CATEGORY

Corporate Tax Services

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Corporate Tax Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

PwC Launches Centre for Nature Positive Business, Enhancing Global Nature and Biodiversity Capabilities

April 20, 2023KMJ Financial Group moves to Commonwealth to bolster Fee-Based and Tax Planning Business

April 19, 2023Bloomberg adds automation capabilities for its Bloomberg Tax Provision

April 18, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Corporate Tax Services

Schedule a DemoCorporate Tax Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCorporate Tax Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Corporate Tax Services category is 5.30%

Payment Terms

(in days)

The industry average payment terms in Corporate Tax Services category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Corporate Tax Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCorporate Tax Services market report transcript

Global Market Outlook on Corporate Tax Services

-

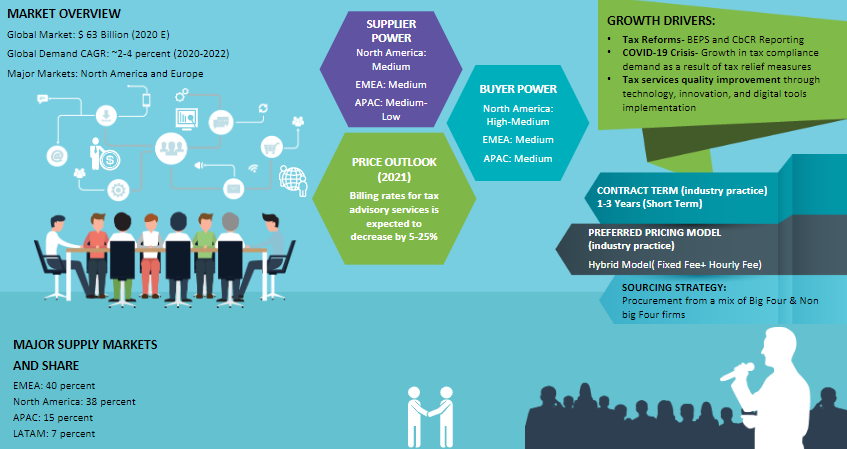

Demand for tax advisory and compliance services has been increasing since 2022, as clients look to navigate increasingly complex tax environment driven by the pandemic and changing tax and economic landscape. Hence, the global corporate tax services market grew by 4 percent in 2022 to reach $68 billion

-

Corporate tax services market is expected to grow by 4–7 percent in 2023, driven by demand for tax compliance and planning fueled by tax due diligence, ESG, M&A related tax advisory work, etc.

-

Increase in demand, due to growing vigilance from tax authorities post pandemic and lack of in-house resources to manage complex tax compliance and reporting, inflation is expected to increase the billing rates by 3–5 percent in 2023

Global Tax Services Market Maturity

North America and Western Europe are the most mature markets for tax services contributing to approximately 80 percent of the global tax services revenue. From the supplier standpoint, Big Four firms command more than 60 percent market share of the global tax services industry.

North America

Demand Trends :

-

Various tax legislations in the US such as Build Back Better, OECD Global tax reforms, increase in sales tax and VAT regulations during the pandemic etc.is expected to drive the demand for tax compliance and advisory services

-

Restructuring, M&A, supply chain, digital reporting, sustainability mandates is expected to drive the demand for tax advisory services

Price Trends :

-

As companies look to navigate complex tax regulations in the region, demand for tax compliance and advisory services is high in the region

-

Billing rates are expected to grow by 4–6 percent, mainly driven by demand by companies looking for external support to navigate the complex tax regime

Regional Market Outlook : North America

Maturity of Suppliers

HIGH

-

Big four firms hold 30-50 percent of the market share

-

Considerable experience of suppliers in tax services domain

-

Commoditized nature of tax compliance services

-

Customized nature of tax advisory services

-

Variety of suppliers ranging from accounting firms to law firms to relocation suppliers

-

High quality of customer service

Maturity of the Buyers

HIGH

-

Higher procurement involvement in sourcing

-

Centralized tax sourcing (centralization of tax needs)

-

Quantitative and qualitative supplier performance measurement

-

Ability of buyers for backward integration (in-house tax consulting)

-

Ability for buyers to in-source tax compliance operations using automation tools

Growth Drivers and Constraints: Tax Industry

Tax services are a dependable source of revenue for most accounting firms, as these services are required by law. Industry growth is mainly driven by major tax policy reforms, digitization of tax, M&A, supply chain, employment and mobility, and sustainability reporting etc.

Drivers

Demand for Tax Services is mainly driven by:

-

Companies looking to improve quality through technology, innovation, and digital tools implementation

-

BEPS reforms, country-by-country reporting norms, two-pillar tax reforms, transfer pricing requirements, and increased scrutiny from tax agencies

-

New accounting provisions and financial adjustments in light of the COVID-19 crisis

-

Increasing tax disclosure requirements by regulatory authorities around the world

Constraints

Key constraints faced by tax services firms are:

-

Insourcing of tax compliance services, i.e., tax compliance could be performed in-house by tax teams via web-based tools, thereby leading to reduced demand for outsourced tax compliance services

-

Falling staff productivity levels, due to automation. Although, automation has expedited work, but tax firms are unable to use this additional capacity

-

Inability to hire and retain experienced professionals (partner-level consultants) serves as a major growth constraint for tax industry globally, especially in advisory area

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.