CATEGORY

Soybean

Soybean is one of the widely traded agricultural commodities which find application in various end use markets ranging from edible oil to livestock feed. Rising demand for protein diet have also supported the steady growth in soybean industry.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Soybean.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Almost 50% of Argentina's soy imports likely to come from Brazil in 2023

March 30, 2023Import of soybean into China expected to rise.

March 23, 2023Dry conditions impact Argentina soybean crop

March 15, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Soybean

Schedule a DemoSoybean Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoSoybean Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Soybean category is 5.30%

Payment Terms

(in days)

The industry average payment terms in Soybean category for the current quarter is 75.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Soybean market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoSoybean market frequently asked questions

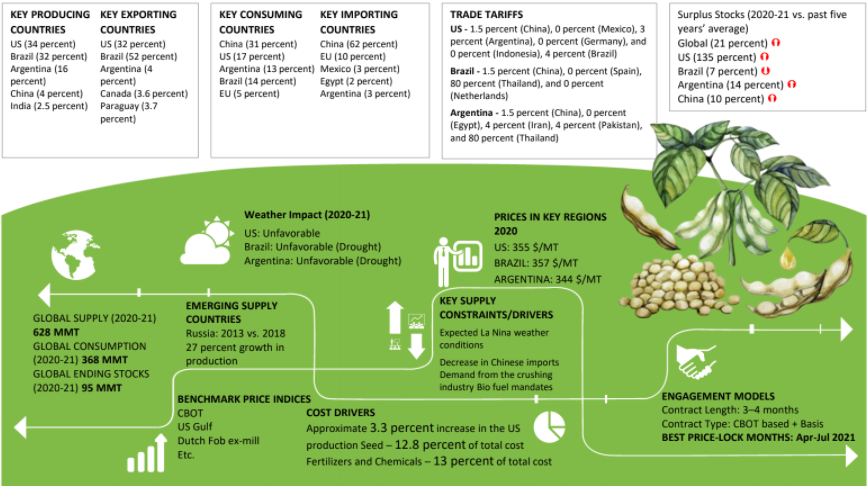

The global soybean supply grew steadily at a 2.9% CAGR during 2014–2020. In addition, the crop production for 2020-21 is likely to increase by 9.8% against the crop year 2019-20.

The prevalence of cardiovascular diseases (CVD) in tandem with the rising shift among consumers toward health-centric diets is driving the consumption of soybean products.

Grain price fluctuations due to climate changes are a considerable concern among soybean producers. In addition, the climate variations impact the crops due to inconsistent downpours, thus affecting soybean production. Furthermore, various studies have associated soy food products with allergies and potential side effects such as menopause symptoms, cancer risk, and increased cholesterol levels.

Brazil and the US are the prominent soybean exporters, making up for nearly 86% of the overall exports, followed by Argentina, Canada, and Paraguay. Risen disposable income and consolidated supply are likely to underpin 20–30% growth in the soybean and its derivatives trade over the coming decade.

China and the European Union (EU) are the leading soybean importers, making up for nearly ¾ of the overall imports, followed by Mexico, Argentina, and Egypt.

A majority of market players prefer the US, Argentina, and Brazil to source soybeans. While Argentina offers the least soybean prices, the country is subject to political uncertainties. Sourcing soybeans from Brazil is a cost-intensive affair. As such, market players find the US as the feasible option to source soybeans.

Soybean market report transcript

Global Soybean Market Outlook

-

Global soybean production is expected to increase by 7 percent in 2022–2023. Global consumption expanded at a CAGR of 3.2 percent. Brazil, the US, Argentina, China, and India are the largest producers of soybean in the world, accounting for more than 87 percent of global production.

-

The US was the world’s major producer and exporter of soybean. However, in recent years, soybean production has increased dramatically in Brazil and Argentina

-

Soybean consumption is expected to grow by 4 percent in the 2022–2023 crop year, and the total supply could improve by 5 percent compared to the previous year

-

The major soybean-producing regions are Brazil, the US, and Argentina, which consist of about 82 percent of the global soybeans produce

Global Soybean Trade Dynamics

-

Increase income levels and consolidated supply are expected to support 20–30 percent growth in the soybean and its derivatives trade in the next 10 years. LATAM is expected to lead the trade growth in the upcoming years.

-

In the past, the global soybean trade grew at a CAGR of 4.69 percent and is expected to increase by 4.5 percent in 2022-23.

-

The top soybean exporters are Brazil and the US, accounting for almost 90 percent of the global exports, followed by Paraguay, and Canada

-

The top soybean importers are China and the EU, accounting for approximately 70 percent of the global imports, followed by Mexico, Egypt, and Argentina

Porter’s Five Forces Analysis on Soybean

Both the buyer (crushing companies) and the seller (seed and trading companies) power to influence the prices in soybean market is mainly based on supply fundamentals. Lack of product differentiation and operational cost reduce the barriers to new entrants and intensity of rivalry is low to medium.

Supplier Power

-

Soybean traders and farmers are the major suppliers

-

Major trading houses, such as ADM, Cargill, and others buy soybean directly from aggregators and their farmers network

-

Soybean prices are fixed based on market fundamentals. For instance, suppliers have more control over soybean pricing during undersupplied scenario

Barriers to New Entrants

-

Product differentiation is low for the soybean seed market, hence the barriers to new entrants is medium

Intensity of Rivalry

-

In the US, soybean market is very fragmented with an average farm size of 900 acres

-

Fixed cost is less compared to the operational cost, and hence the rivalry is low

Threat of Substitutes

-

Soybeans and corn can be easily shifted amongst each other, as they have the same growing seasons and soil requirements

-

Hence, the price of soybean and corn is a major factor for the farmers and buyers to decide their preferred crop

Buyer Power

-

Approximate 90 percent of the soybeans are crushed to obtain its meal and oil

-

These crushing companies ADM, Cargill, Bunge account to ~70 percent of the market share, hence have a high negotiating power during oversupplied scenario

Procurement Insights : Soybean

Best Sourcing Months

-

Based on the seasonality of soybean, the prices of soybeans are expected to witness the lowest levels during the months of October, November, and December in the crop-year

-

The soybean prices are the lowest high arrivals of soybeans crops during these months

Best Sourcing Regions

-

The best sourcing regions for soybeans are the US, Brazil, and Argentina

-

Although the prices of soybean are the lowest in Argentina (this is due to currency devaluation), there are a lot of political uncertainties in the country, which limits the sourcing preferences. Brazilian soybeans are the most expensive, and hence the US is a viable option to source soybeans

Contract Structures

-

Soybean prices and contract structures are fixed by the US suppliers by adding CBOT Futures, basis, and freight costs. Basis is the difference between cash and future prices. Profit margin depends on the time of buying and commodity selling

Why Should You Buy This Report?

This soybean market report comprises first-hand insights, quantitative and qualitative analysis by research analysts, and inputs from industry participants and experts across the value chain. The report offers a comprehensive assessment of macro-economic indicators, parent market trends, and deciding factors coupled with the market attractiveness based on segments and sub-segments. It outlines the major market forces influencing the soybean forecast across various geographies. Furthermore, this research study sheds light on the key technology trends and development taking place in the global soybean industry.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.