CATEGORY

Rail Freight Forwarding Services Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Rail Freight Forwarding Services Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Rail Freight Forwarding Services Australia Suppliers

Find the right-fit rail freight forwarding services australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Rail Freight Forwarding Services Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoRail Freight Forwarding Services Australia market report transcript

Regional Market Overview on Rail Freight Forwarding Services

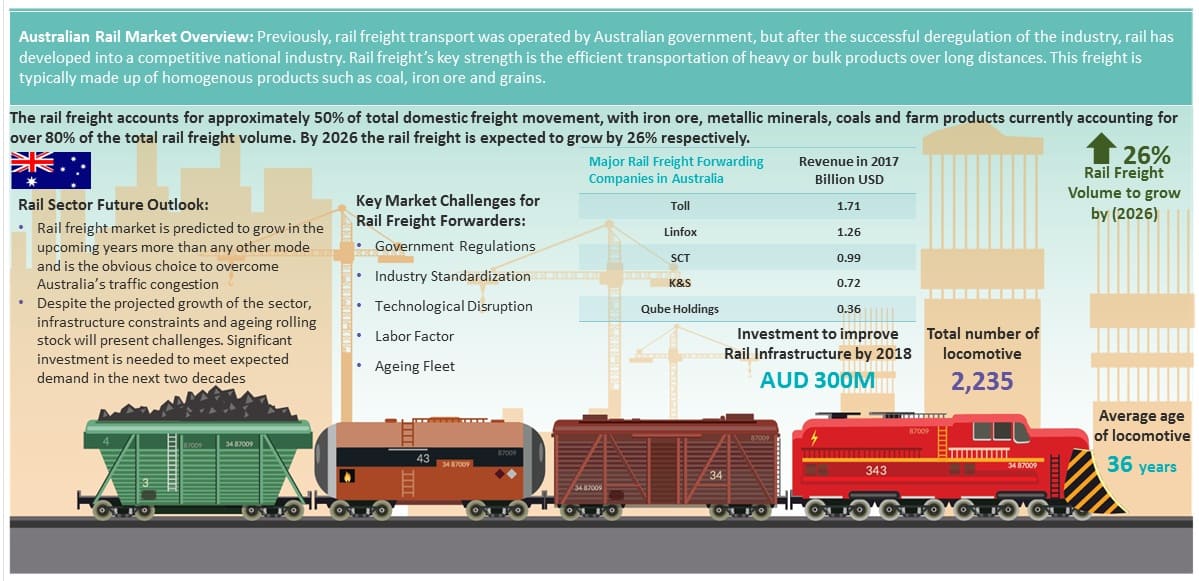

Rail freight is the most efficient mode of transportation from Eastern to Western Australia, the key factors for opting to rail freight is that it saves more time and cost compared to road freight. The rail freight accounts for approximately 50% of total domestic freight, with iron ore, metallic minerals, coals and farm products currently accounting for over 80% of the total rail freight volume. By 2026 the rail freight is expected to grow by 26% respectively.

- Iron ore and coal together account for over 80% (in tonne-kilometre terms) of all rail freight. The largest flows are in the Pilbara region of Western Australia, which accounts for over 94% of Australia's iron ore exports

- Grains, sugar, fertilizers and other bulk commodity account for 8% of the total rail freight. This category also includes pulses, chickpeas, cereal grains and oilseed.

- Non-bulk rail freight, which comprises about 8% of total rail freight, is most significant in the regions of eastern states and Perth, Melbourne and Brisbane, and between Brisbane and northern Queensland

Australian Rail Freight Growth Outlook

- Rail freight market is increasing proportional to the overall growth rate of the Australia economy. By 2019, the rail freight volume is expected to grow by 8-10%

- Rail freight contributes ~50% of total tonne-kilometres of domestic freight in Australia, which is dominated by bulk commodities.

- Iron ore and coal accounts for ~80% of the total bulk volume transported. Other major bulk commodities moved via rail are grains, sugar, fertilizers and mineral sands

Competitive Intelligence on Australia Rail Freight Operators

Historically, rail freight transport was operated by Australian government but after the successful deregulation of the industry, rail has developed into a competitive national industry. Australia's rail fleet comprises about ~2,200 locomotives with an average age of ~36 years.

