CATEGORY

Tablet Coatings

Tablet coating used for taste masking, odor masking, physical and chemical protection, protecting the drug in the stomach, and control its release profile. Coating may be applied to a wide range of oral solid dosage form, such as particles, powders, granules, crystals, pellets and tablets.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Tablet Coatings.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoTablet Coatings Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Tablet Coatings category is 20.10%

Payment Terms

(in days)

The industry average payment terms in Tablet Coatings category for the current quarter is 54.3 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Tablet Coatings Market Intelligence

global market outlook

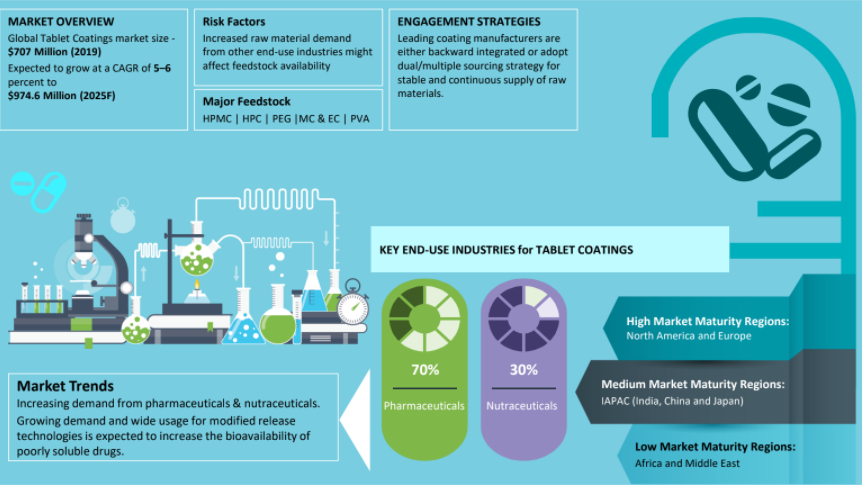

- The global tablet coatings market is expected to reach $ 1,245.2 Million by 2028 by growing at a CAGR of 5.9 percent between 2021 and 2028F

- Pharmaceutical tablet coatings account for about 70 percent of the overall tablet coatings market.

- North America, especially US, is the large pharmaceutical market in the world accounting for about 53 percent of the worldwide consumption, and thus demand for tablet coating systems is high as compared to another region.

- India and China are leading the coatings market by volume when compared to developed markets (US and Europe)

Use the Tablet Coatings market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoTablet Coatings market report transcript

Tablet Coatings Global Market Outlook

-

The global tablet coatings market is expected to reach $ 1245.2 Million by 2028 by growing at a CAGR of 5.9 percent between 2021 and 2028F

-

Pharmerging nations are expected to lead the demand for tablet coatings with anticipated CAGR of 8–9 percent by 2022F

-

Currently, pharmaceutical tablet coatings dominate the tablet coatings market with a market share of 70 percent

Industry Drivers and Constraints : Tablet Coatings

Drivers

Growth in modified release technologies

-

Market is driven by demand from oral solid dosage forms, such as sustained, enteric and immediate release tablets

-

The modified release market is expected to grow at a CAGR of 6 percent until 2022

Pharmaceutical tablets coatings

-

There is a growing demand for pharmaceutical tablet coatings, which currently accounts for about 70 percent and is expected to drive the tablet coatings market

Demand for pigmented film coatings

-

Demand for pigmented film coatings is growing mainly due to its application in the prevention of counterfeit drugs. Also, the visual differentiation of products helps in enhanced brand recognition

Constraints

Fluctuating raw material cost

-

Pricing risk exists as the prices fluctuate for different raw materials, which has a negative impact on the coatings market

Consolidated market

-

The supply base for tablet coatings is consolidated resulting in a low negotiation power for buyers

Need for coatings technology and Quality by design

-

High expectations of different coatings technology and US FDA requirement for quality by design from pharmaceutical and nutraceutical industries, have led to an innovation driven market, in turn making it difficult for new suppliers to enter

Tablet Coatings Cost Structure

Since, raw material constitutes majority of the manufacturing cost for coatings, fluctuations in the price of raw materials (especially when it is single sourced) would have an impact on the coatings price.

-

Raw material constitute nearly 90 percent of the total manufacturing cost for the coatings. Raw materials are homogenized together in aqueous or organic medium to form tablet coatings.

-

Utility cost accounts for around 7–8 percent of the total cost. However, these costs are quite less in coatings as machines are only used to blend the raw materials. Labor cost account for 2–3 percent share in coatings production. Labor costs are incurred only for quality checks and maintenance.

-

It is expected that the price for raw materials such as HPMC, HPC, Methylcellulose, Ethyl Cellulose, PVA may increase by 2-3 percent per annum owing to its demand in the market which may reflect in the overall cost structure of the tablet coatings.

Global Tablet Coatings Market Demand by End-use

Pharmaceutical tablet coatings account for about 70 percent of the overall tablet coatings market. Pharmerging nations are expected to lead the demand owing to expanding middle class and governments’ incentive and initiatives.

-

Pharmaceutical tablet coatings market was around $824 million in 2021 and is expected to reach $969 million by 2025, growing at 5.6 percent annually. North America accounts for 53 percent of the world’s consumption of solid oral dosage forms

-

Pharmerging nations are expected to lead the demand for tablet coatings with an anticipated CAGR growth rate of 8-9 percent. High growth rates in demand could be attributed to:

–Rapidly expanding middle class and government incentives to provide drugs at a lower cost

–Expansions by private firms and governments allowing FDI to penetrate into untapped markets

-

Formulated and customizable blends are key areas, in which drug manufacturers are displaying their interest. This is expected to increase the total addressable market for tablets and hence demand for tablet coatings

Why You Should Buy This Report

- The report gives details on price trend analysis, cost structure and feedstock analysis of the tablet coating industry.

- It lists out the major players in the pharmaceutical coatings market and gives an overview of the regional and emerging markets such as India, China and Japan.

- The report provides a thorough SWOT and Porter’s Five Force analysis.

- It gives information about major industry trends such as the development of new coatings, partnerships, acquisitions, and strategic alliances.

- The report details the constraints and drivers in the tablet coatings industry.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.