CATEGORY

Refractories

Refractories are heat and chemical resistant materials mainly used in manufacturing of Steel, Aluminum and Cement.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Refractories.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

China Alumina Imports dropped In Mar-2023

April 24, 2023Alcoa Expands its EcoSource Low-Carbon Alumina Brand to Include Non-metallurgical Grade Alumina

April 11, 2023Impact Minerals signs deal to acquire 80% stake in advanced Lake Hope High Purity Alumina project located in Western Australia

April 06, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Refractories

Schedule a DemoRefractories Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoRefractories Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Refractories category is 10.00%

Payment Terms

(in days)

The industry average payment terms in Refractories category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Refractories market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoRefractories market frequently asked questions

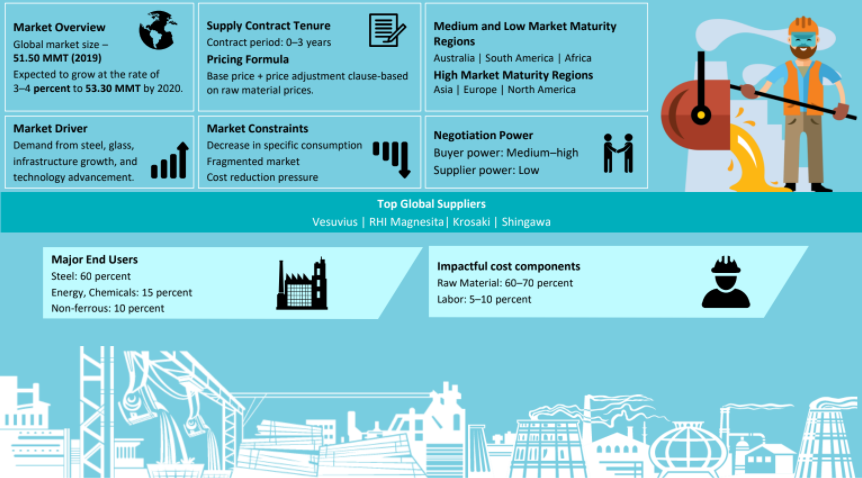

From Beroe's refractories market outlook and analysis reports, Asia, Europe, and North America have high market maturity, whereas Australia, South America, and Africa are the medium and low market maturity regions.

Vesuvius, Magnesita, RHI AG, Krosaki, and Shinagawa are the top suppliers in the global refractories market.

As per Beroe's refractories market forecast for 2022, the Chinese refractory production is estimated to reach 27.46 MMT billion with an average growth rate of 3.70 percent during the 2019-2021 period driven by new plant establishments or restarting of existing plants.

The global demand for refractories is expected to grow due to the following factors. ' Increasing demand from steel, iron, non-ferrous, power, and glass industries ' Rapid growth in infrastructure projects across the globe, especially the APAC region ' Refractories drive the demand for furnace lining, acidic lining, kiln lining material, silicon dioxide bricks, aluminum oxide bricks, alumina bricks, and silica bricks

The global refractories market is fragmented with major accounting for a combined market share of less than 25 percent. In China, there are more than 2000 refractory manufacturers each with annual revenue of RMB20 million. The Chinese market is huge because of the local availability of raw materials such as alumina and magnesite.

Refractories market report transcript

Global Outlook on Refractory Market

Market Overview

Global market size – $25.63 billion (2021E)

Expected to grow at the rate of 4-5 percent to $30.92 billion by 2025

-

APAC region estimated for largest share(74%) of the global refractories market in FY-2021. The region is also anticipated to note highest CAGR of 5.60% in the forecast period(2022-2026)

-

APAC region is also financing “refractories recycling plants” to reduce the carbon footprints. The increasing production of chemicals and infrastructure project are anticipated to generate opportunity for the growth of the refractories market in near future

-

USA coupled with developing economies such as China, India, Brazil and South Africa are making huge investment in large-scale infrastructure projects. Also, power generation, cement, iron & steel, cement and non-metallic industries in such economies are growing at a high rate and thus are anticipated to further drive the refractories market

Global Refractories Drivers and Constraints

Downstream Demand

-

Since Q1-2022, demand from major downstream industries, such as steel and pig iron remained weak due to cautious buying attitude from buyer side amid increasing energy/freight rates

Drivers

Infrastructure/Demand for Cement

-

Demand for cement and lime is ever increasing, due to the infrastructure growth in emerging countries, which in turn drives the demand for refractories in cement processing.

-

Most of this construction projects have resumed in China and is likely to gradually resume in other APAC countries after the COVID-19 pandemic is contained.

Mineral Processing Output

-

Increasing steel, non-ferrous and mineral output processing, and beneficiation due to growing demand for the commodities, drives the demand for refractory usage.

-

Rising commodity prices of steel, aluminium, gold, silver, and other non-ferrous minerals impact the global mineral production, which in turn would help in increasing the value of demand for refractories.

-

Suppliers in emerging economies are rapidly adopting technologies, in order to improve efficiency and increase production capacity

Constraints

Supply Constraint/Reduced capacity utilization rates

-

Supply has improved in Q1-2021 due to following COVID-19 protocols and adopting technologies such as digitization and automation, However, mills are still operating at reduced capacity utilization rates as compared to pre-covid scenario.

-

Environmental regulation in China coupled with increasing feedstock price and looking for coal alternative to electricity by major refractories producers will increase the production cost.

Increasing Logistics Cost

-

Increased logistics cost impacts the import of raw material and increases the domestic and landing cost of refractories, exporting nations

-

At present, the freight rate of both short-distance and long-distance international ocean shipping is still high

-

Chinese government continues taking measures in increasing the containers at ports to reduce the ongoing container shortages for export.

Cost Structure : Refractory Market

-

The major cost factors involved are raw materials and labor costs, which account for about 80 percent of the total cost.

-

In case of downstream sector, output of pig iron, cement, flat glass, ferroalloys, coke and zinc dropped in Aug-2022, but the output of crude steel increased marginally. The output of alumina, electrolytic aluminum and non-ferrous metals such as lead and copper increased significantly

-

In addition, rising logistical bottlenecks amid new COVID-19 related lockdowns in China, feedstock supply shortages, increasing coal and fuel prices is expected to further support the prices of refractory products in near term

Procurement Best Practices : Refractories

This section provides key insights into refractory procurement and allied services. These facts and figures are vital to understanding the different nuances and technicalities of procurement in refractories. The report details the prevailing contract and bid practices. The report then analyses the pros and cons of these procurement practices. Some aspects of the contract favor suppliers while others are more advantageous to the buyers. The competitiveness also differs for the different contract types. An accurate estimation of the refractory requirements and procurement quantities prevents delays in the bid process as well as the operations of the refractory.

The different aspects that one must consider before selecting suppliers for refractory procurement are listed and analyzed in detail. The technical, as well as legal parameters of the components, are studied.

Technological Advancements

The industry has seen many great advances in technology that have optimized the refractories industry. Some of these advancements are used to improve the refractories process while others improve the end product. The latest technological advancements have minimized the adverse environmental impact of the industry. Certain advancements are common to the industry while others are proprietary solutions provided by companies.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.