CATEGORY

Records Management

Archiving services/Records management is the process of ongoing management of records over their lifecycle from creation to destruction.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Records Management.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Iron Mountain EV drive. Will it have an impact on the overall price of records management services in the long run?

October 11, 2022The need for the digital transformation of records management

July 18, 2022Iron Mountain EV drive. Will it have an impact on the overall price of records management services in the long run?

October 11, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Records Management

Schedule a DemoRecords Management Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Records Management category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Records Management category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

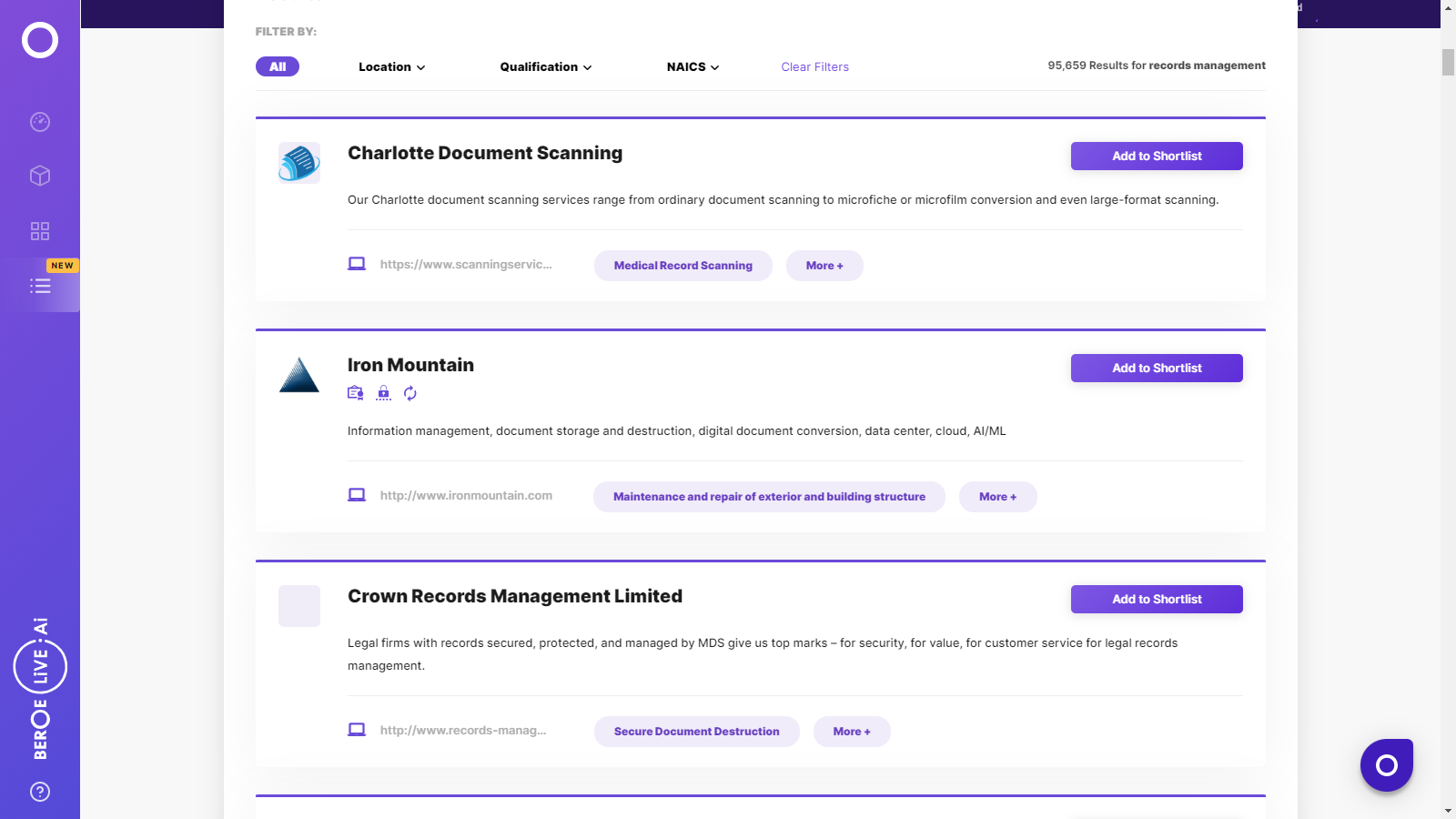

Records Management Suppliers

Find the right-fit records management supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Records Management market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoRecords Management market frequently asked questions

According to the report shared by Beroe Inc., the records and information management industry showed considerable growth in recent years due to changes in laws and regulations passed by the governing bodies. Other factors include: The industry has a high retention rate More number of organizations are starting to practice the art of maintaining electronic records Emerging regions like the APAC, Latin America, and Africa shows promising growth due to increasing acceptance of DPO services

The net document management system market size holds a CAGR of 5.2 percent. North America stands at the top of the market (based on size) with a gross valuation of $65 Bn, while the APAC and Latin America net valuation of $46 Bn and $13 Bn.

