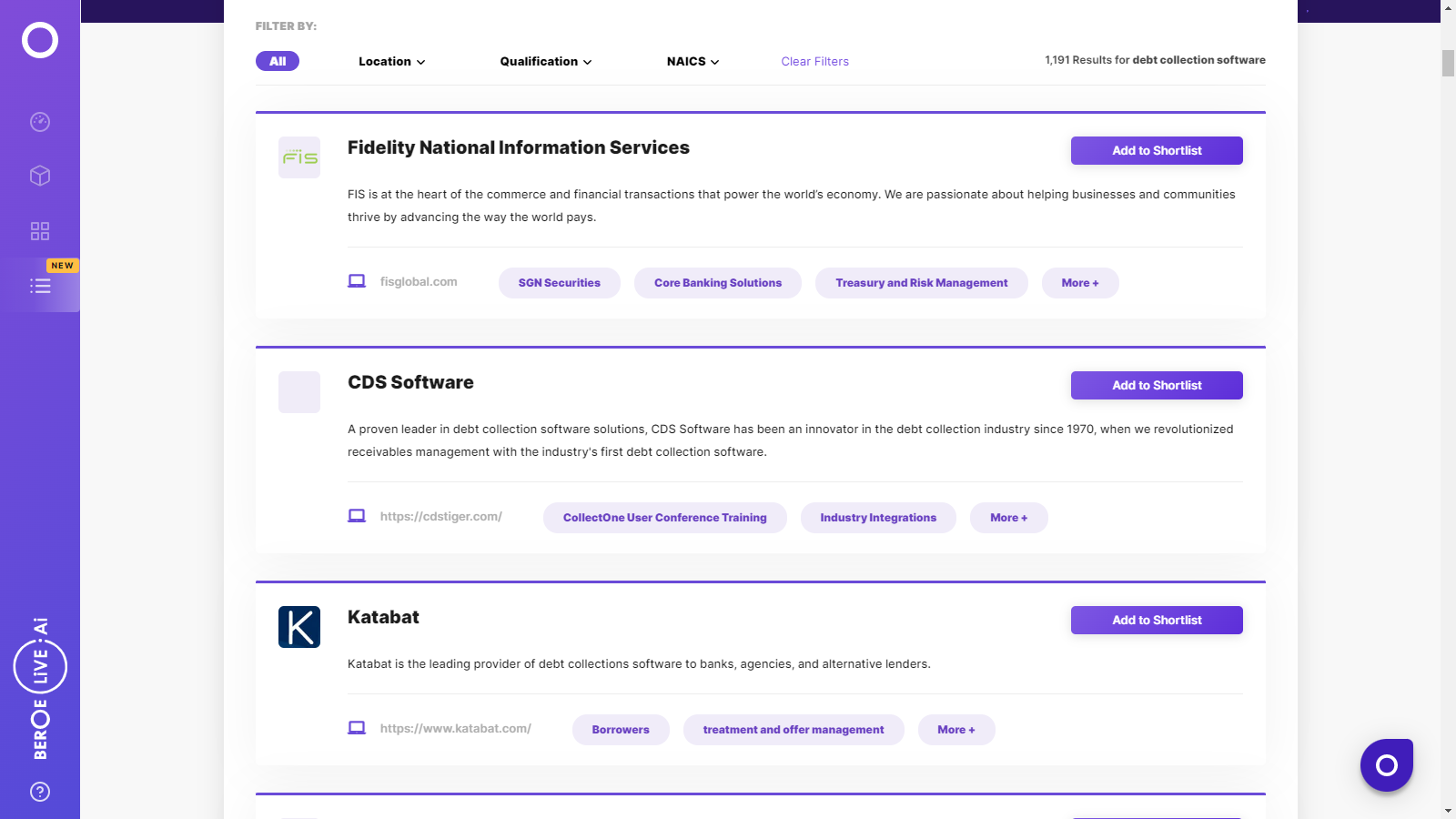

Debt Collection Software Suppliers

Find the right-fit debt collection software supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Debt Collection Software market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDebt Collection Software market report transcript

