CATEGORY

Strategy Adopted for Batteries EMEA

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Strategy Adopted for Batteries EMEA.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

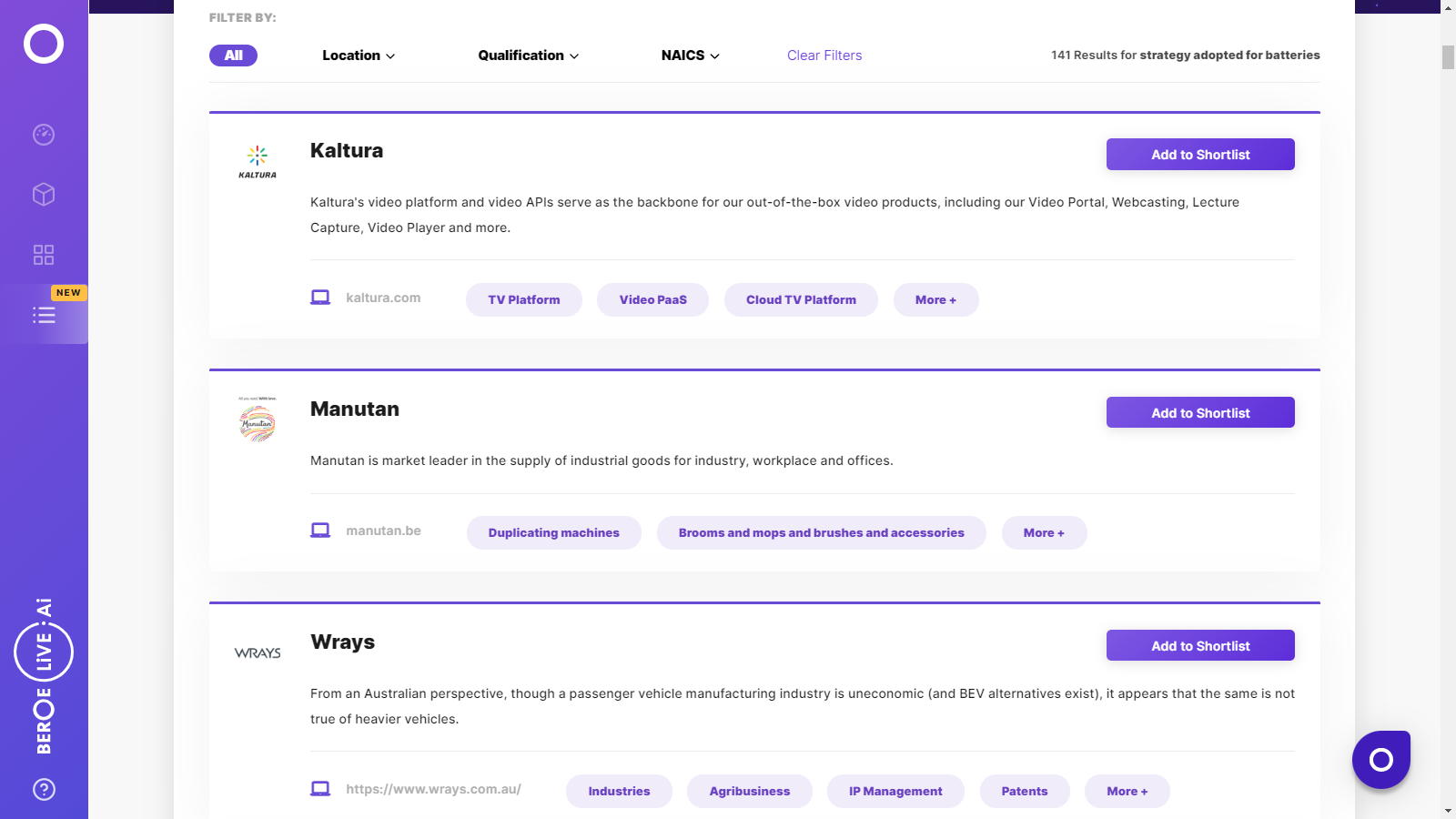

Strategy Adopted for Batteries EMEA Suppliers

Find the right-fit strategy adopted for batteries emea supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Strategy Adopted for Batteries EMEA market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoStrategy Adopted for Batteries EMEA market report transcript

Regional Market Outlook on Strategy Adopted for Batteries

Industry, in order to gain maximum coverage and ensure the products are available at maximum number of stores, is suggested to adopt centralised and satellite DC strategy across Europe.

