CATEGORY

Pumps and compressor - Mining

Mining Pumps refer to the types of pumps required as part of the mining process like, slurry pumps, centrifugal pumps, magnetic drive pumps, submersible pumps, borehole pumps, diaphragm pumps, and self-priming pumps. Mining compressor is a mechanical device that increases the pressure of a gas by reducing its volume.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Pumps and compressor - Mining.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Pumps and compressor - Mining Suppliers

Find the right-fit pumps and compressor - mining supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Pumps and compressor - Mining market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPumps and compressor - Mining market report transcript

Global Pump and Compressor Mining Market Outlook

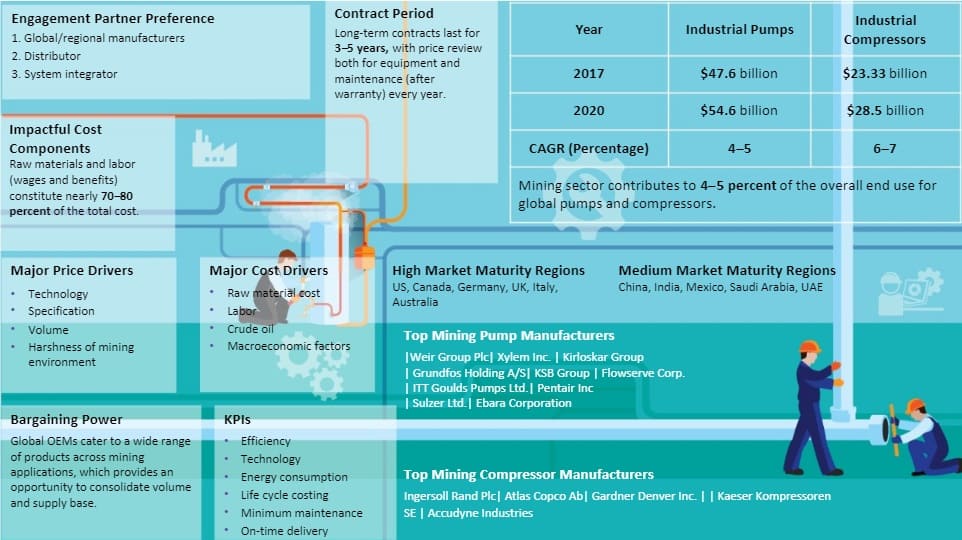

- The total global pump and compressor market was valued at $71 billion in 2017, with pumps holding ~68 percent of the share

- The pump market is forecast to grow at a CAGR of 4–5 percent to $54.6 billion by 2020

- The compressor market is forecast to grow at a CAGR of 6–6.5 percent to $28.5 billion by 2020

- The APAC is the highest demand generating region, followed by North America and Europe

- The top mining pump manufacturers are Weir Group Plc, Xylem Inc., Kirloskar Group, Grundfos Holding A/S, KSB Group, Flowserve Corp., ITT Goulds Pumps Ltd., Pentair Inc, Sulzer Ltd., and Ebara Corporation.

- Raw materials and labor (wages and benefits) constitute to nearly 70–80 percent of the total cost in the pumps and compressor mining market.

- The mining sector contributes to 4–5 percent of the overall end use for global pumps and compressors.

Global Market Maturity

- The global pump and compressor markets are valued at $47.6 billion and $23.33 billion, respectively, in 2017 and is expected to grow at a CAGR of 4-5 percent and 6-7 percent, respectively, until 2020. APAC accounts for approximately 34–36 percent of the market for both the rotary equipment

- In the mining industry, the supplier base for both pumps and compressors are relatively consolidated when compared to other industries

Market Trends

- The low-maturity regions, such as the Middle East, Africa, and LATAM are served by distributors, and the OEMs expand their presence through them for both sales and maintenance

- Regions, such as APAC, have medium maturity, in terms of adoption of smart technology and value-based approach. They focus on initial cost, followed by energy and maintenance costs while procuring pumps and compressors

Global Pump and Compressor Market by End-user Industries

- The mining rotary equipment market is driven by the extent of capital expenditure, both in new facilities and expansion or upgrade of existing facilities

- Production levels also determine the rate at which the existing pumps need to be replaced. So, the new rotary equipment is purchased and installed late in the project lifecycle

- Owing to the falling mineral prices, there has been a slowdown in new mining projects. This, coupled with the rising mining cost, might weaken the demand for new rotary equipment in this segment

- The similar impact on the oil and gas industry is likely to weaken OEMs' revenues, thereby, there is an opportunity for negotiation with manufacturers who have significant oil and gas end-use sales

Global Pump and Compressor Market by Product Category

- Positive displacement (PD) pumps are set to increase their market share in mining applications, especially progressive cavity pumps, owing to their ability to transfer high-viscous fluids with high-solid content

- Screw compressors will dominate the mining compressor market. The integrated VSD drives are set to increase the compressor energy efficiency and their market is expected to grow at 8–9 percent between 2015 and 2018

Global Market Drivers and Constraints

The repair, retrofitting, and rental markets are likely to grow in the slowdown period, however, investments can be made in technically advanced pumps and compressors with higher efficiency and lower the total cost of owners

Drivers

Driven by efficiency and advanced technology

- Emphasis on energy efficiency will increase the demand for efficient and sustainable equipment

- Pumps with lower maintenance cost and longer lifetime, using technology such as remote monitoring, surface coating, will drive the market for new equipment

Strong demand from repair, reusable water, and rental market

- Growing demand from repair, retrofitting increases the scope for global manufacturers in aftermarket parts and services

- Mines have started recycling and reusing the water for irrigation, which can drive the demand for mild steel pumps and compressors, which are used along with evaporators

Constraints

Commodity prices and raw material price fluctuation

- Fluctuations in currency exchange rate, as well as fluctuations in raw material prices, risk net revenue and operating margin of global manufacturers, respectively. Commodity prices decline would reduce the demand for new mining equipment

Maintenance labor

- The availability of skilled labor for mining equipment is decreasing, particularly in the emerging regions, also their associated costs are getting higher

Regulations

- Stringent environmental laws and regulations with regard to water and waste disposal and air emission Driven by efficiency and advanced technology

Pumps and Compressor Mining Market Overview

- Original mining pump manufacturers have better bargaining power compared to other players.

- If demand for steel from other sectors, such as automobile, increases, manufacturers are less likely to hold negotiating power among their tier-1 suppliers for steel.

- To safeguard supply, long-term contracts are preferred, based on orders.

- The pumps and compressor mining industry is dominated by tier-1 suppliers, who have the capability to manufacture heavy duty equipment and tailored specifications.

- The replacement market and the similar product and service capabilities of top players increase competition.

- There is no substitute as such; however, demand for energy-efficient and low- maintenance equipment is increasing.

- This trend, over the long term, can be a threat to the centrifugal equipment suppliers as a whole. However, top original mining pump manufacturers are diversifying their product portfolio as per market drivers.

Why You Should Buy This Report

Information about pumps and compressor market size, applications, market maturity, trends, regional market outlook, etc. Industry drivers and constraints and Porter’s five force analysis of the global pumps and compressor mining market. Supply market outlook and SWOT analysis of major mining pump manufacturers like The Weir Group Plc., Xylem, Inc., KSB Group, etc. Cost and price analysis and key price drivers. Turbine pumps procurement intelligence, sourcing models, pricing models, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now