CATEGORY

PVC

Polyvinyl Chloride (PVC) is predominantly used in construction industries followed by automobiles and packaging. Globally,naphtha based PVC would remain competitive than carbide based even at increased crude levels due to the high fixed costs involved for a carbide based producer.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like PVC.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoPVC Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPVC Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in PVC category is 2.70%

Payment Terms

(in days)

The industry average payment terms in PVC category for the current quarter is 62.1 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the PVC market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPVC market frequently asked questions

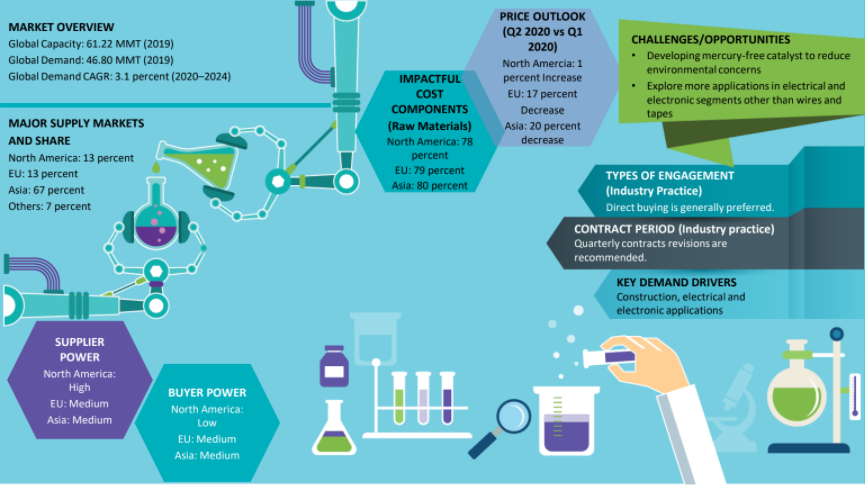

According to market research reports from Beroe, the global demand for the PVC market is expected to grow at a CAGR of 3.8 percent through 2016-2022.

The global capacity of the PVC market was estimated at 60.54 MMT in 2016.

Construction and applications in the electrical and electronics segment are anticipated to drive the demand for PVC in the future. Moderate growth is expected to be seen in applications in the consumer segment.

In the second and third quarters of 2019, there was a one percent increase in the PVC market prices in North America, a six percent decrease in the EU, and a 4 percent decrease in Asia.

Asia has the largest share in the global PVC market, which is 66 percent, followed by the EU with 14 percent, North America with 13 percent, and others with the rest 7 percent.

The challenges/opportunities in the global PVC market come from ' ' Developing mercury-free catalyst to reduce environmental issues ' The possibility of exploring more applications in electrical and electronic segments other than wires and tapes

Shin-Etsu, Westlake, Formosa Plastics, Sinopec, INOVYN are the top global suppliers in the PVC market.

North America has a high supplier power, while the EU and Asia have medium and low supplier power respectively.

Direct buying is the preferred engagement model in the global PVC industry.

There are three types of contract models ' ' Market price contract: The supplier provides the commodity at the market price. ' Fixed contract: The supplier's margin is locked for the contract period. ' Contract revisions: Quarterly contracts are usually preferred.

From Beroe's industry analysis reports, the global PVC market is expected to grow at a CAGR of 4.7 percent to reach around $46.6 billion by 2022.

The rise in ethylene prices led to an increase in the PVC price in the U.S. amidst a soft regional demand, balanced supply, and cautious buying sentiments.

PVC market report transcript

Global Market Outlook on PVC

-

The global demand is expected to grow at 3-4 percent CAGR during 2023–2026

-

Construction and applications in electrical and electronics segment are expected to drive the demand in the upcoming years

-

Applications in consumer segment are expected to witness moderate growth

-

Supply is expected to be adequate despite moderate capacity additions during 2023-2026 period.

Global Market Size: PVC

-

The global PVC market is expected to reach around $50.8 billion by 2026

-

The major growth drivers include applications in the construction, electrical & electronics, and automotive segments

-

Growth in consumer goods applications is anticipated to remain modest during this period

-

The global PVC market size was observed to be $50.2 billion in 2021, a Y-o-Y increase due to uptrend in demand across all the regions and firm prices due to supply issues in the US

-

The market size dropped in 2020, due to a drop in demand and considerable drop in PVC prices. However, prices improved in 2021 and 2022, hence recovery of market size were witnessed. Price decline and drop in demand would be the major factors for decline in market size in 2023

PVC Global Capacity–Demand Analysis

-

The overall PVC market is observed to be currently adequately supplied, with supply and demand gap likely to reduce in the upcoming years

-

Growth in global construction, infrastructure, and electronics industry in Asia are expected to drive the global demand

Market Outlook

-

The global demand for PVC stood at 44.1 MMT during 2022 and is projected to grow at a CAGR of approx. 3-4 percent during 2023–2026

-

Asia is the largest consumer of PVC, accounting for about 64 percent of total demand, followed by Europe, accounting for about 12 percent

-

Asia holds majority of the capacity (66 percent), followed by Europe (14 percent)

-

Capacity expansions are expected during the forecast period in Asia. Producers are expected to operate at 70-80 percent in 2023, due to weak demand. Operating rates are expecting to improve from 2024

Engagement Outlook

-

Feedstock prices are observed to be EDC (ethylene source), based in North America, Europe, the Middle East, and rest of the world, and acetylene (carbide source) based in China

-

Ethane and naphtha-based production in North America and Europe are expected to remain cost competitive compared to carbide-based method

-

Engaging with regional PVC supplier with multiple global presence would be beneficial in the long run

PVC Global Demand by Application

-

The infrastructure growth in Asia, combined with the quality and cost-effectiveness of PVC, is one of the major contributors to the rise in global demand

-

PVC demand from food packaging industry is expected to drop from 2025, due to sustainable commitments by major brand owners. Overall, the impact to the overall PVC industry is expected to be minimal.

