CATEGORY

Polystyrene

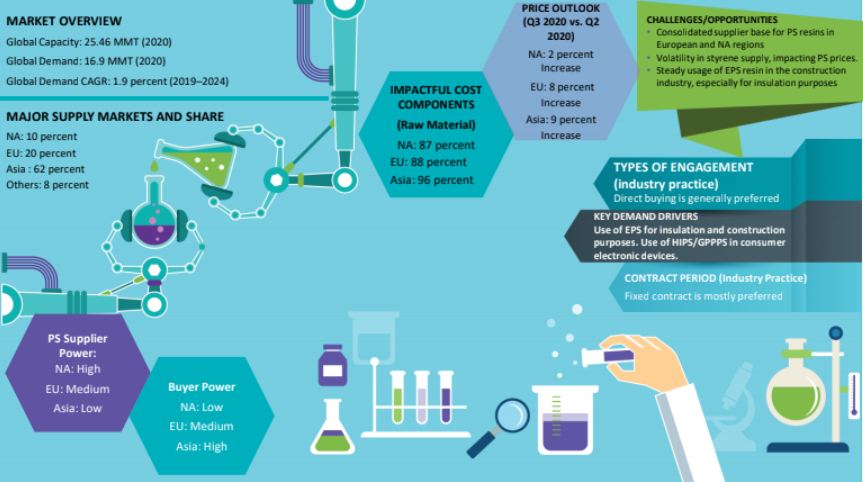

Polystyrene is synthetic aromatic polymer made from styrene monomer. The polymer has three grade namely HIPS (High impact polystyrene), GPPS (General purpose polystyrene) and EPS (expandable polystyrene) which has uses across downstream industries like Packaging, Construction, Manufacturing of Electric and Electronic Appliances .

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Polystyrene.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Asian styrene facilities will realize considerable capacity expansions in 2023 and 2024

January 09, 2023EPS capacity expansion at Sunpor to be completed in H2 2022

July 19, 2022Asian styrene facilities will realize considerable capacity expansions in 2023 and 2024

January 09, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Polystyrene

Schedule a DemoPolystyrene Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPolystyrene Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Polystyrene category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Polystyrene category for the current quarter is 70.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Polystyrene market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPolystyrene market report transcript

Global Market Outlook on Polystyrene

-

The global market is estimated to grow by 2.4 percent during 2023-2026. The lower growth rate can be attributed to the sluggish downstream demand, especially from the packaging and construction segment

-

The packaging segment has reduced the usage, due to its issues with sustainability. Multiple states in the US and Europe have banned its usage, reducing its competiveness with other resins

Industry Best Practices : Polystyrene

Volume/ Minimum Order Quantity

-

Direct buying is preferred for minimum order quantity of one or above truck load/rail load

-

Low volume may limit the benefits of direct buying for a CPG company

-

One truck load Volume: 25 MT

-

One Rail load Volume: 90–110 MT

Logistics

-

Logistics management is one of the major cost components in the direct buying process

-

Fuel cost, which is a major spend in transportation, is expected to be three times lower for rail cars over truck load

Process Complexity

-

Producers may give preference to large convertors and distributors over CPG buyers

-

CPG buyers can enter into long-term contracts with producers with a minimum guarantee, so that a steady business relationship is maintained over time

Global Market Size-Polystyrene

-

The global PS market size is expected to grow at a rate of 0.3 percent during 2023-2026, driven majorly by downstream users like construction and electronics. The global PS market is expected to reach $32.6 billion by 2026.

-

The HIPS/GPPS market is driven majorly by the Asian market, which is expected to grow at a 2-3 percent CAGR during 2023-2026. Global PS prices are forecasted to decrease by 8-10 percent in 2023 amidst bearish market sentiments and lower crude oil prices.

-

The EPS market is driven by firm demand from the Asian market, which is expected to grow by 2.5–3.5 percent CAGR during 2023-2026, while mature markets, like Europe and North America, are expected to grow by 1–2 percent CAGR during 2023-2026.