As per the report, the most important milestone in the record and document keeping domain is the implementation of ISO 15849. The rule was laid down to enable effective record management for organizations of all sizes and types and help them in better risk management and provide opportunities for cost savings.

Records Management market report transcript

Global Records Management Industry Outlook

-

The global market for records management, including physical and electronic, was valued at $8.52 billion in 2022, growing at a CAGR of 8–10 percent in 2027 and expected to grow at 15.42 billion by 2027

-

The emerging regions, including Africa, APAC, and Latin America, are expected to witness higher growth rates, due to increasing acceptance of DPO services

-

Industry has a high retention rate (Tier 1 players have an average client retention rate of about 98 percent)

Global Records/Documents Market Overview

Record/document management industry has seen a growth in the recent years, due to laws and regulations passed by governing bodies.

-

Industry has a high retention rate (tier-1 players have a client retention rate of about 98 percent)

-

The practice of maintaining electronic records is becoming more popular among many organizations

-

Regional dynamics: Emerging regions, including Africa, APAC, and Latin America, are expected to witness higher growth rates, due to the increasing acceptance of DPO services

Regulatory Trends

The most important International Standard for Record and Document keeping is ISO 15489.

-

ISO 15489 was laid down to enable effective records management for organizations of all sizes and types. They help in better risk management and opportunities for cost savings

-

Each country has its own standards for records and document keeping, and hence, differences arise between the ISO 15489 Standards and the Standards laid down by each country

Drivers and Constraints : Records Management

Drivers

-

Companies need to comply with various regulations imposed on them during audits and legal matters. Hence, there is a need for excellent and efficient records management and maintenance.

-

Reduction in cost of storage worldwide has also favored the records management market

-

Huge advancements in the technology space have enabled services like online records storage, storing digital copies of documents, and document imaging.

-

Ease of use and faster retrieval times have played a major role in end users to shift gradually to record management and electronic records management services.

Constraints

-

Economic conditions like higher levels of unemployment, inflation, tax rates and other economic factors affect the demand for record, management services.

-

Increased market competition restrain expansion of all: Service providers compete for acquisition to undertake expansion activities, which increases the price for acquisitions and reduce opportunities for some. The market is seeing big players becoming bigger like Iron Mountain and few regional players scaling up

-

Lack of a universally accepted standard is also one of the major challenges for this market

-

There can be an unexpected increase in spend due to factors including fuel hikes and hidden costs

-

Organisational reluctance in support due to issues related to information confidentiality

Pricing Models : Records Management

What will be the best-suited pricing model for the buyer?

-

Considering the number of transactions that take place in the banking sector on daily basis, the volume of papers/boxes for storage will never be predictable. It is suggested to go for an open book pricing model which will help the buyer to only pay for what they use and will result in transparent billing as well. For records management, the cost components involve a lot of hidden charges such as extra payment which includes palletizing, shrink-wrapping and transportation costs and other service charges

-

Opting for an Open book pricing Model will help to reduce the makeup pricing of different box type. An open book model would let the buyer understand better the fixed and variable costs which incudes, the cost per cubic feet incurred during the engagement period with the service provider

-

By adopting open book pricing with the supplier the buyer can better understand the true costs of the operation incurred by the supplier and can lead to a better supplier relationship over a long period

-

Most of the suppliers offer fixed cost model as they have a rate card for each of the services. Opting for an open book model will completely depend on the mutual understanding of the buyer and the supplier.

Types of Pricing Models

-

Fixed Cost: In this pricing model the required set of services expected to be performed by the supplier in the speculated time frame is decided and a fixed cost is set on this, payable by the client.

-

Activity Base Cost: This pricing model assigns the cost of each service according to the consumption/usage for each service engaged with. Subsequent contract depending on spend for individual services can be drawn.

-

Hybrid Model: This is a mixed model that takes feature of the above two models that can vary based on negotiations carried out between the client and the vendor.

-

Open Book Model: In this model, the pricing on the outsourced engagement is highly detailed with no hidden costs.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now