CATEGORY

Road Freight Transportation Vizag Region

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Road Freight Transportation Vizag Region.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

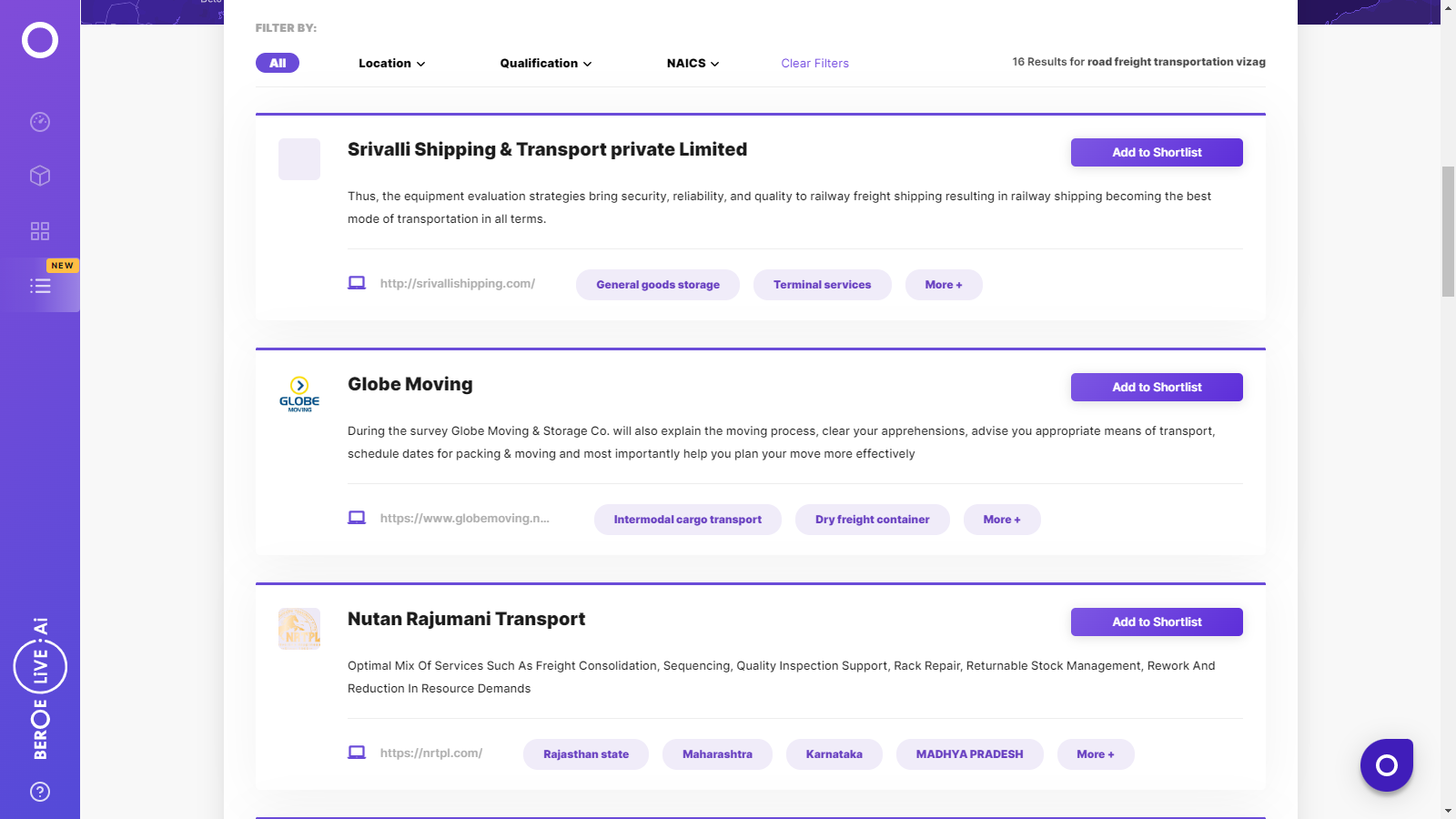

Road Freight Transportation Vizag Region Suppliers

Find the right-fit road freight transportation vizag region supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Road Freight Transportation Vizag Region market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoRoad Freight Transportation Vizag Region market report transcript

Regional Market Overview on Road Freight Transportation

Major factors impacting the freight rates in the current scenario are volatile fuel prices, increase in lubricants, spare parts prices, due to GST and the revised tax structure on trucking companies based on axle weight.

