CATEGORY

Road Freight Services Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Road Freight Services Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

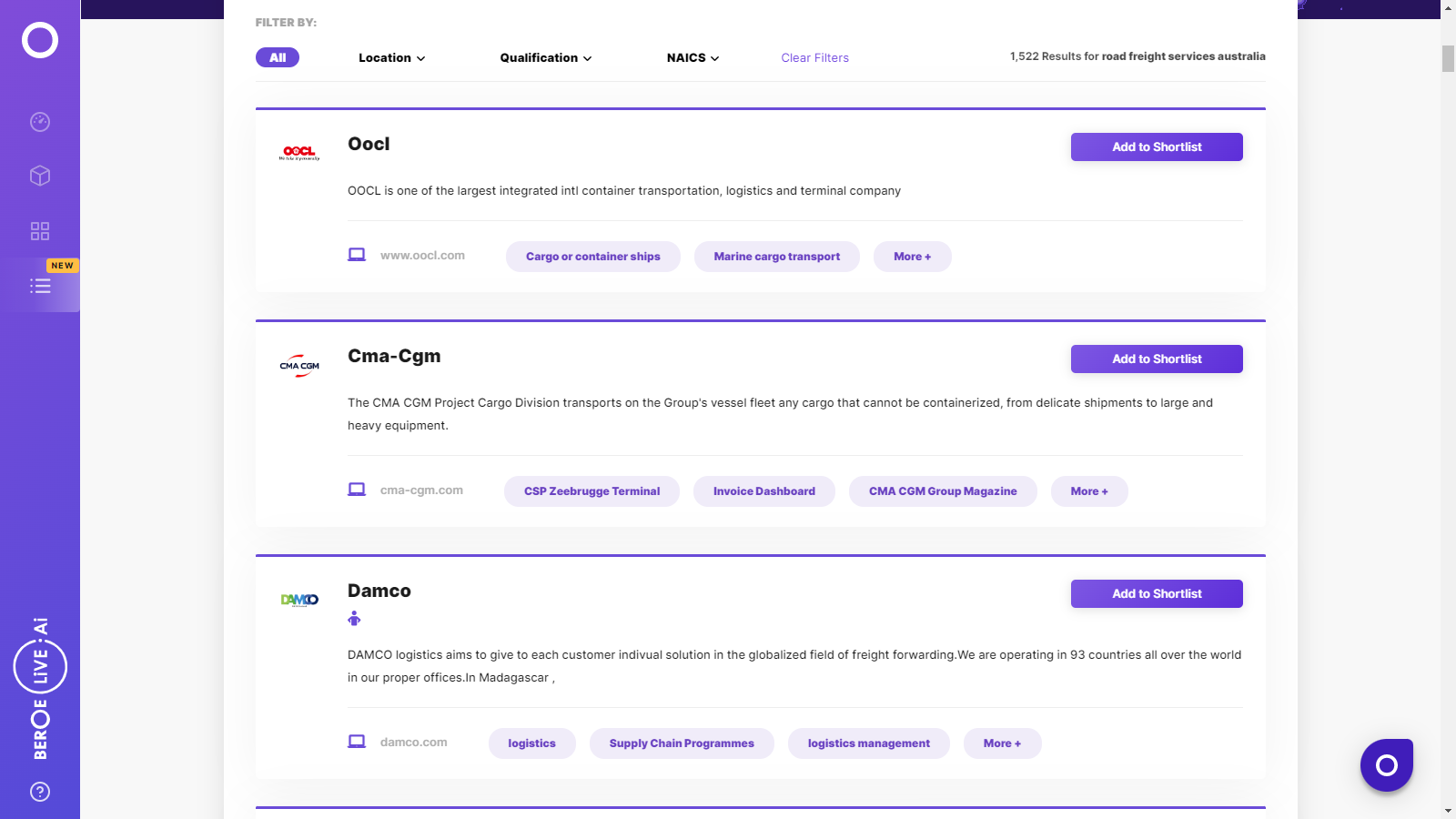

Road Freight Services Australia Suppliers

Find the right-fit road freight services australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Road Freight Services Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoRoad Freight Services Australia market report transcript

Regional Market Outlook on Road Freight Services Australia

- The trucking industry in Australia is facing unprecedented changes, as digitization and shipper expectations are evolving. New technologies are enabling greater efficiency and more collaborative operating models, which can reduce truck operating costs

