CATEGORY

Secondary Packaging Equipment

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Secondary Packaging Equipment.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

KUKA launches new Delta robot KR 3 D1200

January 24, 2023Diagraph launched Resmark 5000, a high-resolution Inkjet Coder for End-of-line Packaging

November 15, 2022Syntegon launches the upgraded Sigpack TTM cartoner platform

September 26, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Secondary Packaging Equipment

Schedule a DemoSecondary Packaging Equipment Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Secondary Packaging Equipment category is 6.60%

Payment Terms

(in days)

The industry average payment terms in Secondary Packaging Equipment category for the current quarter is 71.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

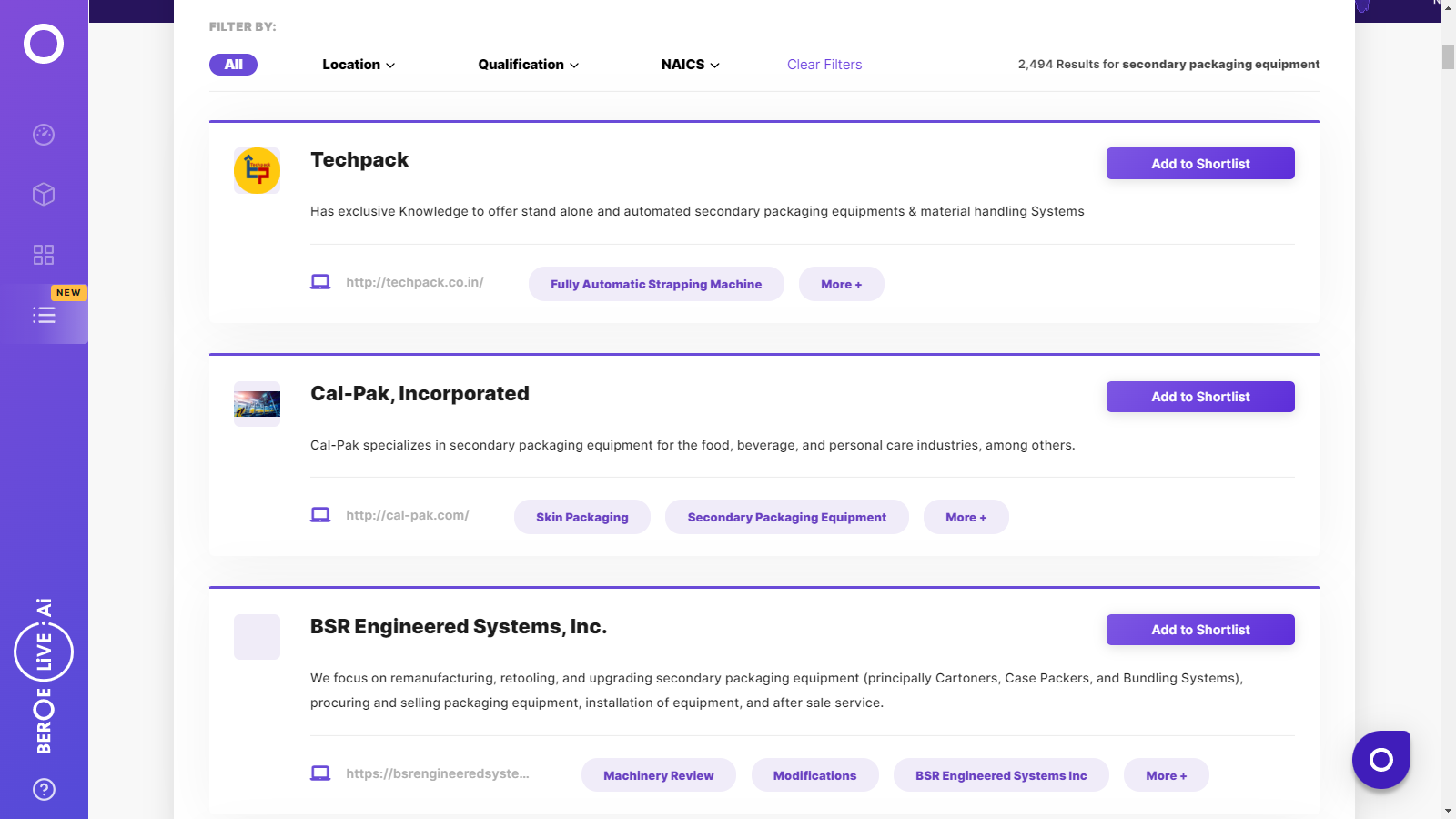

Secondary Packaging Equipment Suppliers

Find the right-fit secondary packaging equipment supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Secondary Packaging Equipment market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoSecondary Packaging Equipment market frequently asked questions

The global secondary packaging equipment market size was US$12.96 Bn in 2019 and is expected to reach US$17.67 Bn value by 2025, growing at 5.3% CAGR.