Road freight market in Vizag is highly unorganized and fragmented with owner operated truck companies having less than 5 trucks, due to the presence of strong lorry owners (trade) union in Vizag, utilization of backhaul or other state trucks is not possible for shippers.

Market Overview

- The Vizag trucking market is highly fragmented and dominated by the local transport companies, with a market share of more than 90 percent

- The presence of public sector undertakings generated the growth of industries in and around Vizag within a radius of 40 km. Vizag approximately contributes to 15–20 percent of the overall freight movements within Andhra Pradesh

- Vizag attracts major truck traffic from Telangana, Krishna district, central India, Southern India, West and East Godavari districts

- The major investments in Visakhapatnam district are around urban clusters. The three major industrial clusters in Visakhapatnam are around Atchutapuram, Nakkapalli, and Bheemunipatnam

Lorry Owners Association (Vizag, Srikakulam and Vizianagaram)

- Lorry trade union is very rigid in Vizag, Srikakulam, and Vizianagaram districts. This trade union does not allow other state or districts trucks to pick the load originating from Vizag

- All the trucking companies must be a part of the trade union to move the load within these three area and in case of using other state trucks could lead to penalties ranging from 150 to 500 rupees per truck

Logistics Infrastructure and Trucking Landscape in Vizag

Shippers located near Atchutapuram, Gajuwaka, and NAD areas are benefited by a large pool of trucking providers. An expected increase in the government spend in developing Chennai-Visakhapatnam industrial corridor around the district results in decrease of congestion issues and shippers get an opportunity to explore national level trucking companies in the near future.

Infrastructure Development

- Major industries and clusters include Atchutapuram SEZ, Brandix India Apparel City, Divi's labs, Hetero Drugs, Hindustan Petroleum Corporation, Jawaharlal Nehru Pharma City (Ramky), National Thermal Power Corporation, and Visakhapatnam Steel Plant

- Infrastructure development is expected to improve at special economic zones, located in the 60 km radius of the city

- Traffic congestions in Atchutapuram, Gajuwaka, NAD and Bheemunipatnam regions are impacting the truck transit times

- The expansion of national highways and state roads is highly necessary to reduce the traffic congestions issues in Vizag

Trucking Supplier Landscape

- Majority of trucking suppliers are located in Gajuwaka, Autonagar, Madhurwada, nearby areas of Atchutapuram and Bheemunipatnam

- Local supplier dominance is higher in the region and there is major impact of trade unions on trucking supply

Supply–Demand Dynamics

Increase in the maximum axle load by the Ministry of Transport could impact trucks supply in the market in the near future, as many carriers will utilize the maximum payload capacity rather than purchasing new trucks. Due to implementation of this law, transportation costs can come down and also many carriers will avoid overloading of trucks.

Truck Registrations in Andhra Pradesh

- The overall truck and trailer registrations approximately increased by 5 to 8 percent during 2017–2018 in Andhra Pradesh, due to upswing in new industry establishments

- Vizag city approximately contributes to more than 15–20 percent of total truck registrations in the state and followed by Vijayawada, Kakinada, Guntur, Nellore, and Chittoor

Freight Demand Trend:

- Freight hauled by Taurus and LPT trucks is expected to grow by approximately 10 percent in the coming months of 2018 and the uptrend is likely to continue through 2019

- Freight demand of construction related materials, agro, chemicals and FMCG is also expected to increase and complements the growth of new trucks

Supply Trend:

- Supply of new heavy duty trucks in the market is in a positive trend across Andhra Pradesh and the supply is coping up with growing demand

- Utilization levels of trucks in Vizag are expected to be moderate, due to the presence of huge supply base and also availability of back haul opportunities

Seasonality of Trucks in Vizag

Vizag industrial areas are in development phase, and the impact of festivals or seasonal freight demand of other industries on trucking services is minimum. Also, the impact of heavy machinery, steel and other related industries is low, since these industries primarily use flat bed or containerized trucks for port movements.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now