Primary Distribution: Centralised vs. Decentralised Model

- Distribution is done through a CDC, where point-to-point or milk run deliveries are adopted to service the regional or local DCs

- CDC handles direct distribution to region-specific distributors/ modern trade DCs across Europe

- The rest of the distribution area is covered through local DC acting as a cross-dock network

- Line haul semi-truck feeds the cross-dock, which in turn uses route truck for deliveries. This model allows next day delivery to these areas

Decentralised Distribution Model

- Distribution companies operate a network of regional DCs, each handling distribution within a specific geographical region

- Goods from the manufacturing unit are distributed directly to regional DCs across Europe

- Regional networks are adopted to drive service levels and have easier access to customers

- Regional DCs are also used as cross-dock location for faster replenishment to retail DCs

Decision Model

Product distribution network is influenced by various factors, such as product volume, variety (SKU type), uncertainty and costs (storage, transportation, etc.). In practical scenarios, consolidation/ centralisation of distribution is done selectively, with products of high value-to-weight ratios often being good candidates.

Industry Adoption Rate

Industry, in order to gain maximum coverage and ensure the products are available at maximum number of stores, is suggested to adopt centralised and satellite DC strategy across Europe.

- Centralised (High value and low volume products): Buyers preferring to have better control over the supply chain, such as pharma, focus on service levels and prefer to centralise their distribution network

- Decentralised (Low value and high volume products): Buyers, such as agricultural portfolios, in an effort to reduce transportation and storage costs, prefer decentralised distribution strategy by having (local) 4–5 DCs, supplying a fixed region

- Centralised and Satellite DC (Medium value and medium volume products): FMCG/ batteries/ light industry, who wants to gain maximum coverage and make their product available in all the stores, prefer to follow a mix of both centralised and decentralised (satellite DC) distribution strategy

Pros and Cons

Centralised Distribution

Advantages

- Improves warehouse operating efficiency and maximises asset utilisation (warehouse space, labour and equipment)

- Transportation assets can be efficiently used, due to simpler routing and scheduling

- Reduction in operating cost

- Efficient inventory control, due to pooling of variable demand fulfilment

Disadvantages

- Potential risk in case the warehouse is temporarily inaccessible or damaged, e.g., by flood, fire, natural disaster, etc.

- Limitations in responsiveness to customer needs, e.g., urgent need to support sales and marketing promotion with additional stocks

- Increase in outbound costs, due to large number of shipments and in smaller quantities

Decentralised Distribution

Advantages

- Capability to cater to the needs of customers and provide support to sales and marketing activities on a regional level

- Low risk in the event that one of the warehouses is temporarily inaccessible or damaged, e.g., by flood, fire, natural disaster, etc., as there are other facilities for continuing the operations

Disadvantages

- High operating costs, e.g., administrative costs, warehouse rents, transport and equipment costs

- High total inventory costs, as each warehouse is required to stock a certain level of inventory

APQC: Centralised vs. Decentralised Benchmark

According to APQC's research, industry's adopting distribution can achieve consolidation efficiencies; however, it will have little effect on the quality of order delivered and may increase the overall logistics costs.

APQC considered and compared the below parameters among organisations using a centralised structure with those using a decentralised structure to benchmark the best model.

Delivery Quality

- Perfect Order Performance: The performances of centralised and decentralised were identical at median and bottom performers, thereby emphasizing that other than top performers, centralised or decentralised has little impact on order performance

Inventory Management

- Value of Stockouts: Centralised model has a lower value of sales order line items that are unfulfilled, due to stockouts or production capacity as a percentage of revenue than those with a decentralised logistics structure

- Inventory Carry Cost: Centralised logistics structure has a lower value of inventory being held in warehouses than decentralised structure

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now