CATEGORY

Shrimp

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Shrimp.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Ecuador's shrimp exports to be impacted by earthquake and floods

April 04, 2023Black Tiger Shrimp demand to improve as Vannamei farms face threat of diseases

January 23, 2023Thailand to import 10,500 tonnes of shrimp

August 09, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Shrimp

Schedule a DemoShrimp Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoShrimp Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Shrimp category is 5.30%

Payment Terms

(in days)

The industry average payment terms in Shrimp category for the current quarter is 75.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Shrimp market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoShrimp market frequently asked questions

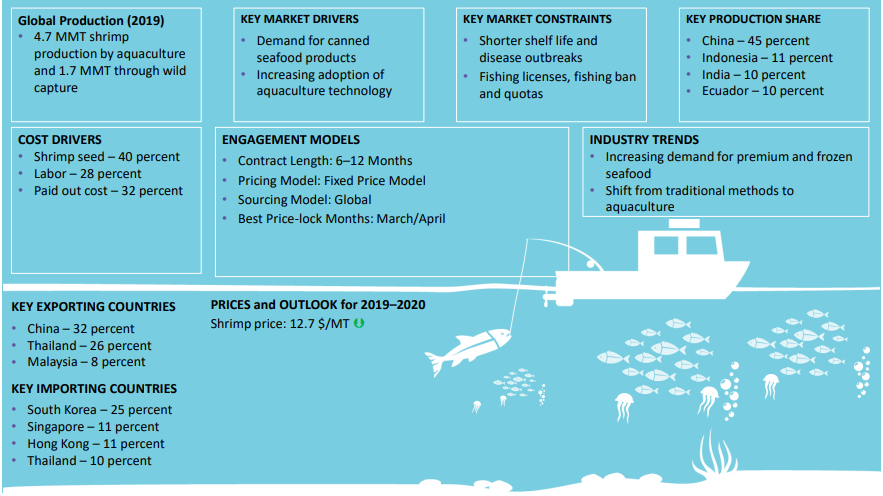

Increasing consumption of processed/ready-to-cook (RTC) seafood and rising disposable income are major driving forces for the global shrimp market. In addition, market players are increasingly adopting aquaculture technology to gain a competitive edge.

China, accounting for nearly half of the global shrimp production, will continue to attract stakeholders over the forecast period. The majority of the supply comes from aquaculture and wild capture. Despite the reduced shrimp demand in 2020 due to the COVID-19, China’s shrimp market is poised to make a gradual rebound.

As per Beroe’s category intelligence study, the global shrimp production is expected to surpass 6 MMT, at a 4% CAGR.

China (32%) is the leading shrimp exporter, followed by Thailand (26%) and Malaysia (8%).

Surging demand for frozen and premium seafood and rapid shift from conventional agricultural methods to tech-driven aquaculture practices are the key trends impacting the global shrimp market growth.

South Korea makes up for a quarter of the global shrimp import, with Singapore and Hong Kong share the same divide, followed by Thailand.

Governments worldwide have imposed their own control mechanism to avoid overfishing and exhaustion of resources. For example, countries including China and Thailand have enabled fishing licenses and quotas for their fisheries and seafood industries.

Seafood raising and processing are subject to disease outbreaks. For instance, early mortality syndrome (EMS) has led to a significant decline in shrimp production in China, Vietnam, and Indonesia.

Shrimp market report transcript

Global Market Overview on Shrimp

-

The global seafood industry is highly fragmented, with a supply of approx. 180 MMT of fishes annually (both wild caught and aquaculture, 2021) and is estimated to reach 181 MMT in 2022.

-

Fish capture over the decade has taken a more inland approach with the major capture type being aquaculture and tuna, shrimp, salmon are the most captured and traded species

-

Aquaculture currently holds 48 percent of the market share, and it is expected to increase its share in the total capture beyond 50 percent by the end of 2022

Market Drivers and Constraints : Shrimp

The important driver for the seafood market is the increasing demand from the frozen ready-to-cook seafood industry, while the major constraints currently are the disease outbreaks and the costs incurred in ensuring a disease-free environment.

Drivers

Increasing demand for processed/ready-to-cook seafood:

-

The seafood industry is gaining momentum, due to convenience and time-saving factors

-

Increasing disposable income and per capita consumption are also seen favorable for the growth of the industry

R&D/technology:

-

Aquaculture is gaining dominance over traditional agricultural practices, wild fish harvesting, etc., due to its volume production

Constraints

Shorter shelf life and disease outbreaks:

-

Disease outbreaks can occur both during raising and processing seafood. EMS or Early Mortality Syndrome had caused a substantial decrease in the shrimp production of the leading countries, like China, Vietnam, Indonesia, etc.

Government regulations:

-

Every country has its own control mechanism to prevent overfishing and the exhaustion of its resources. Countries, like Thailand, China, have fishing quotas and licenses in place, with respect to their fisheries and seafood industry

Supply–Demand Analysis : Shrimp

-

Global shrimp production is estimated at 6.6 MMT in 2023, with an average growth rate of 4.2 percent, with the supply facing glut in the global market.

-

Currently, about 71 percent of the shrimp supply is through aquaculture, then wild capture, with China occupying majority of share in harvesting both types of supply

-

Demand for shelf stable canned shrimp could increase in 2022

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.