CATEGORY

Tallow

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Tallow .

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoTallow Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoTallow Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Tallow category is 4.60%

Payment Terms

(in days)

The industry average payment terms in Tallow category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Tallow market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoTallow market report transcript

Global Market Outlook on Tallow

-

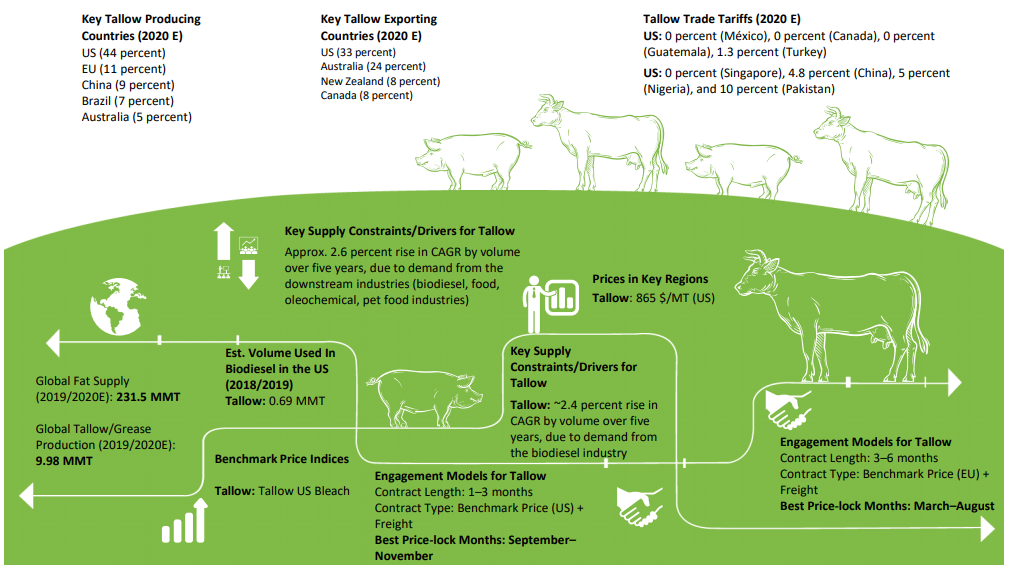

Tallow constitutes to ~35.4 percent of the total fat production in the animal fat production and around 4.4 percent of the global production of fats and oils. The global tallow production has risen at a CAGR of ~2.4 percent over a five-year period. Demand has been driven by preference for tallow in the biodiesel industry

-

Globally, tallow is mainly used in biodiesel, animal feed, and oleochemical. The US is the largest tallow producer, comprising around 47 percent of the global tallow production

Global Tallow Supply–Demand Analysis

The US is the largest tallow producer, comprising around 47 percent of the global tallow production, followed by the EU and China. The demand from Chinese market was slow until Jan 2023 due to surge in covid-19 virus cases. However, it is expected to improve in Q2 2023.

Market Overview (2023 F)

-

Globally, tallow is mainly used in biodiesel, animal feed, and oleochemical. The US is the largest tallow producer followed by the EU and China. Due to economic ambiguity, and the ongoing Russia-Ukraine war, the demand outlook for 2023 (F) is remain uncertain.

-

In 2022, global tallow market was tight due to COVID-19 pandemic, low slaughter rates, Russia–Ukraine conflict, high energy cost, and supply.-chain issue. However, in H2 2022, the slaughter has improved compared to H1 2022. In 2023 (F), the slaughter rates are likely to improve.

Tallow Global Demand by Application (2022/23 E)

-

The main end-use application of tallow is for biodiesel, animal feed, and oleochemical, which account for 77 percent of the global demand

-

In the soap making industry, tallow is considered as a superior quality raw material compared to plam sterin

Tallow Consumption by Country (2022/23 E)

-

The US and the EU together consume 55 percent of the global tallow produced

-

China ranks third, in terms of production and consumption of tallow

-

China is assumed to be importing ~45 percent of its raw tallow demand from Australia and New Zealand and does the processing (bleaching) domestically

Global Tallow Trade Dynamics

According to information from Oil World, the US became a net importer of tallow, with net arrivals reaching 528 Thd Ton in Jan/Nov 22 compared to 323 Thd Ton a year earlier. The biggest supplier were Australia and Canada.

-

At present, tallow’s global trade volume is decreasing, due to a rise in demand of non-GMO based glycerin, supply chain issue, and high feed cost.

-

The US, Australia, Canada, and New Zealand are the largest exporters of tallow. China is the biggest consumer in Asia.

-

In 2022/23, the US was a biggest import of Tallow followed by Belgium (9.24%), the Netherlands (7.84%) and others.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.