Downstream Demand Outlook

Major Application Segments

-

Pipes and fittings mainly go to construction and agriculture industries

-

The dynamic automotive industry is another key contributor, with PVC being used as around 10 percent of the overall plastic in automobiles

-

Low cost and superior water resistance qualities of PVC compared to leather and rubber make it an ideal material to be used in consumer goods, such as clothes and footwear

PVC Application Outlook

-

PVC producers are anticipated to explore more applications in electrical and electronic segments other than wires and tapes

-

Profiles for doors, windows, and applications in CPG segments are projected to witness moderate growth

-

PVC demand in medical applications would most likely witness a further fall in Western Europe and North America, due to safety concerns

-

Owing to sustainability targets by various organizations, PVC demand from food packaging industry to see a decline from 2025

Supply–Demand Trends and Outlook: North America

Demand Trends

-

Domestic demand from construction and infrastructure witnessed a decrease from H2 2022, due to higher inflation and lower consumer confidence index. The trend is expected to broadly continue in 2023

Supply Situation

-

North American PVC market is currently oversupplied, with regional capacity exceeding the demand. However, outages due to weather related events curtailed regional supply significantly in H1 2021

-

Self-sufficiency in the ethylene front would enable North American PVC suppliers to run their plants at higher rates during the forecast period. Overall, supply to be adequate till 2026

Capacity Additions and Removal

-

The total capacity expansion of 0.60 MMT is expected during 2021–2022

-

A supplier has announced second phase of capacity expansion 0.38 MMT at Louisiana slated for completion in 2023. First phase of expansion came online in 2021

Impact to CPG

-

Domestic buying will continue to be cost competitive, due to excess supply available. Considering the volatility in raw material ethylene prices, buyers could opt for long-term contracts with quarterly price revisions

-

Supplier margins for the domestic producers to be higher than other regional producers due to ethylene cost advantage

PVC Cost Structure Analysis

Currently, North American ethane-based PVC is observed to be the cheapest, followed by naphtha-based PVC in Europe and carbide-based PVC in China. Naphtha-based PVC may not remain competitive than carbide-based at increased crude levels. However, carbide-based PVC prices may increase, due to the supply shortage observed in China.

-

With steady crude oil prices, North America continues to have cost advantage on raw material front

-

While naphtha-based PVC is expected to remain competitive at $40/bbl oil, competitive position of Chinese carbide-based vinyl looks questionable

-

Utility cost includes electricity, steam, water, and fuel/gas. Among these, electricity is the main utility that accounts for most of the cost incurred

-

Utility and labor costs were observed to be low across all the geographies

Industry Best Practice : PVC

Engagement Models

-

Direct buying is the preferred engagement model in the industry

-

CPG companies outsource their packaging requirements to their converters, since it helps them to focus on their core business

-

Consortium buying is not a common practice for CPG players in the resin market

-

Opportunities to tie up with major downstream segments, like construction, could be utilized to be benefited with discounts for better volume

Contract Models

-

Market price contract: The supplier supplies the commodity at market price or benchmark price

-

Fixed contract: The margin of supplier is fixed throughout the contract period or fixed price is locked for the contract period

-

Contract revisions: Quarterly contracts are generally preferred in this industry

Pricing Formula

-

Based on Monomer Contract Prices

P(PVC) = Monthly contract prices for feedstock + fixed component + premium

Note: VCM prices are observed to be EDC (ethylene source) based in North America, Europe, Middle East, and rest of the world and Acetylene (carbide source) based for China

-

Based on Index Prices

P(PVC) = Price of the resin quoted in the index for the month (CMAI/CDI/Platts) +/- margin percent

Producer margins are observed to be the highest in North America (20–25 percent), followed by Europe (15–18 percent) and Asia (12–15 percent)

P(PVC) = Resin index prices for the month + conversion cost + margins

Why You Should Buy This Report

- The market report provides insights and analysis about the global and regional PVC market size, supply-demand trends, market trends, trade dynamics, import-export, and market forecast.

- The global market outlook section presents the overall global market as well as scrutinizes the supply and demand outlook separately. This is useful as the dynamics and the geographies of the major importers and exporters are different. The market details are also studied regionally.

- The research study offers Porter’s five forces analysis of Asia, Europe, and North America and lists out the major industry drivers and constraints.

- It provides a comprehensive view of the cost structure, pricing analysis, and price trends.

- Further, the study has discussed the supplier landscape and the SWOT analysis of major players such as Westlake Chemical, Formosa Plastics Corp., and Sinopec, among others.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.