CATEGORY

Rapeseed Oil and Meal

Rapeseed oil is extracted from Rapeseed . The extraction is done through mechanical pressing followed by solvent extraction. Rapeseed meal is one of the key by-products of this process.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Rapeseed Oil and Meal.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

German rapeseed oil exports decline in 2021/22 marketing year

November 28, 2022Higher canola crush margins indicate strong demand for the commodity

November 16, 2022Australia's canola crops output forecasted to a record 6.75 million tonnes.

November 16, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Rapeseed Oil and Meal

Schedule a DemoRapeseed Oil and Meal Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoRapeseed Oil and Meal Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Rapeseed Oil and Meal category is 4.60%

Payment Terms

(in days)

The industry average payment terms in Rapeseed Oil and Meal category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Rapeseed Oil and Meal market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoRapeseed Oil and Meal market frequently asked questions

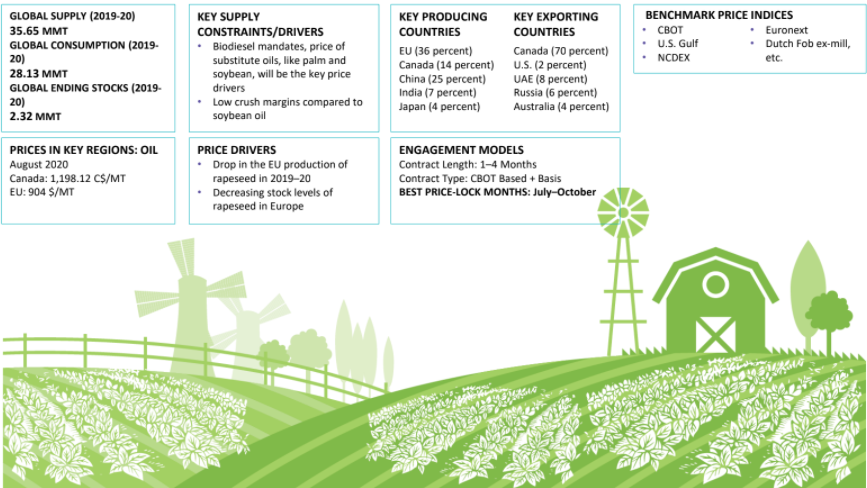

The global rapeseed oil market size is set to change in the upcoming years. According to the Beroe experts, the global consumption of rapeseed oil and meal was 28 MMT approximately while the supply was 35 MMT. The production size of China is 11.79 MMT while the production size of Europe is 16.97 MMT. The report outlines that there might be a short supply of rapeseed oil and meal due to crop damage in the UK region in the year 2021. This can directly impact the global supply for the short term. However, due to a good harvest, the demand will be met with the supply eventually and there will be a balance in the supply and demand of rapeseed oil.

There are many top rapeseed oil suppliers that are outlined in the Beroe report that has been curated by industry experts. The top rapeseed supplier and manufacturers include Cargill, Wilmar International Ltd., and Bunge Limited.

According to the rapeseed price forecast report by Beroe, the production by the EU decreased which impacted the price of the rapeseed oil directly. Substitute oil prices such as those of soybean and palm influence the rapeseed oil prices too. Bio-diesel mandates can influence the price of rapeseed oil and meal.

When it comes to vegetable oils, rapeseed is one of the most vital crops. It comes at par with soybean oil which is another edible oil. Rapeseed makes 40 percent oil making it one of the most in-demand oils and fats. The industries that will drive the rapeseed market include industrial, food, and vegetable oils.

The key rapeseed oil and meal producing regions are Japan, Canada, India, the EU, and China. The EU region produces the most at 36 percent. The key exporting countries include Russia, Canada, Australia, the U.S., and UAE. Canada exports 70 percent of rapeseed oil and meal.

Rapeseed Oil and Meal market report transcript

Global Market Outlook on Rapeseed Oil and Meal

-

The EU is the major producer of rapeseed in the world, but Canada leads the global exports contributing to more than 50 percent of the total exports, for both rapeseed oil and meal

Rapeseed Oil: Trade Dynamics

-

Rapeseed oil production is highly influenced by the crush margins versus soybean in the EU

-

Global demand remains strong though trade volume is expected to decline on reduced crush, production, and exports in Canada

Rapeseed Meal: Trade Dynamics

-

Demand from China and the US is likely to drive global trade during 2023, owing to increasing demand from the animal husbandry sector

-

The trade volumes are also dependent on the trend in substitute products and crushing volume, mainly that of soybean

-

Rapeseed meal exports from India are in increasing trends. Currently, India is the most competitive supplier of rapeseed meal, owing to bulk production. India’s rapeseed meal exports are in an increasing trend in the fiscal year 2022–2023

Impact of Macroeconomic Factors on Rapeseed Oil and Meal

-

The consumption rate of edible fats will likely increase with the increasing population

-

There is also an increasing shift in the preference for vegetable-based oils over dairy derivatives in the developing countries, majorly due to the prices

-

The increasing disposable income level in the developing countries impacts the price of Rapeseed oil and Meal

Population growth in developing countries

-

The Asian population has been growing at 0.95 percent this year, with the increasing population consumption of vegetable-based fats is expected to increase

Strong per capita demand

-

Per capita consumption of edible oil for the food use is likely to increase in the developing countries, such as India and China, by 2–3 percent

Lower China GDP growth rate affects demand

-

Reduction in per capita GDP is likely to affect the consumption of edible oil, but the demand for protein meal will persist, despite GDP

Strong demand

-

Rapeseed yields high amount of oil after palm, also the industrial uses of canola oil are high, hence the demand will continue to persist

Rapeseed Oil and Meal: Cost Structure Analysis

-

Raw material is the key cost factor contributing to close to 80–85 percent of the total cost in the processing of rapeseed oil and meal. The processing cost for the rapeseed meal is low, since it is only a by-product of rapeseed oil and requires only two additional steps, which is oil extraction and drying before packing.

Key cost factors and feedstock that impact the materials:

-

The raw material is the key cost factor, which constitutes to around 80 percent of the total production cost

-

Labor cost accounts for nearly 2 percent, the total variable costs amount to around 10 percent, and the utilities amount to another 2 percent

Key factors affecting feedstock price

-

Global production of rapeseed and price of solvents (hexane)

Why Should You Buy This Report

- Information about the rapeseed oil market size, value chain analysis, supply-demand analysis and trade dynamics.

- Regional market snapshot and analysis of North America, Europe, and Asia.

- Porter’s five force analysis of the global rapeseed oil market.

- Rapeseed oil and rapeseed meal price analysis, cost structure analysis, rapeseed price outlook, etc.

- Supplier profiles of key players.

- Rapeseed oil suppliers profiles of key players.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.