CATEGORY

Stretch Wrapping, Palletizing And De-palletizing Equipment

Stretch wrap equipment uses a highly stretchable plastic film that is wrapped around items to keep the items tightly bound. Palletizing equipments is used in the operation of loading an object such as a corrugated carton on a pallet or a similar device in a defined pattern. Depalletizing equipment helps in the operation of unloading the loaded object in the reverse pattern.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Stretch Wrapping, Palletizing And De-palletizing Equipment.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Stretch Wrapping, Palletizing And De-palletizing Equipment Suppliers

Find the right-fit stretch wrapping, palletizing and de-palletizing equipment supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Stretch Wrapping, Palletizing And De-palletizing Equipment market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoStretch Wrapping, Palletizing And De-palletizing Equipment market report transcript

Global Market Outlook on Stretch Wrapping, Palletizing And De-palletizing Equipment

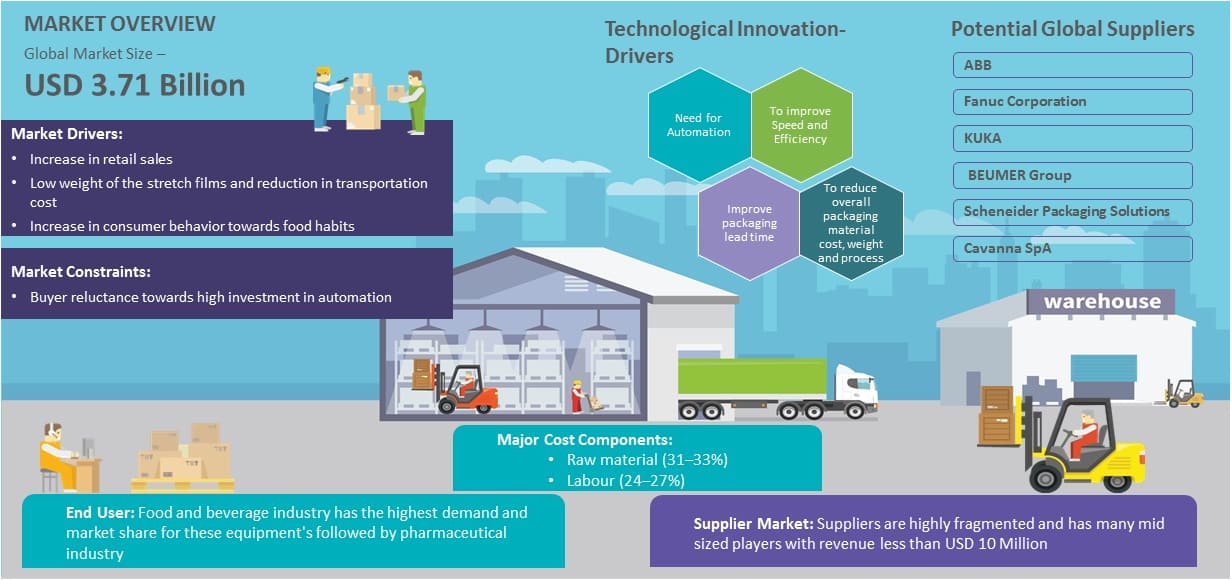

The global palletizing equipment and stretch wrapping market is expected to reach USD 715 million and USD 3 Billion by the year 2021 respectively, growing at a CAGR of 4-5 percent. Breakthrough in technology and enhanced speed and quality of packaging line has driven the need and importance for automatic and robotic solutions

Trends in Wrapping and Palletizing

- As the outcome of business is getting closely linked with the end-of-line packaging, wrapping, palletizing and pallet packaging technologies are gaining importance in every industry

- Case palletizers dominate the palletizing market, followed by bulk palletizers, which is expected to experience a fast growth at a CAGR of 4–4.5 percent. Bulk palletizers are used in palletizing products such as bottles and cans

- Technology: Human Machine Interface controls are changing the traditional and robotic palletizers, by allowing machine reconfiguration to handle multiple case sizes, numerous product layers, and pallet patterns

- Major industry players resort to mergers & acquisitions (M&A) as well as capacity expansions to cater to the growing demand. Furthermore, companies including Sigma Plastics Group and Berry Plastics Corporation have acquired companies to expand their market presence

Region-wise Trends in wrapping and Palletizing market

- US and Europe accounts for more than 60% of the demand for stretch wrapping and palletizing machinery in the world.

- Asia Pacific will experience a strong growth at CAGR slightly more than 5% over the period of 2016-2021

- Emerging regions such as Asia, Latin America, and the Middle East will compensate for the slow growth in the developed nations

Growth Drivers and Constraints

Stretch films, which are light and are easy to use in packaging lines have high demand among end user industry such as Food and Beverage Industry.

Drivers

- Demand for stretch film is expected to grow due to increase in sales of retail items, as well as increasing efficiencies in film manufacturing and layering.

- Increased suitability for most of the packaging applications will set a major driving force for stretch wrapping industry. Also, the use of collaborative robots in palletizing application will increase due to its higher productivity and efficiency in processing line.

- Food and beverages application accounted for 40 percent of the overall revenue driven by the increasing demand for high strength, low weight packaging materials. In addition, ease of packaging material sterilization is expected to drive the demand for stretch films for food packaging.

- The steady increase in income of consumers and changes in consumer behavior towards package foods in developing countries will likely be a driver for the global palletizing and stretch wrapping equipment as the manufacturers expand their manufacturing and packaging lines.

- The low weight of the stretch films results in a substantial decrease in the transportation cost thereby elevating the profit margins, resulting in the higher adoption of such packaging materials by the leading end-use industries.

Constriants

- End users may need to adapt to ever growing newer technologies such as collaborative robotic palletizers, which may incur high capital costs

- Projected weak sales of confectionery products among developed regions will reduce the demand for the packaging line equipment

Market Overview by End Use Industries

Palletizer Market Share By End Use Industry – FY2017

- Palletizers and stretch wrapping equipment are extensively used in the foods and beverages packaging industry. The beverage industry continued to struggle as sales of both non-alcoholic and alcoholic drinks were weak

- Large population of the Asian economies is fueling the demand for food products in the region. The segment that is witnessing a fast rise in demand is convenience food, pre-cooked and frozen ready to eat products

- Among other industry segments, personal care products boosted the share of palletizing machinery,

- Most of the largely discretionary product segments such as chemicals, hardware/industrial/automotive, and paper/non-durables cut spending on packaging machinery and declined slightly in proportional share compared with year-ago totals

End-user Demand for Palletizing and Stretch Wrapping Market

- Food and beverage industry represents the majority as well as the fastest growing end-user market for both palletizing and stretch wrapping machinery worldwide

- CPG and Food and Beverage have high demand for constant innovations, which is resulting in a cheaper and more sophisticated machine upgrades, reducing investment cost and time

- During the period 2014–2018, the usage of robots in packaging lines is expected to increase to 40–45 percent, due to surge in demand from FMCG companies. Though FMCG constitutes to less than 20% of demand for industrial robots, it is considered as attractive in automation for Packaging lines

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now