CATEGORY

ATM Services Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like ATM Services Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

ATM Services Australia Suppliers

Find the right-fit atm services australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the ATM Services Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoATM Services Australia market report transcript

Regional Market Outlook on ATM Services Australia

APAC is the fastest growing market in the industry, with India and China leading, in terms of the number of deployments, this is because the countries are taking fast phase in moving to digital economy

Demand for ATM service is expected to remain low for the region due to high adoption of cashless practices

Revenue: $4.96 billion,

Growth Rate (2021): 4–5 percent

Regional ATM Services Market Maturity

-

Due to COVID-19, ATM services began seeing a decrease in transaction volumes of varying degrees across its network, depending on location. As the pandemic reduced and travel restrictions and social distancing orders are withdrawn, the demand for ATM industry is slowly increasing.

- Asia region was not affected much compared to Europe & North America initially. However, current trends shows that many service providers are expected to have cost constrains due to lockdowns

Regional Market Outlook : APAC

Market Information

Market Size (2021) - $4.96 billion

-

Locations with High Maturity - Japan, Singapore, Australia, and New Zealand

-

Maturity of Service Providers - Scattered presence of global service providers and regional service providers. Local service providers are very high in this region.

-

Maturity of Buyers - Most buyers are trying to switch to regional suppliers to consolidate their supplier base.

Supply Market Outlook

Supply Trends and Insights

Supplier Market Trends

Introduction of Self-Service Solutions

-

To assist Financial institutions in branch transformation and automation, self service solutions are being rolled out by service providers that provide cash recycle(deposit & withdrawal), check deposits, coin dispensers, financial solutions and products, video assisted tellers that provide round the clock, personalized banking solutions

Increasing ATM Availability and Reducing Stock-out Downtime

- Enhanced cash recirculation functionalities and accurate forecasting of cash demand are some of the key trends to ensure that ATMs are provisioned with the right amount of cash needed and avoidance of out-of-cash downtime

Operational Efficiency

- Automated fault-detection systems, integrated servicing and replenishment schedules and centralized ATM software environments are some of the cost reduction techniques

Security Solutions

- Suppliers are implementing card readers with EMV/chip recognition, card less transactions through biometrics, mobile application-based NFC, to reduce the risk of card skimming & other threats

Managed Services for FIs

- Large non-bank ATM and financial services kiosk operator, who offer lower costs and an established operating history, generally contract with FIs and banks to manage their ATM networks

