CATEGORY

Sodium Hypochlorite

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Sodium Hypochlorite.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoSodium Hypochlorite Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoSodium Hypochlorite Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Sodium Hypochlorite category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Sodium Hypochlorite category for the current quarter is 70.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Sodium Hypochlorite market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoSodium Hypochlorite market report transcript

Global Market Outlook on Sodium Hypochlorite

-

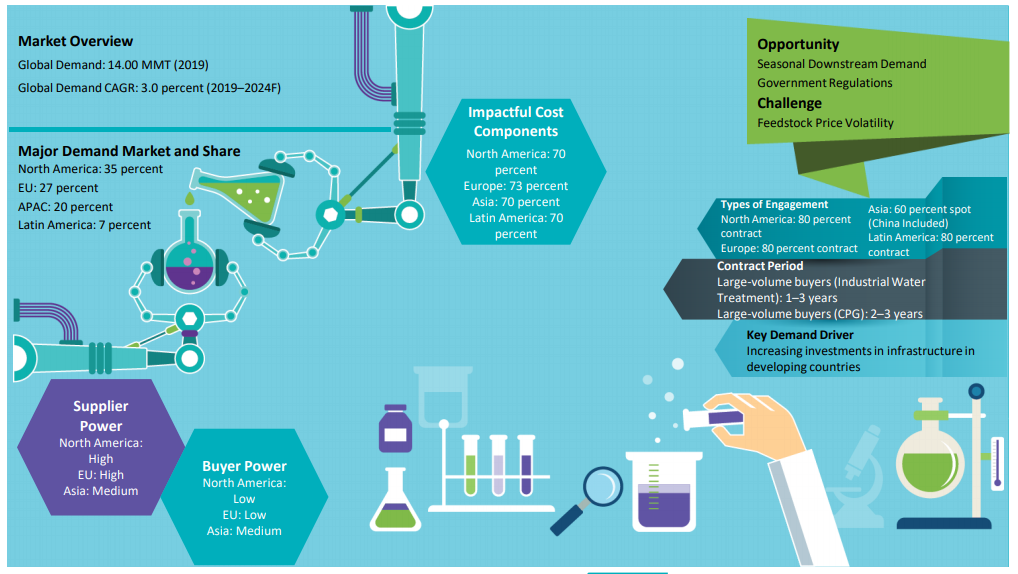

The global SHC demand is estimated at 15.50 MMT in 2021, which is expected to grow at the CAGR of 3.5 percent until 2025

-

The global supply of SHC will continue to outpace the demand during the forecasted period, due to availability of other substitutes and enough capacity already installed in the market

Global Market Size: SHC

-

The SHC market is forecast to reach $233 million by 2025, after growing at a CAGR of 4.82 percent during 2022–2025

-

The SHC market demand is expected to drive the global demand for household applications as well as for industrial municipal water treatment applications

Global Capacity–Demand Analysis : Sodium Hypochlorite

-

Developing economies, like APAC, MENA, and Latin America, are showing strong growth rates in SHC consumption

-

This will pose good opportunities for suppliers to tap these potential regions and increase their market shares

Market Outlook

SHC Market Trends – Enough Capacity to Meet Demand Until 2025

-

The global supply of SHC will continue to outpace the demand during the forecasted period, due to availability of other substitutes and enough capacity already installed in the market

SHC Capacity Analysis – Highly Distributed

-

SHC being a product produced in a chlor-alkali plant, there are possibilities of it being produced at 100 percent chlor-alkali capacity if at all there is no demand for the raw material

-

There are caution signs of SHC supply glut in Europe, however, the demand side is weak

Demand by Region – China Leads Growth

-

Developing economies in particular China will remain the growth engine driving the demand for SHC during 2021-2022

-

Rapid urbanization in these economies is witnessing high growth rates in the industrial sectors, including pulp and paper

Industry Drivers and Constraints : Sodium Hypochlorite

Drivers

-

Seasonal Downstream Demand: Prices of SHC usually increase during summer season (June to September) of every year, when the demand from drinking water, hospitals, etc., spurs up, and there is not enough supply

-

Government Regulations: The US and the UK governments have enforced food processing companies to sanitize food processing equipment and food contact surfaces with solutions containing bleach, leading to an increase in SHC

Constraints

-

Availability of Substitutes: SHC is perceived as an environment-unfriendly commodity, which is likely to phase out in the coming few years. Manufacturers are already producing oxygen-based stain removers, which act as whitening agents on clothes as an alternative for SHC

-

Volatile Feedstock Prices: Caustic soda is one of the major feed stocks to SHC production process, accounting for 60 percent of the feedstock cost. Caustic soda production process requires electricity, whose major source is burning of fossil fuel. Energy prices, such as cost of coal and natural gas impacts the price of SHC

Sodium Hypochlorite Cost Structure Analysis

-

Major cost driver in the production cost is the raw material cost. It contributes to around 60 percent of the total production cost. And, the major raw material is water in the production of SHC (based on the purity of the product).

-

SHC prices vary based on the concentration level, i.e., higher the concentration, higher the price. The concentration level considered to build the model is 12.5 percent, which is the industry standard benchmark

-

The production plant for the SHC is fully automatic, due to which very less labor is required, due to which the labor cost is only 1 percent of the total production cost. Demand for the SHC to increase at CAGR of 1.5–2.0 percent

Global Trade Dynamics : Sodium Hypochlorite

-

North America: The US is a net importer; however, export volumes have increased marginally owing to increase in demand from cleaning segment s from LATAM countries

-

Europe: Net exporter, wherein much of the exports are directed to Russia, the UAE, and Qatar. Trade dynamics is expected to remain the same, as there are no planned capacity additions in Europe

-

APAC: Net exporter, wherein much of the exports are directed to Afghanistan, Qatar, and South Africa. However, the export quantities have reduced drastically, owing to environment regulation imposed on SHC manufacturers, resulting in plant shutdowns

-

Latin America: Net importer, with majorly importing from China, the US, and Spain. Trade dynamics are expected to remain same, as there are no capacity additions planned.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.