Global Capacity-Demand Analysis

-

Global production capacity for polystyrene* (HIPS and GPPS) is estimated to be around 14.6 million metric tons, with Asia accounting for about 62 percent of the total capacity

-

Global production capacity for polystyrene* (EPS) is estimated to be around 9 million metric tons, with Asia Pacific accounting for about 70 percent of the total capacity

-

The global PS market is expected to grow at ~ 2.4 percent during 2023-2026, driven majorly from downstream users, like construction and electronics

Market Outlook

Capacity Dynamics

-

Mature markets, like Europe, North America, and Japan, have witnessed capacity rationalisation, resulting in a total of 4–6 suppliers/region, while developing nations, like Middle East, China, and Taiwan, have witnessed capacity additions. There are no major capacity reductions announced during 2023-2026

Demand Dynamics

-

The HIPS/GPPS market is driven majorly by the Asian market, which is expected to grow by ~2.4 percent CAGR during 2023-2026

-

The EPS market is driven by firm demand from the Asian market, which is expected to grow by ~3.0 percent CAGR during 2023-2026, while mature markets, like Europe and North America, are expected to grow by 1-2 percent CAGR during 2023-2026

Engagement Outlook

-

For CPG buyers with volume of 5,000–10,000 MT, one can look at direct buying from producers as a viable option.

-

Direct buying can reduce the overall sourcing spend of PS by 5–8 percent, as the margins between intermediaries, like distributors and convertors, get eliminated.

Global Trade Dynamics : Polystyrene

-

North America: The region was a net importer of EPS and HIPS/GPPS resins, imports primarily from South Korea, Taiwan, and Brazil. Overall PS imports increased by 14 percent Y-o-Y during FY 2021, due to high demand from the packaging sector to produce disposable food packaging solutions. Overall net imports have increased by 29 percent Y-o-Y during FY 2021

-

Europe: Europe was a net importer of PS in FY 2021, with a spike in imports (an increase of 33 percent Y-o-Y in 2021) from the Asian region in FY 2021 due to a 78 percent Y-o-Y hike in PS prices. In 2021, total net imports are expected to reach 37 thousand MT.

-

Asia: Asia is a net exporter of HIPS, GPPS, and EPS resins. After the COVID-19 pandemic, demand for PS recovered, and prices for PS in the USA and Europe dramatically increased. As a result, net PS exports increased by 66 percent year over year in 2021

-

Brazil: Exports from Brazil have increased by 30 percent Y-o-Y in 2021 due to better netbacks from South Africa and other South American nations.

Industry Drivers and Constraints : Polystyrene

Drivers

-

Food packaging demand in Asia: Food packaging accounts for 25–35 percent of the total demand. Increase in packaged food demand, rising demand for food containers, and disposable cutlery in Asia are expected to be the key drivers in the coming years.

-

Appliances demand in Asia: Increase in disposable income is likely to drive the home appliances demand from the Asian markets. The consumer electronics is a major driving segment, which is expected to grow by 3-4 percent CAGR by 2026.

-

Construction demand: Increase in global temperature may also push the demand for heat insulation materials like polystyrene in the coming years. This segment is likely to witness a steady growth rate of 2–3 percent from 2023 to 2026.

Constraints

-

Capacity reductions: Total Petrochemicals plans to shut their 110,000 MT/YR by the end of FY 2019. The plant is located in Spain while INEOS Styrolution plans to reduce ~ 50,000 MT/YR of its capacity by replacing it with ABS. This is expected to be operational by FY 2021.

-

Delay in feedstock styrene capacity additions: In the past years, styrene monomer prices have been driven mainly by supply–demand dynamics, which in turn prompted the PS prices. Sinopec-SK (Wuhan) Petrochemical Company is planning to start its 27,000 MT/YR styrene monomer (SM) plant in FY2019. Capacity additions of ~5 MMT/YR was expected to come online by H2 2018 To H1 2019 however the delay in construction means these plants would be operational only by FY 2021. Styrene has a very high correlation of 0.83 with HIPS and GPPS. Thus any major change in the feedstock price can be expected to be reflected in PS price.

Cost Structure Analysis : Polystyrene

-

Majority of costs for PS are driven by the volatility in raw materials rather than supply–demand situations

-

Benefitted by lower production cost, this volatility in raw material prices could decline in Asia, as the region is expected to be self-sufficient by 2021 with upcoming capacities of styrene coming online

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.