CATEGORY

Sulfuric Acid

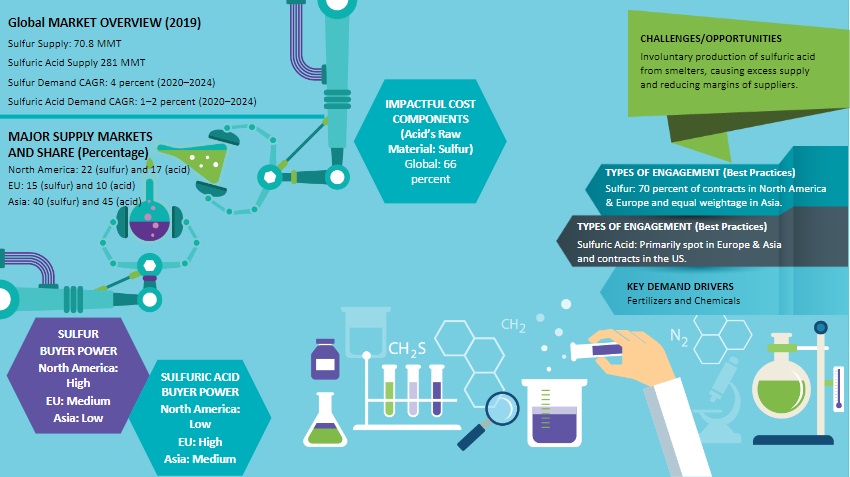

The global demand is expected to grow at 4 - 5 percent CAGR for sulfur and 2 percent CAGR for sulfuric acid through 2016 - 2022 Asia (high population zones: China and India) is expected to drive the demand for sulfur

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Sulfuric Acid.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoSulfuric Acid Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoSulfuric Acid Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Sulfuric Acid category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Sulfuric Acid category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Sulfuric Acid market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoSulfuric Acid market report transcript

Global Market Outlook on Sulfuric Acid

-

The global demand is expected to grow at 3.2 percent CAGR for sulfur and 2.2 percent CAGR for sulfuric acid through 2023–2026, respectively

-

Russia and China, being the largest exporters of fertilizers and acid, have been imposed with sanctions, due to geopolitical tensions between Russia and Ukraine. China, on the other hand, has implemented a dual-control policy on its export fertilizers and critical commodities to increase its domestic supply

-

Sulfuric acid usage in the chemicals segment is also expected to increase by about 1–2 percent CAGR during the same period

Global Market Size: Sulfuric Acid

-

The global sulfuric acid market is expected to reach $93 billion by 2026

-

The key market driving end use is the agriculture segment (used for producing phosphoric acid, and in turn, phosphate fertilizers)

-

Global agriculture production is expected and being aimed to grow at 1–2/year in the next decade, which is likely to be a key driver for the sulfuric acid market

-

The top importers China, India, and the US are expected to drive the sulfuric acid market

-

Fertilizer consumption is high in China and India, followed by the US

-

Based on FAO, the caloric requirement is expected to double in the next 25 years, with population touching 8 billion

Global Capacity–Demand Analysis : Sulfur

-

In the long run, all the key production markets are likely to get self-sustained, which is expected to export sulfur to import in the regions, like LATAM and Africa

-

This is likely to shift negotiation power toward buyers in the markets, like North America, in the next 3–4 years

Market Outlook

-

Capacity dynamics: Sulfur production has increased by about 18 percent from 2018 to 2022. Sulfur is primarily produced during the crude oil and natural gas refining (>96 percent of the total production). The increased oil output is likely to improve sulfur production as well. The rest is produced from Pyrites and mining activities of sulfur deposits

-

Key consumption regions: China (28 percent), the US (18 percent), and Middle East & Africa (18 percent)

-

Key producing regions: China (17 percent), the US (12 percent), Russia (10 percent), and Canada (8 percent)

Engagement Outlook

-

Concept of negative pricing: Instances were noticed in 2009, when negative pricing was prevalent in the US, due to excess supply and economic recession, where agriculture activities slumped to a large extent. However, though such scenario is unlikely in the future, extensive discounts or allowances in the prices of sulfur are likely in the key markets, when they attain self-sufficiency and find it difficult to place material in the international markets

Industry Drivers and Constraints: Sulfur and Sulfuric Acid

Drivers

Demand-driving segment

-

The fertilizer industry (particularly, phosphate fertilizers) is the largest segment, which drives the demand for sulfuric acid, and in turn, for sulfur

-

This is expected to drive the sulfur market at 3–4 percent CAGR and sulfuric acid market at 1–2 percent CAGR from 2016 to 2022

Demand-driving region

-

With the anticipation of resumption in the Chinese phosphate, post the slump in 2016, both sulfur and sulfuric acid imports into the region are expected to increase

-

The US and India are the next in line agrarian economies, which are expected to consume these materials for fertilizer production

Constraints

Excess supply and involuntary production

-

The involuntary production nature of sulfuric acid from metal smelting has resulted in many of the sulfur burners to go out of business in regions, like Europe, and also posing as a liability for new smelters to be put up in the region

Compelled for discounted selling

-

In certain cases, the market is highly supplied, which often sellers resort to heavy discounts (in some cases, negative pricing), in order to avoid the material handling/inventory costs, as the acid cannot be disposed, due to environmental concerns

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.