CATEGORY

Recovered Paper

Recovered paper, paper for recycling or waste paper is a sustainable and alternate raw material for wood pulp used in paper manufacturing. Most common recovered paper grades as OCC, Mixed paper and Board, Sorted office paper, Sorted graphic paper for de-inking etc

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Recovered Paper.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoRecovered Paper Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoRecovered Paper Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Recovered Paper category is 5.40%

Payment Terms

(in days)

The industry average payment terms in Recovered Paper category for the current quarter is 84.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Recovered Paper market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoRecovered Paper market report transcript

Recovered Paper Market Analysis and Global Outlook

-

Major exporters, like the US and the EU, are witnessing negative or minimum growth rates after the import ban in China.

-

There is a huge demand from India and Indonesia continuing in US and European OCC, with India being the price leader for OCC import to Asia from other regions

-

The domestic recycling rate, globally, is expected to increase, due to the shortage of imports

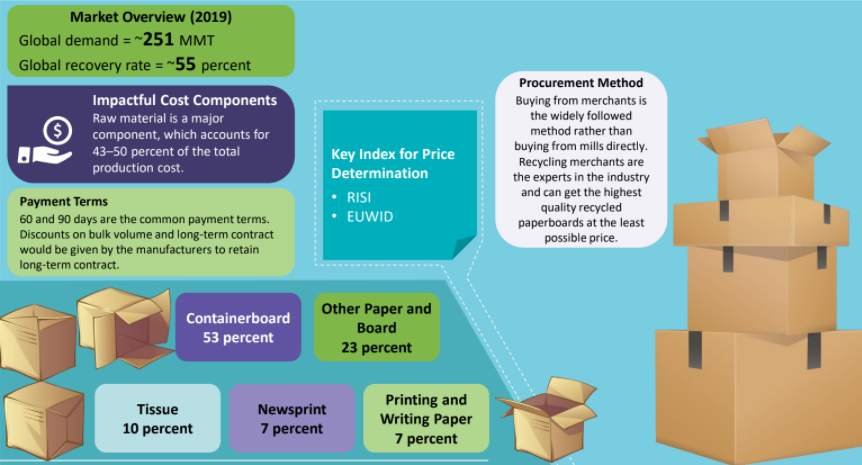

Global Recovered Paper: Market Overview

-

The global recovered paper demand is expected to increase at a CAGR of 2–3 percent until 2027

-

Asia (dominated by India and Southeast Asia) are the major driver of demand with the US and the EU being the prime exporters of recovered paper, globally due to increasing demand from corrugates market, owing to increasing e-commerce, due to COVID-19 impact

Global RCP End-use Market

-

Europe and the APAC are the major regions that use recycled paper for containerboard production

-

While 95 percent of the total containerboard produced in the APAC is made from RCP, the value is 82 percent for Europe (combining WE and EE)

-

For boxboard, 67 percent is recycled in the APAC, whereas in Europe, it accounts for 51 percent of the total boxboard produced

-

The demand for newspaper and printing & writing paper has been on a continuous decline in the developed regions, and its share is expected to decrease even further by 2023

-

Tissue share is expected to increase, mainly driven by the developing regions, like APAC and LATAM

RCP Growth Drivers

Demand From China

-

China has huge appetite for OCC, and hence, demand from China largely drives the global market. With OCC import restrictions, it is expected to create an adverse effect on the global recycling industry

-

Due to OCC import restrictions, Chinese mills have started importing virgin pulp to make up for the loss of OCC. Another practice that is expected to gain momentum among the converters in China is the import finished containerboard

Increase in Industrial Production

-

Increase in industrial production will result in increased demand for containerboards, which, in turn, will increase the demand for OCC. An increase in the paper and board production globally will also induce the demand in the OCC segment

-

With strong growth rates projected in China and other regions, like EE, India, LA, demand for OCC is expected to increase in the future

Shift to Recycled Grades

-

The demand for OCC or any other grades of RCP will depend on the availability of alternate forms of fiber in the region. For example, OCC demand in a region like Brazil or Chile will be minimal due to abundant availability of virgin pulp

-

Shifting consumers’ preference between virgin and recycled grades in the end products will determine the demand for the same in the future

Growing Concern for Environment

-

Every ton of paper recycled reduces the CO2 emission by about 21 percent, water consumption by 7,000 gallons, 380 gallons of oil, 4,000 kilowatt of energy, and 3.3 cubic yards of landfill space

-

Paper fiber can be recycled as many as seven times, making it a very crucial raw material for paper producers

Cost Structure Analysis : Recovered Paper

-

The cost of raw material is lower in regions, like North America and Europe, because of the ease in availability of raw materials

-

In Asia, owing to low recovery rate, raw material is imported from these regions, pushing the share higher

-

On the other hand, labor availability and average labor costs are much lesser in Asia compared to North America and Europe, bringing the labor cost contribution down

-

Other costs constitute to various verticals, like marketing, sales and distribution, general administration, and financing

-

Recovered pulp accounts for 55–65 percent of the raw material cost is the key cost driver

-

In Asia, the unemployment rate is higher than in Europe and US and the labour wages are significantly lower compared to the western countries.

-

Asia has the lowest raw materials cost, followed by Europe and the US

-

The difference between total production costs among the regions are narrow, due to high labour costs in Europe and US

Sustainability Trends in Recovered Paper

Clear Labeling

-

Brands are focusing on showcasing packaging disposal instructions on the product and inform if there are any sustainable claims. Increased transparency informs customers on product recyclability and disposability

Lightweight Packaging

-

Lightweight packaging is gaining momentum, as there are multiple benefits, as it requires less material to produce packages and the environmental impact, due to logistics is minimized along with a reduction in waste sent to landfills

Using Recyclable Materials

-

Using recyclable materials in manufacturing containerboard ensures that it creates a minimal impact on the planet. Most of the buyers are shifting toward using recyclable material to make an increased impact on sustainability initiatives

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.