CATEGORY

Propylene Glycol

Propylene glycol is a derivative of propylene oxide which finds its use in Unsaturated Polyester Resins (which goes into construction, transportation, marine industries as a reinforced plastic and fiberglass composites) along with Food, Drug & Cosmetics etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Propylene Glycol.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

European PG prices remain stable week on week

August 24, 2022World's first sugar process PDO production facility successfully begins production in China.

July 18, 2022European PG prices remain stable week on week

August 24, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Propylene Glycol

Schedule a DemoPropylene Glycol Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPropylene Glycol Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Propylene Glycol category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Propylene Glycol category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Propylene Glycol market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPropylene Glycol market frequently asked questions

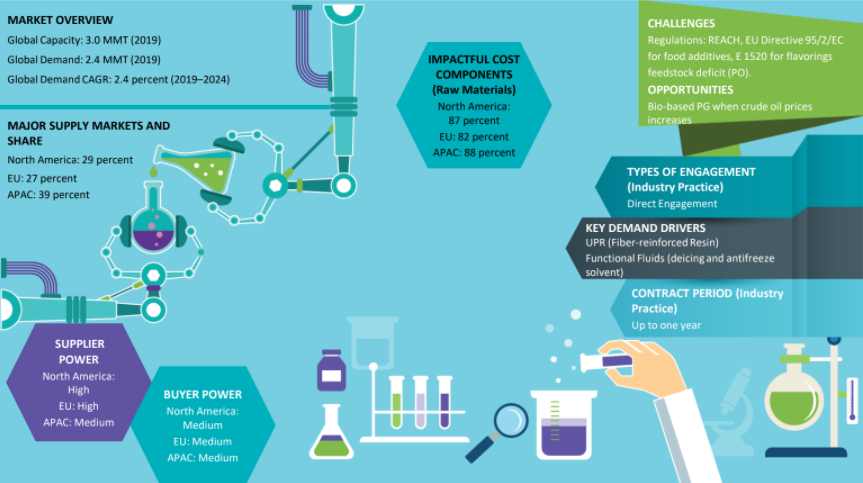

The global propylene glycol market is estimated to grow at a CAGR of 4.4 percent until 2022, with the demand likely to reach 3 MMT by the end of 2022. The demand for unsaturated polyester resins or UPR which are used in construction, transportation, and marine industries is projected to grow at a CAGR of 5-6 percent until 2021 as per Beroe's propylene glycol market report.

North America holds 28 percent of the supply market share, the EU holds 27 percent, and the APAC region holds 40 percent.

The major suppliers of propylene glycol are Dow Chemicals, LyondellBasell, Ineos Oxide, Shell, and BASF.

The global propylene glycol market size is expected to exceed $4.5 billion by 2022. Due to the high usage of bio-based PG in pharma industries in the North American and European markets, their growth is faster than conventional PO-based PG. Besides, bio-based PG also ensures a lower level of toxicity to the environment.

The key applications driving the PG growth are heat transfer fluids, fragrance, cosmetics, and personal care sectors.

Propylene Glycol market report transcript

Propylene Glycol Global Outlook

-

The global market demand (in MMT) is estimated to grow at a CAGR of 2.2 percent during 2023–2026, with the demand likely to reach 2.64 MMT by the end of 2026

-

Bio-based MPG is less competitive during 2016–2020. 2021 is likely to have been a golden year for bio-MPG producer compared with conventional MPG units, due to lower feedstock cost and ample availability, however, softening of prices in 2022, is expected to have remained favourable for conventional MPG production process.

-

The market is expected to recover in 2023, with easing crude oil prices and abandonment of zero-COVID policy in China, macro economic challenges are likely to continue and are likely to restrict any strong growth rate in 2023

Propylene Glycol Demand Market Outlook

-

Globally, high demand for bio-based PG is noticed from the pharma and CPG industries. Two bio-based new capacity additions will be commissioned by the end of 2023

-

PG growth rates in Europe will be lower (a CAGR of 1.4 percent) compared to other regions during 2023–2026, due to mature downstream markets

Propylene Glycol Industry Best Practices

-

Large-volume buyers usually prefer buying via contract across all the three major regions

-

Among small-volume buyers, CPG players opt for contracts, due to the need for high-quality pharma-grade MPG, while non-CPG small-volume buyers can buy in the spot market

-

Regional sourcing is preferred in Europe, owing to REACH regulation on PG, while both global and regional sourcing are followed in North America and Europe

