CATEGORY

Process Automation

Process automation refers to measurement, control, electrification and other application used in processes where the main objective is continuous production.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Process Automation.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoProcess Automation Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Process Automation category is 4.90%

Payment Terms

(in days)

The industry average payment terms in Process Automation category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

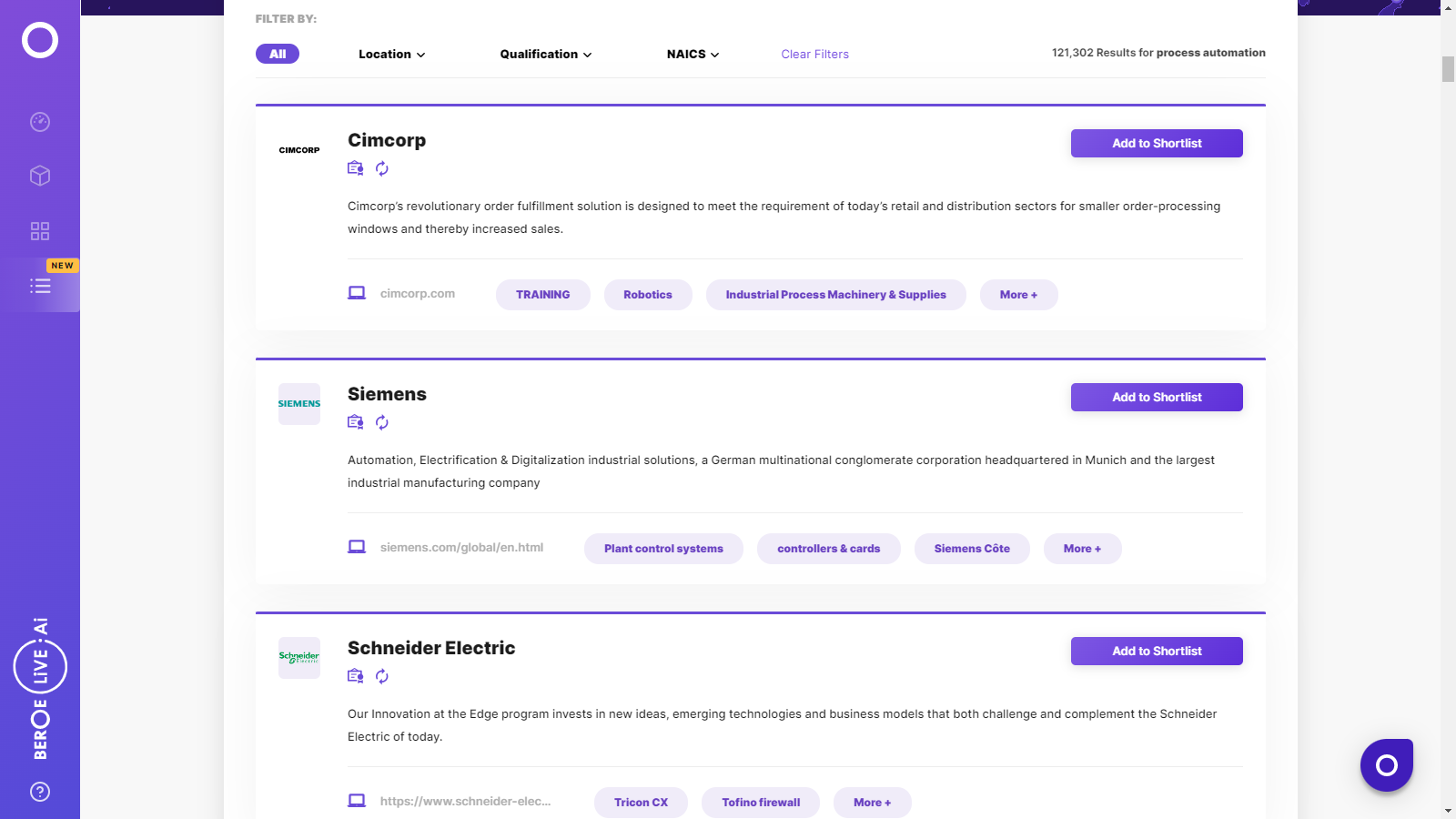

Process Automation Suppliers

Find the right-fit process automation supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Process Automation market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoProcess Automation market frequently asked questions

As per Beroe's market reports, Europe will continue to dominate the process automation market in 2020 in terms of growth prospects. Besides, the MEA region has been growing at the fastest CAGR of 9.5 percent since 2017 and is expected to continue that until 2020.

