CATEGORY

Starch

Starch is produced from corn, tapioca, wheat, potato and etc and is widely used in food and beverage industry.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Starch.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Starch industry suffering from availability issues

March 28, 2023Ingredion develops next generation tapioca waxy starch

January 02, 2023Starch price witness a decline globally

January 02, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Starch

Schedule a DemoStarch Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoStarch Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Starch category is 5.70%

Payment Terms

(in days)

The industry average payment terms in Starch category for the current quarter is 120.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Starch market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoStarch market frequently asked questions

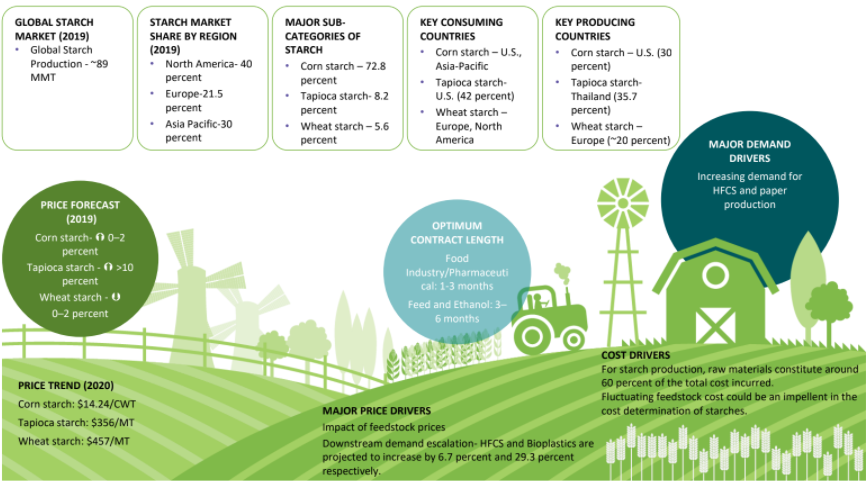

As per Beroe's analysis, the total size of the starch market is ~85 MMT.

The three major sub-categories of starch are corn-starch, tapioca-starch, and wheat-starch. The share of each sub-category is 72.8 percent, 8.2 percent, and 5.6 percent respectively.

The total starch production ~85 MMT is sub-divided into three parts wherein 53 percent goes into sweeteners, 36 percent goes into native starches, and 11 percent goes into modified starches.

According to Beroe's insights, the leading suppliers for each starch type are as follows: Corn-starch: ADM, Cargill Tapioca-starch: Siam Quality starch, General starch Wheat-starch: ADM, Roquette Freres

As per Beroe's report, the starch market share by region is categorized into three parts: North America ' 40 percent Europe ' 21.5 percent Asia Pacific ' 30 percent

For the food industry/pharmaceutical, the ideal contract length is 1-3 months, while for food and ethanol it's 3-6 months.

Starch market report transcript

Global Starch Market Outlook

Global STARCH MARKET (2022)

Global Starch Production: Approx. 120 MMT

-

The global supply of starch has been rising at a CAGR of 5.73 percent between 2022 and 2030. About 80 MMT of corn starch and 8.8 MMT of tapioca starch were produced globally in 2022. Demand for starch mainly comes from Germany and France in Europe and Indonesia, Malaysia in the Asian region. Both corn and tapioca starch are predominantly used in the F&B industry, paper and animal feed industry.

Starch Market Share by Region (2022)

-

North America is the largest market followed by Asia Pacific, the industry is expected to grow tremendously on account of the expansion of production facilities in the emerging economies such as India and China, coupled with increasing demand for the food, paper, and textile sectors

-

The robust manufacturing base of the food processing and paper industry coupled with the growing demand in Germany is expected to augment demand in Europe over the forecast period

-

High demand for modified starch-based products from the convenience and packaged food sector would propel the growth of starches, thereby resulting in the improvement of margins of the food processing industry over the past couple of years

-

The textile sector in China, Malaysia, and India increases the growing domestic consumption coupled with favorable regulations attract investments and strengthen the market

Corn Starch Supply-Demand Analysis

-

The global corn starch market size was $21.13 billion in 2020 and is projected to reach $33.27 billion by the end of 2027, exhibiting a CAGR of 6.7 percent in the forecast period. More than 80 percent of the global corn starch is concentrated in the US and China, in which, the US is the world's largest producer of corn starch and also maintains low prices.

-

Corn starch, used as a thickener or binder, constitutes a minimal percentage of the total corn starch application. Major application of corn starch in the food sector covers a broad spectrum of dairy, confectionery, bakery, meat products, etc.

-

US and China are the major producers of corn starch, holding about 30 percent and 28 percent of the global share respectively. US-based global companies, utilize corn starch to manufacture sorbitol. Therefore, the key regions to focus are the U.S., China, as well as major producing countries in the EU, and parts of Asia, other than China

-

The Chinese government’s strict COVID-19 mobility restrictions may cause disruptions to spring-planted grain production and increase corn imports though the country’s abundant grain reserves will keep national food security largely intact. This may disrupt the transportation of planting inputs and farmers’ mobility, reducing the production of spring-planted grains

-

There is a likelihood of limited availability of corn for downstream industries, owing to reports on 250,000 to 400,000 tons of Brazilian corn being kept in reserve instead of being distributed domestically

Global Demand by Application –Corn Starch

-

Based on the product type, the global corn starch market is segmented into modified starch, native starch, and sweeteners

-

Of these, sweeteners are leading the global market with a mammoth share of over 50 percent in the overall market

-

The burgeoning demand for High Fructose Corn Syrups (HFCS) in a range of food and beverages is anticipated to be pivotal to the rising demand for corn starch-based sweeteners in the near future

-

China is very significant, with respect to the corn starch market

-

Therefore, the key regions to focus on for the suppliers are the US, China, as well as major producing countries in the EU, and parts of Asia, other than China

-

The most dominant region among these is North America, both in terms value and volume

-

The Asia Pacific corn starch market is expected to expand at the highest CAGR of 6.4 percent over the forecasting horizon

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.