CATEGORY

Cheque Processing Services

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Cheque Processing Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCheque Processing Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Cheque Processing Services category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Cheque Processing Services category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

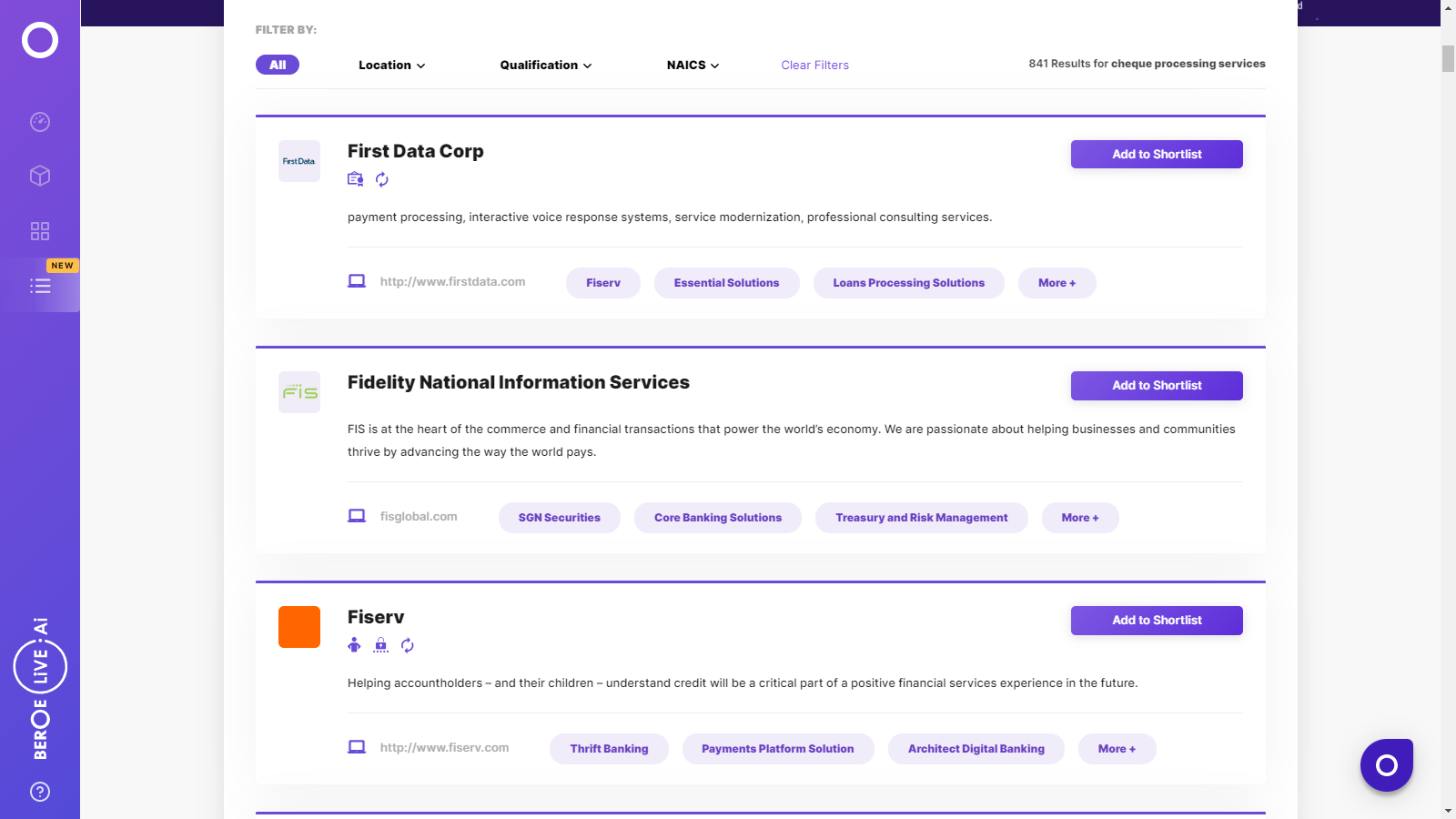

Cheque Processing Services Suppliers

Find the right-fit cheque processing services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Cheque Processing Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCheque Processing Services market report transcript

Cheque Processing Services Market Outlook:

-

The highest adoption rate of cheque processing is in Asia Pacific, and particularly, in countries, like India, China, Malaysia

-

Due to COVID-19’s impact, most of the clients have transacted through digital banking, and so, it has reduced the usage of cheques. These side effects are slightly offset by the use of Cheque Truncation System (CTS) and Cheque Imaging Services, which offers contactless and quick transactions.

Supply Market Outlook

-

It has been observed that cheque processing as a mode of payment is considered obsolete in North America and Europe

-

The highest adaption rate of cheque processing is in Asia Pacific and particularly in countries, like India, China, Malaysia and middle eastern countries but are being phased out in countries like Australia and New Zealand.

Market Monitoring: Cheque Processing

Banks have the option of truncating the cheque at the branch or the service branch or outsourcing the process completely.

Cost Components

Investments required to implement cheque truncation can be divided into two areas:

-

Hardware: Investment in scanners, based on the truncation model chosen by bank. Interestingly, most banks will have an existing scanner and may be able to extend its usage

-

Software: Applications required for integration into the bank’s core banking system and implementation of the cheque truncation software. These costs will form the major chunk of the overall investment required and will be costlier than the hardware costs

Procurement Centric Five Forces Analysis: Developed Markets

(North America and Canada)

Supplier Power

- It has been observed that supplier power of cheque processing providers in the developed markets is medium, as cheque processing as a payment method is becoming obsolete

Barriers to New Entrants

-

It has been observed that barriers to new entrants is relatively higher, as the cheque processing regulation changes from time to time

-

New entrants are not willing to enter the cheque processing market, as the adaption rate of cheque processing is decreasing in the developed markets

Intensity of Rivalry

- Intensity of rivalry is relatively higher in the developed markets, as there are many major providers have into the cheque processing space

Threat of Substitutes

-

Threat of substitutes are high in the developed markets, as there are many alternate payment options that poses a threat to cheque processing systems and the adaption of other digital payments are relatively higher in the developed markets

Buyer Power

- It has been observed that buyer power is relatively higher, as cheque processing adaption level is relatively lower in the developed regions and suppliers offer rebates in processing cheques

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now