The major factors that will be driving the growth for the global process automation industry are the need for operational efficiency, fast-growing SMEs, shift towards IoT and cloud-based automation, rising demand for smart factories, mass and supply chain customization, integration of systems, innovation in AI, and advancement in M2M communication technology.

Oil and gas, metals and mining, pharma, paper and pulp, automotive, chemicals are the major end-use industries of the process automation market.

North America and Europe have high market maturity, while the Asia-Pacific region has medium market maturity in the industrial automation market.

According to market analysis and research from Beroe, the global industrial automation market size is expected to reach $178 billion by 2020 from its earlier market value of $138 billion in 2016, growing at a CAGR of 6.6 percent.

The impactful cost components are the raw material prices that constitute about 55 percent of the total cost of manufacturing process automation equipment.

Integrator fees, contract and volume negotiation, and discounts are the key negotiation factors in the global process automation market.

From 2016 Beroe's reports, the global industrial automation industry was estimated to be worth $258 billion with $116 billion in discrete and $138 billion in process industries.

The key players in the process automation industry include Honeywell International Inc., General Electric Company, Mitsubishi Electric, Rockwell Automation, Johnson Controls Inc., ABB Ltd., Samsung Electronics Co. Ltd., Siemens AG, and Schneider Electric.

In the process automation market, OEMs prefer lump-sum pricing, distributors prefer cost-plus pricing, while the integrators prefer market-priced/ milestone based/ time and material-based pricing.

Sourcing from OEMs, integrators, and distributors are the most adopted models globally to attain cost savings by eliminating manpower across tasks and maximizing process efficiency.

Process Automation market report transcript

Process Automation Global Market Outlook

Market Overview

Global Market Size: $130.5 billion (2023 E)

Global Demand CAGR: Approx. 6.12 percent (2023–2025)

Major Market Drivers

-

Rapid technological change

-

Emphasis on increasing

-

productivity

-

Increasing labor rates

-

Need for safety

Process Automation Regional Market Outlook

-

Europe is expected to continue to dominate the market, in terms of growth prospects in adopting automation; however, the APAC is expected to witness the highest growth rate during 2022–2025

-

Increasing focus on adopting automation across all industry verticals and spending more on new technologies are expected to be major drivers in the coming years

Process Automation Demand Market Outlook

-

The automation industry has been revolutionized by the combination of the digital and physical aspects of manufacturing, aimed at delivering optimum performance. Further, the focus on achieving zero waste production and shorter time to market has augmented the growth of the market.

-

Automation of manufacturing processes has offered various benefits, such as effortless monitoring, reduction of waste, and speed of production. This technology offers customers an improved quality with standardization and dependable products within time and reduced labor costs.

-

This is further supported by development of integrated multi-functional control systems that are modular and scalable. All these factors together are estimated to drive the automation systems market globally during the forecast period.

Global Process Automation Market Maturity

-

The global process automation market is expected to be at $130.5 billion in 2023 and is expected to grow at the CAGR of 6.12 percent until 2025

-

Europe is accounted for the largest market share, followed by Asia-pacific and North America, respectively. The Asia-Pacific region is expected to witness the highest growth rate of 7.54 percent during the forecast period

Global Process Automation Industry Trends

-

The market is dominated by established players who have a strong foothold in terms of geography as well as customer base. The growing demand for process automation is augmenting the competitiveness among vendors. Major strategy among the big vendors include new product launches, mergers and acquisitions, partnership and collaboration thus offering end to end multi-location solutions to global buyers

-

The Industrial Internet of Things (IIoT) and the Industrial 4.0 are at the center of new technological approaches for development, production, and management of the entire logistics chain, otherwise known as smart factory automation and are dominating trends in the industrial sector, with machinery and devices being connected via the internet

Global Process Automation Market

-

SCADA system plays a crucial role in process automation, since these systems form information modeling engines that can be prototyped into a logical model. These information modeling engines are essential to control and monitor single and multi-plant workflows, and offer greater visibility into various automation processes, workforce, equipment, and documents