Propylene Glycol Global Market Size

-

The global PG market is expected to exceed $4.6 billion by 2025

-

Bio-based MPG is less competitive during 2016–2020

-

2021 is likely to have been a golden year for bio-MPG producer compared with conventional MPG units, due to lower feedstock cost and ample availability, however, lower prices in 2022 is expected to have remained favorable for conventional MPG production process. Market size is estimated to shrink down Y-o-Y in 2023, on the account of Y-o-Y decrease in propylene glycol prices

Propylene Glycol Global Capacity–Demand Analysis

-

Global capacity and demand was estimated to be at 2.99 MMT and 2.42 MMT in 2022. The global demand is forecasted to grow at a CAGR of 2.2 percent during 2023–2026. Inflation and recession concerns globally primarily driven by Russia–Ukraine crisis, high crude oil and natural gas prices, and zero-COVID policy in China are few factors that impacted demand in 2022. Though, the market is expected to recover in 2023 with easing crude oil prices and abandonment of zero-COVID policy in China, macro economic challenges are likely to continue and are likely to restrict any strong growth rate in 2023

Market Outlook

-

Currently, the US is the largest market for PG, followed by China and Germany

-

Though China has eased restrictions on COVID, macroeconomic challenges are expected to continue into 2023, especially in the US and Europe, where both inflation and interest rates are high.

-

Asia represents almost 42 percent of the global PG consumption, with China being the major consumer

-

Globally, about 4 percent of PG is produced through biofuel route, made of glycerine (soybean or canola seeds in the US) or sorbitol (corn, based in China)

-

Bio-based PG production would result in capacity expansions across China, France, and the US

Engagement Outlook

-

Asian buyers should engage in spot pricing model for a maximum period of one year, due to the availability of bids, and offers from several producers and imported material

-

Since the buying trends are soft, it is recommended to go for a 70:30 (contract to spot ratio), which would increase the savings potential. On the contrary, lower volume buyers can opt for need-based buying amid uncertain macroeconomic environment, as supply remains ample and supply risk is low

-

Moving forward in 2023, cautious buying is projected to remain the norm, given the general uncertainty over global economic growth

Global Propylene Glycol Market: Drivers and Constraints

Drivers

Demand from Various Segments

-

The Asian region with high downstream demand from the construction, automotive, and homecare industries is expected to be the major driver of PG.

Glycerin-based PG

-

Bio-based PG is gaining popularity among the CPG and pharma companies, due to its lower toxicity and side effects. It is likely to drive the PG market faster than the conventional PO-based PG.

Crude Prices

-

Crude is a robust lead indicator, as any significant increase or decrease in NYMEX/BRENT futures will subsequently have a similar effect on PG prices within the next 20–30 days.

Constraints

Coronavirus Outbreak

-

Coronavirus Outbreak has significantly impacted the major demand segments of Propylene glycol i.e. Construction and Automobile segment. Hence, the demand is forecasted to grow at much lower rate than previous forecast.

Mature Markets

-

European downstream markets are more mature as compared to the Asian region and will not witness high-demand growth rates.

Regulations

The strict environment regulations in Europe are:

-

PG is subjected to the legislation for chemicals in Europe - REACH

-

EU Directive 95/2/EC on food additives (excluding other than colours and sweeteners)

-

E 1520 for Flavourings for foodstuff (1gm of PG/Kg of food), beverages and Cosmetics Directive 76/768/EEC

Euro (€) Devaluation

-

Peak demand of PG in Europe comes during winter

-

Imports will be costlier for European buyers and would prefer regional sourcing vs. imports from other nations

Cost Structure Analysis : Propylene Glycol

-

Raw material is the major cost driver of PG and hence, Europe and the US have greater control over its pricing, due to its self-sufficiency

-

Europe (especially Germany) is the best sourcing destination on the back of sufficient PG supply and maintains the lowest margins

-

Raw material cost constitutes more than 80 percent of the overall cost of production for both conventional (PO hydrolysis) and bio- based (DMC process) processes in all the three regions

-

PG prices are tagged to its primary feedstock, propylene and glycerine prices

-

PG contracts in Europe and the US settle in line with the variation in propylene prices

-

European electricity and labor costs are higher compared to other regions, owing to the shift toward renewable source of energy

Why You Should Buy This Report

- This report offers in-depth coverage of propylene oxide prices, propylene glycol prices, trade dynamics, supply-demand trends, and major industry events in global and regional markets.

- The report details the recent innovations in the propylene glycol industry, such as advancements in bio-based PG that are likely to result in capacity addition in the coming years, given its high growth rate.

- It offers a breakdown of the cost structure analysis and factors affecting the propylene glycol as well as propylene oxide market.

- Further, the report provides an exhaustive supplier profile and a SWOT analysis on key suppliers such as BASF, Shell, and Ineos Oxide.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.