CATEGORY

Road Freight Services

Road freight can be classified as transporting either goods and materials between two destinations with vehicles spanning from small distribution vans to long road trains to enable transportation by way of motorised and non-motorised carriages.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Road Freight Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

French road transport unions to join calls for nationwide strikes and demonstrations from March 5 to10

March 06, 2023Truck Drivers in Chile began an indefinite strike

November 25, 2022Truckers Strike in South Korea

November 24, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Road Freight Services

Schedule a DemoRoad Freight Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Road Freight Services category is 5.30%

Payment Terms

(in days)

The industry average payment terms in Road Freight Services category for the current quarter is 51.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Road Freight Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoRoad Freight Services market report transcript

Global Road Freight Industry Outlook

-

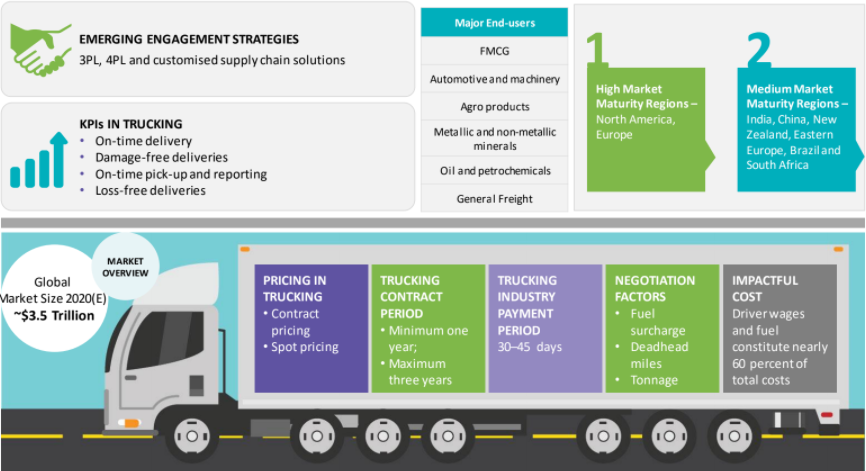

The global road freight market is expected to grow moderately in 2023* to reach $3.9 trillion. It is forecasted to grow at a CAGR of 4 to 5 percent through 2025, as global economies are expected to rebound from the impact of COVID and Ukraine–Russia conflict in 2023

-

Bank of America survey has found that truckload demand has fallen 58% to near-freight-recession level. Consumer spending habits are contributing to the decline, too. As pandemic restrictions eased, buyers scaled back their online shopping habits and spent more money on services rather than goods, according to the Bureau of Economic Analysis.

-

High rates of driver/labor absenteeism are forcing several suppliers to hire temporary staff. Additional costs associated with hiring, training, and retention are forcing several operators to increase freight rates. Additionally, inflationary pressure and fuel costs will continue to impact the road freight market throughout this year

Global Road Freight Industry Trends

-

Shippers are increasingly looking for end-to-end supply chain solutions from suppliers

-

Suppliers are enhancing themselves to meet the demand of the shippers by providing value-added services in addition to transportation services

Global Road Freight Drivers and Constraints

Drivers

Retail Sales:

-

Retail sales are expected to increase by a CAGR of 5–6 percent, which will in turn drive the demand for trucking in coming years

-

Accounting for more than one tenth of retail sales, e-commerce is expected to grow about 20 percent, which will increase the demand for logistics services, particularly in Asia Pacific and North America

Transport Infrastructure:

-

Countries are working towards improving their infrastructure to pave way for efficient transport of freight, realizing that it is an important element of any economy, helping to stimulate development, thus cutting the lead time and costs of trucking

Global Trade Activity:

-

During the last decade, increased production of high-value and light-weight goods and expanded trade among the member countries results in increased road freight transportation

GDP:

-

Because growth in GDP implies increased economic activity, there is a positive correlation between the development of freight transport and GDP, where any increase in GDP is directly related to the increase in road freight services in that region

Constraints

Fuel Rate:

-

Fuel prices account for nearly 30–35 percent of trucking freight rates, thus having a major impact on pricing. The price of diesel fuel hit an all-time high in the US in 2022. The average price of a gallon of diesel is up to $5.55 in Q2 2022

Shortage of Drivers:

-

Driver wages account for nearly 35–40 percent of suppliers’ operating costs. Driver wages are expected to increase due to the prevalent shortages in the industry. With the advanced technology autonomous trucking brings, along with the benefits of reducing daily driving stress and boredom, it’s sure to attract young, tech-savvy drivers to the industry.

Supply Trends and Insights : Road Freight

Global/Regional Supplier

Business and Technological Trends:

-

Global suppliers are enhancing their service capabilities by incorporating new business and technological trends

-

The latest business trends include hyper-customization of services, on-demand delivery, and smart energy logistics that cater to buyers with high market maturity

-

The introduction of digital identifiers for accurate tracking of consignments is the new trend on the technological front of logistics

Bundled Services:

-

Global suppliers provide value-added services, in addition to transportation, such as warehousing, end-to-end supply chain solutions and inventory management, thus bringing the supply chain under one roof

Tier-2/Local Supplier

-

Experience across Industries: Tier-2 companies are building their capability to provide a wide range of services to various sectors, such as oil and gas, retail, pharmaceutical and chemical

-

Extensive Network: Tier-2 suppliers have well-established business networks with domestic manufacturing companies and national suppliers (for subcontracted logistics)

-

Last-Mile Delivery: They perform short-haul transportation of goods, thus providing last-mile connectivity

Engagement Trends

-

Most Adopted Model Globally: The 3PL logistics model

-

Why? To achieve cost and time savings, flexibility and focus on their core business of the buyers

-

Contract Length: Two to three years, with an option to extend, based on performance, linked with SLAs

-

Pricing Strategy: Shifting from market pricing to performance-based contract pricing, also linked with SLAs

Why You Should Buy This Report

- This business intelligence report on the road freight industry provides details about the best procurement practices, pricing models and SLAs and KPIs of the road freight market.

- The report details the trucking industry regulations, cost structure and payment terms in countries such as the USA, Switzerland, the UK, Germany and India.

- It provides an overview and SWOT analysis of key companies providing road transport services such as UPS Freight, FedEx Freight, and Schneider National, to name a few.

- It offers the industry constraints and drivers, regional market outlook and Porter’s five forces analysis across various regions.

- Further, this research study contains extensive insights into factors that will impact the growth of vendors of the road freight transportation market across continents.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.