-

Currently, the industries are challenged by an absence of the skills required to efficiently collect and consolidate disparate data from various devices and systems. This reduces the visibility and efficiency across multiple operations

-

Despite the challenge, companies are integrating the SCADA system to handle most of their operations. For instance, recently, California Family Foods (CFF) upgraded its rice mill operations with modern SCADA, which is expected to compel other similar organizations to adopt to this technology

-

The advancements in wireless networking technology provides an enormous opportunity for wireless connectivity of field devices, both, in the oil and gas and other chemical processing plants

Supply Market Outlook : Process Automation

Global/Regional Supplier

-

Increase in innovation: Global vendors in the automation industry have been continuously striving in a highly competitive environment by bringing in more innovative products as well as enhancing their existing product capabilities

-

Increase in M&A activities: The automation industry players are focused on mergers and acquisitions to expand their reach to untapped global markets and increase their product and service portfolio

System Integrators

-

Ensures OEE: An integrator ensures OEE to an end-user when they come in mainly for software integration of all the equipment already procured by the client

-

Innovation in automation: Some of the integrators also take up the responsibility of innovating in areas wherever possible in order to stay competitive. For instance, recently, B&R automation upgraded the highly advanced and flexible APROL automation platform by adding a powerful system component for Business Intelligence (BI). APROL includes a PAL library of standardized modular software functions for process engineering tasks

Engagement Trends

-

Most adopted model globally: Sourcing from OEMs, integrators, and distributors

-

Why: To attain cost savings by eliminating manpower across different tasks and maximizing process efficiency

-

Contract length: 2–3 years, with an option of maintenance and spare parts services

-

Pricing strategy: OEMs prefer lump-sum pricing, distributors prefer cost-plus pricing, while the integrators prefer market priced/milestone based/time and material based pricing

Process Automation Cost Drivers

The cost of automation products and solutions is primarily driven by fluctuations in raw materials and oil prices.

Product Customization & Design

-

Process automation requirements differ across industries, processes, and client sites

-

Variation and increased complexity of design in customization increases the cost of a product

-

Costs involved in designing and testing would also add to the final cost of the product

Labor Cost

-

Labour cost varies from region to region. In order to keep the cost of the product low, global suppliers try to get the products manufactured in low-cost regions like China, India etc.

-

China is already the largest exporter of process automation equipment in the world

Raw Material

-

Steel, iron, copper, rubber etc. form the majority of the raw material prices used in manufacturing automation equipment

-

Fluctuations in these raw material prices have a direct impact on the final cost of the products

Oil Price Fluctuation

-

It is directly linked to the raw material price hikes. It highly affects indirect transportation cost, as well as ocean freight

-

Energy contributes almost 20 percent of the production costs of the parts

Proprietary versus Non-proprietary

-

If the product is proprietary (exclusively manufactured by the OEM), its costs are very high and, generally, manufacturers start producing the spare part after receipt of the order.

-

Non-proprietary carry less cost, due to availability of multiple sources of supplies

Technology Trend in Process Automation

-

While a global pandemic that prevents humans from working in a factory, robots and self-directed equipment will be more sought-after than ever in coming years

-

Process automation companies are investing high into technologies such as artificial intelligence (AI), robotic process automation, industrial internet of things (IIoT), industry 4.0 as they foresee high demand of these technologies across all their end-user industries

-

In the past, the end-user industries such as oil and gas, chemicals etc., have been resistant to innovation or early adoption of high-end technologies as they preferred to leverage proven technologies and standards to ensure safe, secure and consistent operations over time

-

However, things have started to change radically with the advent of industry 4.0. The industrial space has been impacted with incremental technology changes, rapid adoption of new systems and augmented networking architectures over the last decade

Why You Should Buy This Report

- It provides information on the global market size, regional outlook, industry drivers, and constraints, and does Porter’s five forces analysis of the process automation market.

- It provides you supply trends and insights, industrial automation hierarchy, supplier profiles, and SWOT analysis of major players like Siemens, ABB Ltd., Emerson Electric Co., etc.

- It provides an insight into the cost structure breakdown and pricing analysis of the industrial and intelligent process automation market.

- The report details the best sourcing, contract, and engagement models of the industrial automation market.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now