- The long-term outlook of the road freight industry remains positive, with industry revenue predicted to continue to grow at a rate of 2.9 percent over the next five years to reach A$ 60.2 billion in 2025. Retail and manufacturing industries are expected to drive the growth rates

- The Australian road freight market is estimated to be around $45 billion by 2020. The market is expected to grow at a CAGR 2.9 percent over the next five years

- The road transport network in Australia accounted for approx. 195,000 million ton-km and moved a total of more than 2,000 million tons of freight every year

- The primary cities with major freight flows are Sydney, Melbourne, Brisbane, Perth, Adelaide, Gold Coast, Newcastle and Canberra, while the Australian manufacturing, retail and wholesale sectors are also primarily focused on these regions, with a collective market share of more than 50 percent

Trucking Suppliers Landscape

- The trucking market in Australia is highly fragmented with the top three service providers having less than 15 percent of market share

- The total truck fleet in Australia is 3.6 Million with the small companies owning only 2–4 trucks on average

- Toll holdings, Linfox and K&S/Scotts are considered to be the leading road freight service providers for LTL shipments in Australia based on their market share, services and geographical presence

- Larger operators are investing heavily in safety and technology to achieve better quality in services and competitive advantage

- Smaller operators with less scale and financial strength tend to be slow adopters to recent technologies and will become progressively challenged as shippers develop a stronger focus cost optimization and quality to protect their brand

Porter's Five Forces Analysis – Australia Trucking

Supplier Power

- In supply chain transportation market, key suppliers are sub-contracted truck operators and other supplier services like maintenance and repair, fuel, overhead labor, drivers and other consumable elements

- Power of suppliers is high due to low availability of trucks and drivers and raising wage rate for employee in transportation market.

Barriers to New Entrants

- Cost in terms of initial capital investment is high for 3PL market.

- The critical factor is a lack of experience, which is very important for attracting clients. Additionally, service capability of new firms would not be at par with existing firms. However, this can be offset to a great extent by acquisition small, existing firms.

Intensity of Rivalry

- Competition among global 3PL players is highly intense in Australia, with top players investing in locations like Adelaide, Melbourne, Sydney and Brisbane.

Threat of Substitutes

- There is minimal threat of substitutes, because the only possible threat comes from the buyer developing an internal team

- The acquisition trend, that is the acquisition of small and niche players by large 3PL firms, also reduces the threat of substitutes among large 3PL companies

Buyer Power

- Buyer's power to negotiate the freight rate and contractual terms is low due to strong consolidation of 3PL market in Australia

- As a result of consolidation, scope of alternate service providers is very minimum and availability of service providers in the market is very less as well

Road Freight Australia Market Overview

- Australian road freight market is estimated to be around $45 Billion by 2020. The market is expected to grow at a CAGR 2.9 percent over the next five years

- The road transport network in Australia accounted for an approximated total of 195,000 Million ton-km and moved a total of more than 2,000 million tons of freight every year

- The primary cities with major freight flows are Sydney, Melbourne, Brisbane, Perth, Adelaide, Gold Coast, Newcastle, and Canberra, while the Australian manufacturing, retail and wholesale sectors are also primarily focused on these regions with a collective market share of more than 50 percent.

- The top service providers in the overall trucking industry have also consolidated the market for LTL, which accounts for approximately 8 percent of the total trucking industry revenue.

- Road congestion is an issue in capital cities during peak hours however, due to developed infrastructure and new emerging technologies in freight activity could decrease this issue.

- In 2018, truck registrations in the country increased by 3-4 percent from 2017. The upward trend in truck registration is expected to decline in the coming years due to a slowdown in the road freight market

- In the road freight Australia market, utilization levels of van trucks are between 85-90 percent in 2018 due to tight capacity; in Q4 2019, utilization rates are expected to rise due to the increase in freight demand from major industries.

Why You Should Buy This Report

- Information on the road freight Australia market outlook, industry overview, truckers suppliers landscape, etc.

- Porter’s five forces analysis of the Australian road freight market.

- Demand analysis, supply analysis, road freight market trends, seasonality analysis, trucking regulations, etc.

- Cost structure and pricing analysis, pricing models, regulations for road freight services providers, etc.

- Best sourcing practices, contract terms, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now