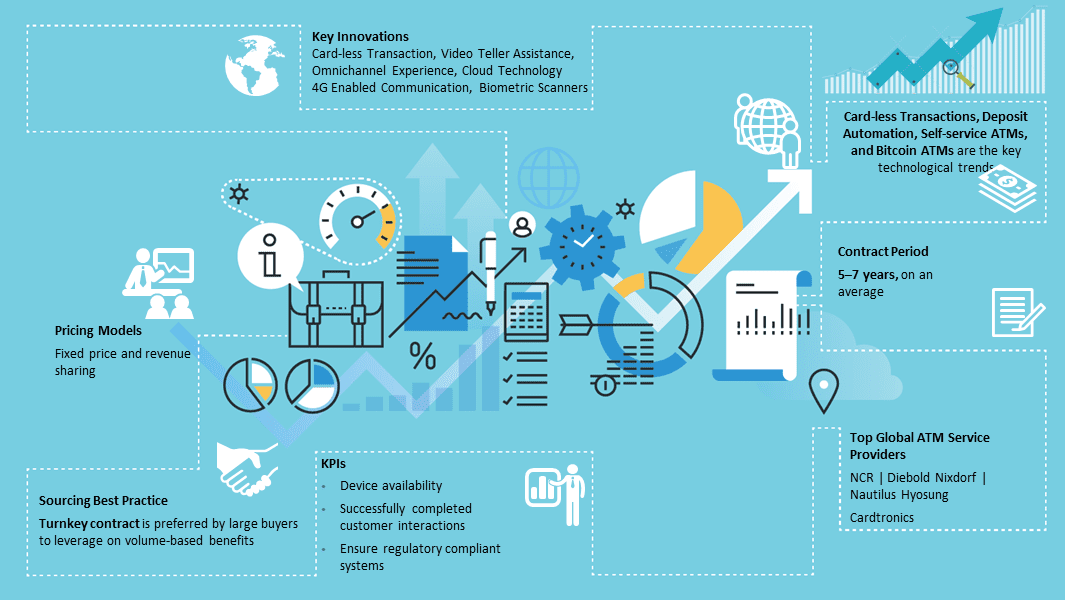

Engagement Trends

-

Most adopted engagement model is the “Turnkey ATM Program”

-

The service provider owns the ATM and performs all operational tasks including cash management and loading, supply replacement, maintenance, customer care, and processing

-

–Key benefit: These turnkey service providers are well established suppliers in the market, providing integrated services to buyers and have proven experience in providing the turnkey solutions

-

–Limitation: Turnkey suppliers do not offer the entire range of OEM’s models. They have certain models and those are offered as a part of bundled service. Mostly, the ATM models are basic, low-cost models

Best Practices: Contract Bid Negotiation

Risk Mitigation

- The RFP structure assumes a fairly open bid process. In this approach, buyers disclose as much information as possible to ensure that service providers provide a fully informed solution. This approach enables negotiation of firm pricing, and mitigates receiving offers conditional on post deal due diligence

RFP Process

-

A good RFP needs to incorporate a detailed bid template, which itemises all service delivery resources. Personnel should be individually listed along with their associated salary information. Sub-contracted services should also be itemized

-

The RFP should include detailed information about the buyer’s site, assets that are maintained, and the current service delivery solution. A clear understanding of the buyer’s expectations will help the service provider to develop a suitable solution for service delivery

Cost Escalations

-

During contract negotiations, service providers may be concerned about uncontrollable expenses for a number of services, especially in hard services spend categories. Sometimes, service providers ask for these spend areas to be exempted from the maximum price controls. Unfortunately, removing price controls may lead to higher risks for buyers, and lesser incentive for service providers, to manage and deliver services efficiently

-

Broader the scope of work, the more reasonable it is for service providers to accept the risk of uncontrollable spend categories. When the service portfolio is large, the risk of a single event resulting in cost overruns is reduced, due to the high volume of services outsourced

Australia ATM Market Overview

According to the Australian ATM industry statistics, most adopted engagement model is the “Turnkey ATM Program”.

The service provider owns the ATM and performs all operational tasks, including cash management and loading, supply replacement, maintenance, customer care, and processing

Key benefit:

These turnkey service providers are well established players in the market, providing integrated services to buyers and have proven experience in providing turnkey solutions

Limitation:

Turnkey suppliers do not offer the entire range of OEM models. They have certain models and those are offered as a part of bundled service. Mostly, ATMs are basic, low-cost models

ATM providers in Australia must ensure availability ratio of ATM at 98% for all services covered under the maintenance contract. For availability ratio lower than 98%, penalty points should be calculated and deductions should be made off the monthly maintenance fee/ATM x Number of ATMs impacted.

During contract negotiations, ATM providers in Australia may be concerned about uncontrollable expenses for a number of services, especially in hard services spend categories.

Sometimes, service providers ask for these spend areas to be exempted from maximum price controls.

Unfortunately, removing price controls may lead to higher risks for buyers, and lesser incentive for service providers to manage and deliver services efficiently

The ATM services contract is the first legal relationship with a new/existing service provider. A well-written contract is essential for maintaining a smooth relationship with a service provider and will also help the buyer in avoiding cost overruns.

Why You Should Buy This Report

- Information on the Australia ATM services market maturity, buyer trends, drivers and constraints, Australia ATM industry statistics, etc.

- Porter’s five forces analysis of the Australia ATM market

- Technological trends, supply trends and insights, categorization and product portfolio of key ATM providers Australia

- Engagement models, sourcing models, pricing models, price analysis, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now