CATEGORY

Road Transportation Services China

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Road Transportation Services China.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Road Transportation Services China Suppliers

Find the right-fit road transportation services china supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Road Transportation Services China market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoRoad Transportation Services China market report transcript

Regional Market Outlook on Road Transportation Services

China government is planning to spend USD 2.17 Trillion between 2016–2020 to develop the transportation infrastructure and logistics hubs. This scenario will improve the quality and efficiency of services in the market for shippers

China's logistics costs are higher than the developed countries and also higher than some of the developing countries in Asia which is mainly due to the country's geography, road transportation infrastructure and trucking regulations

- Asia-Pacific region is ranked first in the logistics market with China leading the list among all countries in the region

- Rail freight volume increase by 7.7 Percent in Q1 2018 compared to same period last year. The Q1 2018 volume stands around 983.7 million tones.

- The overall Logistics sector is expect to reach 280 trillion Yuan ($43.5 trillion) in 2018, an increase of 6.5 percent year-on-year

- Government has placed focus on improving road transportation and lower the regulations in order to reduce logistics cost

- Annual growth rate of e-commerce in Henan, Shanxi, Xinjiang provinces is greater than 100 percent fuelling the logistics industry in China

- China's road freight volume for Q1 2018 was 10.22 billion tons, for a gain of 6.3% compared to the same period in 2017

- Ports of Qingdao, Shanghai and Hong Kong facilitate short sea shipping with Shanghai reaching interior provinces through river ports

- COSCO shipping line has a full fledged domestic cabotage maritime circuit between the above mentioned ports

Supplier Landscape – Road freight

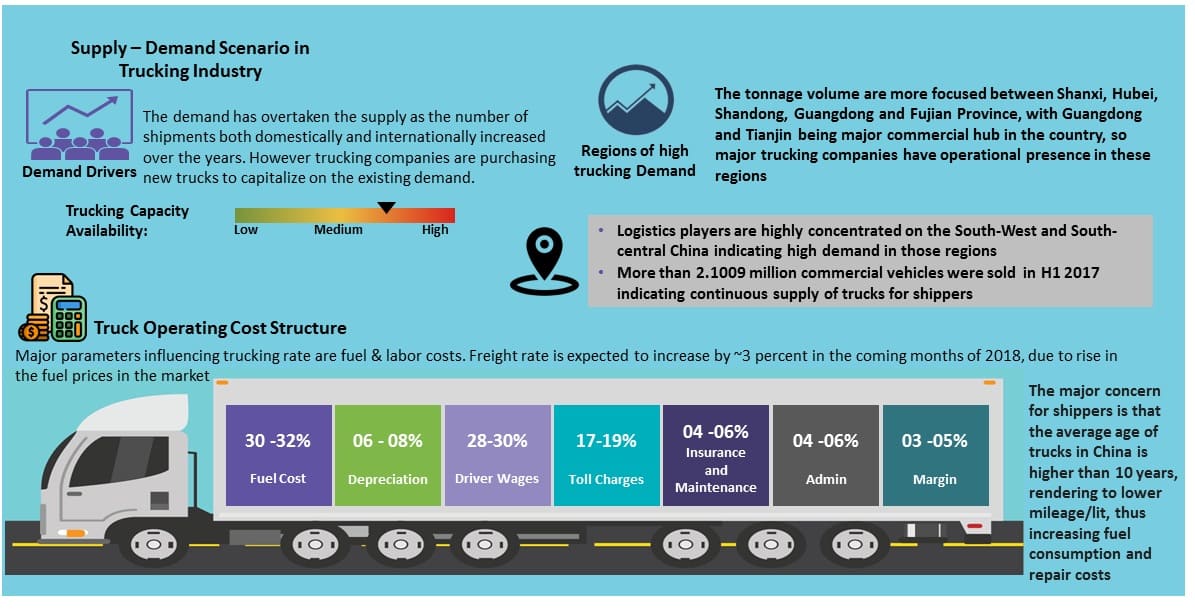

Engagement with more than 2 to 3 regional 2PL companies is recommended in the regions of South-West and South-Central regions due to the higher trucking demand during the peak periods, typically in the months between September to February

The logistics market is in positive growth with foreign investment and the demand for transportation services increased due to growth in exports. Due to the stiff competition among the service providers in the market, shippers can avail better transport services promptly

- Trucking market is highly fragmented with more than 85 percent of the trucks being independent trucks

- China has ~9 Million trucking companies but only 10 percent are capable of serving more than three provinces

- China's logistics market is highly fragmented which is highlighted by top five transportation companies holding < 2 percent market share

Road freight contributes to more than 85 percent of domestic freight movement and is the dominant mode of transportation

Supply and Demand

- Logistics players are highly concentrated on the South-West and South-central China indicating high demand in those regions

- In H1 2017, China's output and sales volume of commercial vehicle reported 2.043 million units and 2.1009 million units, respectively, surging by 13.8% and 17.4% year on year.

Engagement Models: 2PL vs 3PL

Many industrial manufacturing companies are likely to engage with 3PL's because of the capability to organize different trucking contractors, service coverage in remote areas and have a longer payment period in comparison to 2PL's

Global 3PL companies largely outsource transportation and make use of 2PL/Independent transporters and hence the costs are higher by minimum of 5 to 10 percent compared to regional transportation companies

2PL Companies

- 2PL companies make use of own trucks and benefit shippers in terms of cost

- 2PL companies do not provide much of value added services and differentiate themselves by cheaper freight cost to gain businesses

3PL Companies

- 3PL companies outsource most of their transportation leading to higher freight costs when compared with 2PL companies

- Online tracking, On time delivery, longer credit periods are the value added services provided by 3PLs in order to lure customers

Market Trends, Multi-Modality options and Best Practices

Government's investments in rail infrastructure development leads to increase the scope of multi-modal transportation, which will benefit the shipper as rail freight rates are ~25 to 30 percent lesser than road freight rates

E-commerce industry has been growing at a rapid pace in China and the logistics market of China has been receiving many foreign investments targeting the e-commerce industry

Market Trends

- E-Commerce has been driving the logistics sector in China heavily and Amazon Logistics+ service has gained huge attraction

- Amazon Logistics+ service mainly supports caters to needs of SMEs who ship overseas and is at it's infancy stage

- The service, if successful, could benefit many e-commerce shippers and increase competition among incumbent freight forwarders

Multi-modality

- Chinese government has planned to develop the logistics industry by investing in railway infrastructure and build 150 transportation hubs

- Multi-modal transportation is limited to container movement from harbors and government is encouraging multi-modal transportation to reduce logistics costs

- Multi-modal transportation is neither feasible nor profitable for short distance transportation due to the high expense it incurs

Industry Best practices

- Multi-national companies engage with 3PL companies for movement from Plant to the regional distribution centers. Engagement with 2PL/3PL is followed by shippers due to multiple plant locations, last mile deliveries and distribution to multiple DC

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now