CATEGORY

POS lending platforms

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like POS lending platforms.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoPOS lending platforms Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in POS lending platforms category is 6.20%

Payment Terms

(in days)

The industry average payment terms in POS lending platforms category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

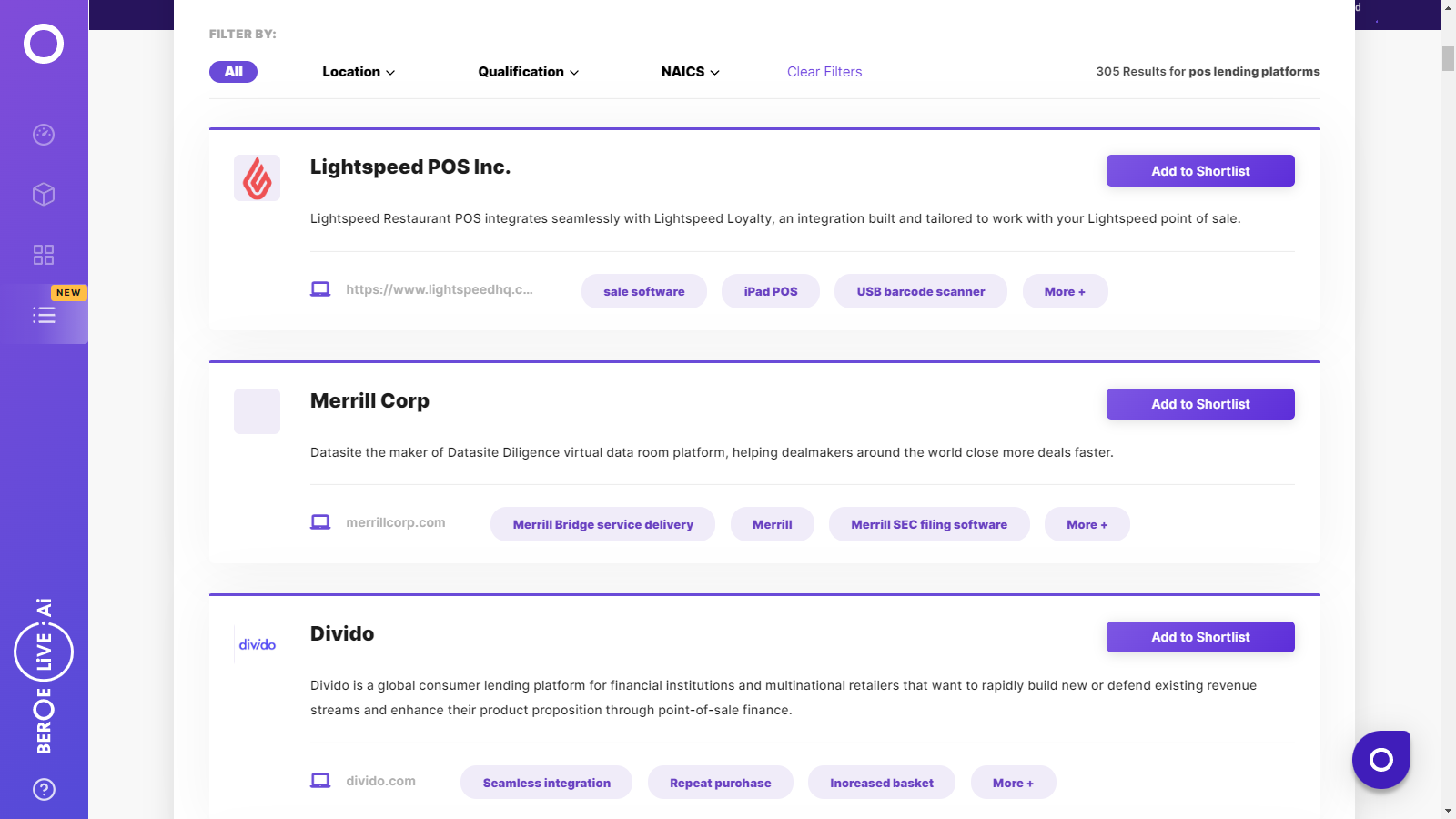

POS lending platforms Suppliers

Find the right-fit pos lending platforms supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the POS lending platforms market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPOS lending platforms market report transcript

POS lending platforms Global Market Outlook:

Market Overview

-

The global POS lending finance market is estimated at $7.8 Billion in 2022. The market is growing at a CAGR of 16 percent and is expected to reach 24 billion by 2028. It has been observed that POS lending finance is growing at 40 percent a year in the US, with similar growth rates in Europe, Australia, and some parts of Asia and the Middle East

POS Lending Finance: Market Maturity

-

POS lending finance is growing at 40 percent a year in the US, with similar growth rates in Europe

-

Globally, POS lending finance is estimated at approx. $7.8 billion in 2022

-

Adoption rates around the world have improved by a minimum of 5 percent in all the markets, after the increasing popularity of Buy Now Pay Later (BNPL) services

Cost Drivers : POS lending platforms

-

New Age FinTechs will continue to innovate: New age FinTechs with their lean organization and innovative operating models, will continue to offer agile and cutting-edge products that will address current consumer pain points with taking a loan.

-

Data and Analytics will disrupt the Lending Value chain: Digitization of various databases and records has resulted in a multi-fold increase in data of individuals and corporations being digitally available.

Porter's Analysis on POS lending platforms : Developed Markets

Supplier Power

- The presence of mature global FinTech providers in the developed markets, like the US and the UK

- POS lending finance is a niche service offered by FinTech providers, which requires high technological capabilities and integration with various credit rating agencies for providing fast disbursal of loans

Barriers to New Entrants

-

Barriers to new entrants are medium, due to existing, established global FinTech providers, and new providers need to create a good reputation and show good results to establish themselves. Good technological knowledge in the consumer lending finance and human capital are required

-

There are intense regualtions in the consumer lending space, and it takes high capital requirements and technological capabilities to enter the market

Intensity of Rivalry

-

The rivalry among the current global FinTech providers are medium, and they are coming up with innovative consumer financing solutions

Threat of Substitutes

-

The threat of substitutes is medium, as other forms of consumer lending (credit cards) are prevalent

-

Banks can launch in-house POS lending finance and increase their lending service offerings

Buyer Power

-

As majority of the integrators are global banks and retailers, the buyer power in POS lending finance space is medium, as the integrators are aware of the lending finance category and are mature

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now