National rail freight operators

- The two largest national rail freight train operators are Aurizon and Asciano (operating under the subsidiary names Pacific National and Patrick).

- Their core activity is coal haulage in Queensland and New South Wales, with other important ancillary bulk-haulage activities

Logistics companies

- SCT and Qube Holdings are the large players operating intermodal services for their own logistics chains. SCT Logistics has a wide portfolio of rail and road activities

- Qube Holdings has a diverse intermodal and bulk portfolio, with a primary focus on local and regional port-based operations.

- Fletcher International provides agricultural products rail services from Dubbo to Port Botany in New South Wales.

- Other logistics companies such as Toll, Sadliers Logistics and Ettamogah Rail Hub use rail freight operators to undertake their rail haulage.

Regional rail freight operators

- Genesee & Wyoming Australia is a major train operator in South Australia and the Northern Territory. Other significant players include Southern Shorthaul Railroad and Freightliner Australia.

- Watco provides grain haulage services in Western Australia

Mining companies

- Mining companies such as XYZ operates trains on their own railways

Key Market Challenges for Rail Haulage Service Providers

Government Regulations

At the macro socio-economic and political scale, after the privatization of railways during 1990s, though majority of railway infrastructure still owned by the government, either federal or state , the Australian federal government only involves in the formation of national policies and provides funding for national projects. Furthermore, due to big investments required and long-term impact on return of investment, the rail transport in Australia has often been neglected in favor of the road transport network.

Industry Standardization

Historically, Australian railways had a gauge uniform issues. This had been handled by federal government and big private companies after the privatization process. But the tonnage issue is under pressure for standardization to integrate with global and domestic trends of intermodal freight.

Technological Disruption

The technology change is a major challenge for the Australian railway industry, which is still run by old and traditional styles. The large Australian territories are under extreme weather and conditions would require huge funding and investment for new technology projects

Labor Factor

Workforce skills and productivity enhanced to improve the customer experience and to stay competitive is another challenge for rail haulage service providers in the rapid technology change era

Ageing Fleet

Australia's fleet of approximately 2,200 locomotives has an average age of 36 years, one of the oldest and least efficient in the world. This is limiting operators' ability to provide a competitive alternative to road transport. Replacement costs ranges from $4 million to $6 million per locomotive, which mean it would cost between $8.6 billion and $13 billion to replace the nation's aged fleet. This will require private sector funding, however, it is difficult to attract the investments in the absence of a firm government involvement in rail infrastructure

Current and Future Market Developments Insight

Major Rail Freight Challenges

- Australia is a large country of 7.692.000 km² (a continent on its own, same size as USA). The majority of its territories is under extreme weather condition. Around 25 million population are living in scattered coastal areas which are very far from one another (except Melbourne and Sydney).

- To manage these challenges of inland transportation, Australia has been developing its transport infrastructure with railway as a central role for its economy and society. Currently, railway is playing a significant part and makes a large contribution to the Australian economy of around $26 billion a year (1.6% of GDP) creating 140,000 jobs

Current Measures Undertaken by the Government

- The Australian government has been maintaining weak Australian dollar for the last 5 years and this policy is projected to continue. It is believed in Australia that the exchange rate induces a positive change on the growth rate of rail freight demand

- Studies from the BITRE (Australian Bureau of Infrastructure, Transport, Regional Economics) have shown that 1% depreciation of the dollar increases the growth rate of non-bulk freight rail demand approximately by a quarter of a percent.

- Favorable international economic conditions are now conducive to bulk freight demand in Australia.

- Australian government have now started to invest in projects such as Victoria's regional rail network advancement, expansion of metro operations in Sydney and Melbourne etc. In certain sense, these investments are making up for a prolonged period of underinvestment in rail infrastructure by the government who gave more favor to road traffic as it brings more short term and visible benefits.

- With the current development in place new regulations are set to be imposed to have an equal playing field for all players/entities in the industry

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now