CATEGORY

Strawberries

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Strawberries.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoStrawberries Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoStrawberries Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Strawberries category is 5.30%

Payment Terms

(in days)

The industry average payment terms in Strawberries category for the current quarter is 75.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Strawberries market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoStrawberries market report transcript

Global Market Outlook on Strawberries

-

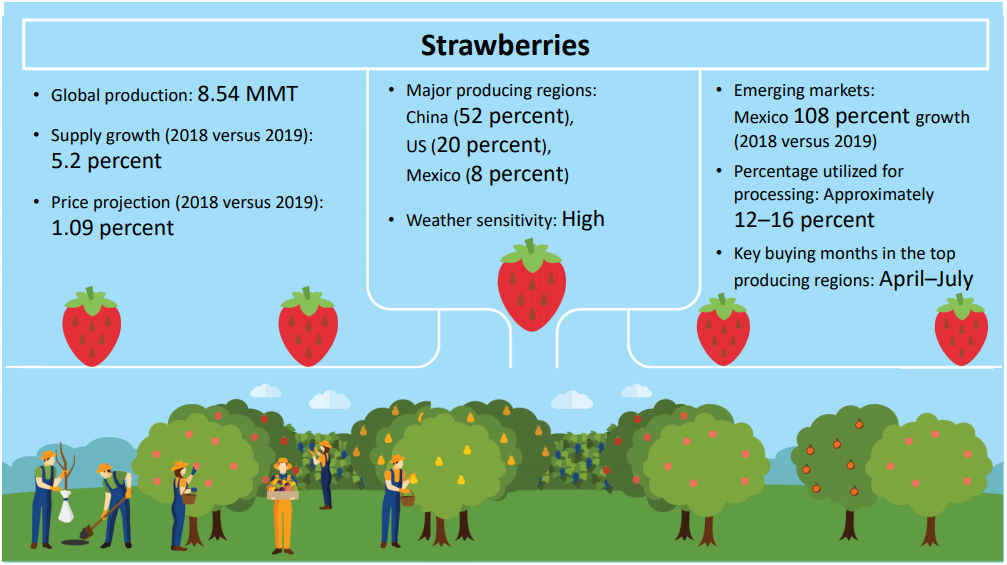

The global production of strawberries is estimated to register at a CAGR of 4-5 percent between 2023 and 2027

-

Demand from processed food segment is rising, due to increased usage in pastries and cakes. Consumption of fresh fruits, on the whole, is also displaying an increasing trend, due to various health benefits associated. This is likely to increase in the upcoming years

Strawberries Global Supply–Demand Analysis

-

Global strawberry production in 2022/23 is estimated to reach 9.33 MMT, supported by rising acreage and yields in regions, like China, California, Mexico, Egypt, etc. Quality of fruit is deemed to be excellent this season

-

However, temporary supply tightness is likely caused in some regions by any decline in production, owing to adverse weather conditions and logistic issues

Strawberries: Top Producing Regions (2022 E)

-

During the first nine weeks of 2023, Florida accounted for 40 percent of the market's volume for fresh strawberries. Despite volume declining in January mostly because of cool, rainy weather, the State's recovering volume in February helped to raise shipments through March 4 by 1 percent y-o-y

-

Through March 4, 6 percent of fresh strawberry volume in California came from the South Coast; however, due to heavy rains, volume was down 56 percent from the previous year. In late February and into March, coastal California strawberry regions were once more flooded by severe rainstorms, which had an impact on the fruit's quality, volume, and yield

-

This year's bad weather has led to greater production costs, reduced volumes, and a change in the strawberry kinds used, according to Egyptian strawberry growers, who are concerned about the situation. As a result, the cost of strawberries in Egypt has significantly increased, reaching a level of $0.5 per kg

Cost Structure Analysis: Strawberries

-

Surging fertilizer costs due to severe shortage is likely to drive up production costs. Anticipation of a rise in global fuel prices due to Russia-Ukraine war could further add to production costs

-

Rising labor costs and water scarcity in major producing regions could increase production costs for 2022, except for Mexico, which has lower labor costs, making it attractive for strawberry cultivation

Cost Parameters in Production and Harvest

-

Fertlizer shortages and logistics challenges are the major cost increasing factors in the current year

-

Labor cost is vital for strawberry harvest and lack of labor availability could lead to crop losses

-

In major producing regions, such as the UK, political and trade scenarios, like the recent Brexit, is impacting trade and could also impact labor rates and regulations whoch would have a sognificant impact

-

Drought, lack of labor, regulatory restraints have led to rising production costs and decease in acreage of strawberries in California

-

The high cost of drilling wells and low labor costs in neighboring Mexico are the challenges faced by the US strawberry growers

-

Drip type irrigation is usually employed for strawberry production, as strawberries require frequent but less water and excessive irrigation that can cause rotting

Industry Drivers and Constraints : Strawberries

Drivers

-

Year around Availability and Convenience: Given factors like seasonality and perishability, processing makes it possible to preserve and consume fruits throughout the year

-

Wide Product Portfolio: Processing offers a range of opportunities for value addition and widening product portfolio, which help the players stay competitive in the market

-

Reduces Perishability and Wastage: Processing increases shelf life, facilitates transport worldwide, helps expand export base with reduced spoilage

-

Globalization: Increasing consumer awareness and immigration of varied ethnic groups drive imports and processing of non-locally produced fruit products that need to be transported and stored efficiently

-

Rise in per capita income: Urbanization, changing lifestyle, increasing focus on health and wellness, higher disposable incomes, and evolving consumption habits have spurred the need for convenient food that is easy to consume and also, wholesome and nutritious

Constraints

-

Supply Uncertainty: There is no guarantee of consistent supply of fruits, which depend on weather and harvest. The producing region’s economic condition could cause price volatility, especially fruits imported from developing countries

-

Capital Intensive: Decrease in conventionally processed fruits, owing to increasing preference for minimally processed fruit products call for processors to keep up with evolving trends.

-

The switching cost is very high and can be afforded only by large players, leaving the small and medium level processors at a disadvantage

-

Access to Raw Materials: New entrants face challenges in securing raw materials supply at early stages of operations and are prone to high-cost fluctuation risks

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.