Rising deployment of automation in the packaging industry, development of innovative and energy-efficient packaging equipment, increasing global consumption of consumer goods, increasing reliance on vacuum packaging machines, and uptight regulatory environment are some of the current trends impacting the global secondary packaging equipment market.

The installment of secondary packaging equipment in the pharmaceutical industry is increasing at a healthy growth rate, given the basic need for essential medicines and drugs for geriatrics and the rising use of disposable medical devices.

The cost of high-tech and customized packaging equipment has increased over the recent past. While replacement and spare components sales account for 20% of the overall market, the lack of channel partners dilutes the sales network in the emerging regions.

Tech-based advances improve the overall operational and cost efficiency, thus promoting sustainability. Further, multi-purpose equipment and machines with rapid changeovers are gaining more momentum. As such, several companies are procuring innovative secondary packaging equipment to optimize their manufacturing processes.

About 6 out of 10 secondary packaging equipment find usage in the food and beverage (F&B) industry. Increasing consumption of ready-to-consume products and heightening consumer awareness regarding packaging quality and functionality are driving this trend.

Secondary Packaging Equipment market report transcript

Regional Outlook-Secondary Packaging Equipment

-

The global market size for secondary packaging equipment is estimated to be at $15.14 billion in 2022 (E ) and is projected to grow at a CAGR of 5.3 percent, to reach a market size of $17.67 billion by 2025

-

Asia Pacific growth rate is expected to be dominant geographical market for the packaging machinery market due to the presence of a large number of food and beverage, and personal care product manufacturers in the region

Demand Analysis –Secondary Packaging Industry

-

Food and beverages, together, was estimated to contribute to around 58 percent of the global packaging machinery market in 2020. This is because, technological advancements and trends in the packaging industry are highly influenced by the end-users of the food and beverages industry alone

–Global food industry captures the highest demand for packaging equipment. This is because, economic development is creating busy lifestyles and this is fueling the growth for convenience, but as consumers become more health conscious, there is a growing demand for both convenient and healthy options. This is driving investment in packaging machinery as a whole, which results in investing in new lines and machines. Also, consumers have become more interested in attractive labelled products, so the demand for labeling & sleeving equipment is on the rise. The stringent regulations, imposed by the FDA, toward mandatory labeling, which contains the details of the products, also aids the industry growth

–The beverage industry is mature in North America and Western Europe and it is growing significantly across emerging markets of South America and Asia Pacific. This industry is heavily influenced by trends—mainly portion size, attractive labeling, product information etc. As a result, the market for packaging equipment is expected to rise in the near future

-

The pharmaceutical industry holds a healthy growth rate, owing to the fundamental need of basic medicines for the ageing population along with an increasing use of disposable medical devices and increased investments for medical apparatuses in developing regions. With increased investments in health care options across matured and emerging regions, the pharmaceutical industry is subjected to less economic fluctuations. The Drug Quality Security Act (DQSA) is also compelling companies to change their supply chain processes and adopt the new labeling standards

Global Secondary Packaging Equipment Market Maturity

-

North America and Europe are among the mature markets for secondary packaging machinery.

-

Asia-Pacific growth rate is expected to be dominant geographical market for the packaging machinery market due to the presence of a large number of food & beverage and personal care product manufacturers in the region

Global Secondary Packaging Market Drivers and Constraints

Drivers

-

Changing consumer needs: The global economy especially in developing countries is witnessing a rise in disposable incomes which results in a higher demand for a wide range of packaged goods. So, a diversification of consumer needs in relation to the packaging quality and functionality acts as an additional catalyst for the packaging machinery market

-

Regulations: Majority of the developing countries such as India, China etc. have been adopting regulations that impacts machinery and materials. Some of the major regulatory focus includes preventing contamination during packaging process or maintaining quality of products

-

Growing technological advancements in machines: Machine sales is also fostered by growing technological advancements in packaging equipment that are process/cost efficient and adding to sustainability. Multifunction machines and machines with quick changeovers are becoming more common, and companies in recent times are procuring new machines to make their process efficient. This trend is likely to take upper hand in near future

Constraints

-

Increasing cost of equipment: The cost of high tech and customized packaging machines have risen in recent years. Replacement and spare parts sales make up to 20% of the total market, but lack of channel partners weaken the sales network in emerging regions

-

Rising input costs: As the packaging needs across user groups and geographies are varying rapidly, the machines are also being customized to meet the needs of changing consumer preferences. However, with catering to these needs, various input costs such as, raw material costs, labor costs, energy and power costs etc. are also rising significantly. As a result, buyers in the packaging machinery market have to constantly look for machines that optimizes power consumption to meet the emission standards and also automate the processes to spend less on labor etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now