Debt Collection Software Global Market Outlook:

-

The size global debt collection software market is estimated at approx. $3.8 billion for 2022 and is projected to grow up to $6.5 million by 2027 at a CAGR of 10.3 percent during 2022–2027

-

Increasing demand to changing lifestyles and increased purchasing power, consumers have become more empowered and for informed purchase decisions made, they are creating a debt cycle

-

The APAC is projected to be the fastest-growing market with the highest rate of 7.1 percent during the forecast period, followed by Europe at 6.9 percent

Debt Collection Software Market – Market Maturity

-

It has been observed that North America has the highest market share of 34 percent in 2022, due to the presence of developed economies. The powerful financial position of the region allows investing heavily in advanced testing and technologies

-

The APAC is projected to be the fastest-growing market with the highest rate of 7.1 percent during the forecast period, followed by Europe at 6.9 percent

Global Debt Collection Software Market: Regional Outlook

Market Trends

Debt collection is impacted by consumer behavior, macroeconomic factors, regulatory changes, and protections on a day-to-day basis. Financial institutions seeking to improve collections need to design a sustainable and profitable debt collections strategy. Process improvements, such as workflow automation, customer management, consistent collections treatment, and collector experience play an integral role in debt management.

-

Automating collections: Many financial institutions struggle with changing debt landscapes and are trying to cope with such situations through outdated technology. With fewer resources, growing debt volume, and consumer protections, the legacy system is inefficient and detrimental. Debtors are now living in an omnichannel and self-service environment; financial institutions that upgrade to new technology witness a host of benefits leading to profitable lending business. Broadly debt management solution enables the banks to minimize bad debt, rehabilitate customers, reduce attrition, and maintain revenue streams. Government agencies are using debt management solution for collecting tax debt, though the revenue size is small, the complexities and inherent data integration challenges that government agencies face is similar to a bank’s infrastructure

-

Shift to customer-centric collections: Financial institutions have the habit of servicing customers’ accounts and not their customers. A customer-centric approach enables banks to design processes and systems (i.e., collection automation) with a key focus on improving customer experience and loyalty

-

Analytics for better account treatment: •Analytics helps banks in building robust collections-scoring models and precise debt collection strategies. Collections solution providers offer analytics modules as part of their end-to-end solution or as a bolt-on solution. Depending upon the quantity and quality of data, collections specific-scoring, models, and decisions can be built. While behavioral scores can predict a longer-term trend, advanced analytics (based on sophisticated algorithms) help managers predict the short-term trends: likelihood that an account will become more delinquent, the likelihood of self-cure, probability of payment in the coming month, and the amount

-

Advanced analytics quantifies, assesses, and helps in deploying the optimum decisions. Combined with the consolidated/360-degree view of the customer, collectors can devise consistent and efficient collection treatment. Instead of managers/collectors deciding by manually communicating with customers, predictive analytics provides the ability to run “what-if” scenarios and “stress test” results

-

Banks can assess the reaction of customers to new collections treatments, approaches, and messages, compare them with old treatment strategies and quantify the new revenue gains

-

Based on multiple discussions with industry stakeholders, analytics can drive ‘offer management’, collector independent treatment strategies, and collections lifecycle related decisioning

Why You Should Buy This Report

This report on the global debt collection software market covers future industry trends, size, regional market share, historical and current data and deep analysis, and projections. It offers an orderly and coordinated methodology for the key aspects that have impacted the market in the past and the future market opportunities on which market players can rely upon before allocating their capital resources.

The research study furnishes a reasonable debt collection software analysis for better decision-making to invest in it. Furthermore, it scrutinizes the aspects and provides a comprehensive outlook of the key organizations that will probably add to the demand in the global debt collection software market over the years ahead.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now