CATEGORY

Polypropylene

Polypropylene is the second largest thermoplastic polymer after polyethylene which finds its use in packaging (food/non-food containers, caps-closures, films etc.), auto components (internal structures, bumpers, dashboard carriers, door panels), films & fibres etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Polypropylene.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

PureCycle announces commissioning of new r-pp plant in Ohio with 105 million lb capacity.

March 28, 2023Chinese PP inventories down week-on-week

February 13, 2023Gap between SEA and FEA PP widens.

February 07, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Polypropylene

Schedule a DemoPolypropylene Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPolypropylene Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Polypropylene category is 10.70%

Payment Terms

(in days)

The industry average payment terms in Polypropylene category for the current quarter is 61.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Polypropylene market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPolypropylene market frequently asked questions

As per Beroe's analysis report, the global polypropylene market is estimated to grow at a CAGR rate of 4.4 percent by 2023. The rise in disposable income and increasing demand from the CPG, and the automobile industry are likely to drive the growth of emerging markets such as Brazil and Asia.

The demand for polypropylene is anticipated to slow down in the coming years especially from the highly mature markets like North America and Europe. As the global polypropylene market has surplus capacity from MEA, and NA, the demand is expected to sharply increase from the Asian countries. On a country-level, China is moving to a stage of self-sufficiency, while the supply deficit will increase across Latin America and Europe.

Given the current situation of COVID-19, the polymer prices are expected to decrease due to balanced-to-long supply in the market and experts believe that the demand will remain soft due to COVID-19. The corona outbreak is also collapsing the crude oil market which is further reducing the global polypropylene market price. Despite the pitfalls, the net polypropylene market share is estimated to be in the range of 1.7 ' 1.8 Million MT/Month, while demand is estimated to reduce by >500 KMT/Month.

Polypropylene market report transcript

Global Market Outlook on Polypropylene

-

The global market is estimated to grow at a CAGR of 4.9 percent during 2022–2025

-

Rise in disposable income, increasing demand from CPG, and automobile industry are likely to drive the growth in the emerging markets, such as Brazil and Asia

-

Demand from ‘highly mature markets’ such as North America and Europe is likely to slow down in the coming years

Polypropylene Demand Market Outlook

-

The global PP market has surplus capacity from MEA and North America, while demand is expected to increase sharply from the Asian countries

-

Import dependency of China is estimated to have come down during 2022

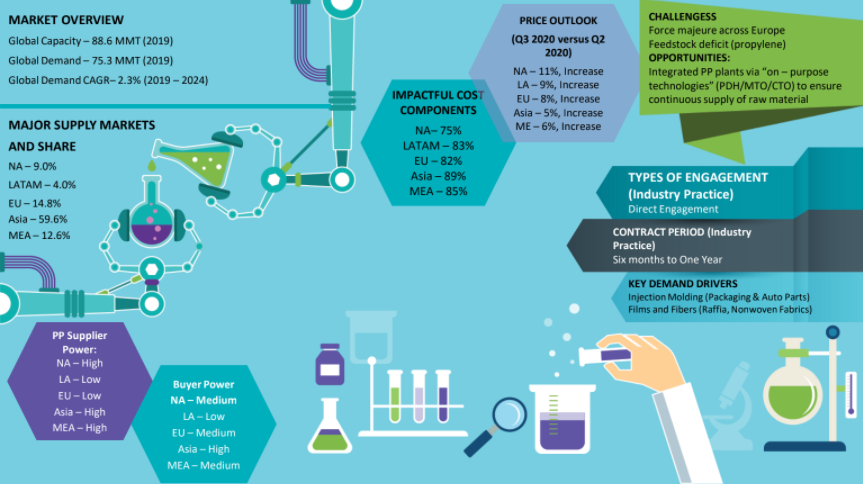

Industry Best Practice : Polypropylene

Engagement models

-

Direct buying and consortium buying are two relevant engagement models in the industry

-

Direct buying is mostly preferred by the CPG industry (large volume, >9,000 MT/year), and consortium buying is preferred among small capacity (<500 MT/year) buyers

Contract structures

Fixed Contract

-

Length of contract: Six months–one year

-

Volumes in contract: >1,000 MT/year

Multi-year Contract

-

Length of contract: 2–3 years (to establish a long-term relationship in a highly matured market)

-

Volume in contract: >5,000 MT/year

Global Market Size –Polypropylene

-

The global PP market is expected to reach $162 billion by 2025

-

Key driving end-use industries are CPG segment (food/non-food containers, caps-closures, films, etc.) and auto components (internal structures, bumpers, dashboard carriers, door panels)

-

Global market size is forecasted to witness a growth rate of around 8–9 percent (CAGR) during 2020–2025. It will be driven by higher PP prices in Europe and the Americas. PP prices during H1 2021 had almost doubled in comparison with 2020 prices, and have increased by ~47 percent on an Y-o-Y basis, leading to 53% Y-o-Y increase in market size in 2021. However, prices corrected in 2022 after a steep increase in 2021, leading to a dip in market size during 2022. Crude oil prices are likely to increase to higher levels in the forecast period, eventually exerting upward pressure on raw material propylene and PP prices, thereby contributing to growth in PP market size during the forecast period.

Global Capacity-Demand Analysis : Polypropylene

-

PP capacity and demand are estimated to be approx. 103.3 million MT and 81.8 million MT in 2021, respectively. The global demand is expected to witness a growth of around 5.0 percent until 2025, driven by Asia, primarily China and India. The global PP resin market is estimated to have increased by 4.9 percent Y-o-Y in 2021 as demand continued to remain strong.

Market Outlook

-

PP capacity and demand are estimated to be approx. 103.3 million MT and 81.8 million MT in 2021, respectively. The global demand is expected to witness a growth of around 5 percent until 2025, driven by Asia, primarily China and India. The global PP resin market is estimated to have increased by 4.6 percent Y-o-Y in 2020 despite COVID-19 pandemic. Asia has posted a growth of 7.4 percent Y-o-Y in 2020, due to high demand in H2 2020

-

Asia represents almost 62 percent of the global consumption of PP, with China being the major consumer

-

Europe (excluding Russia) and LATAM are expected to operate at the maximum rate of 86–92 percent in the forecasted period

-

The top five PP producers, with a capacity share of 30 percent in 2020/21. Sinopec has increased its production capacity by 1.7 Million MT during 2015–2020. It is further expected to increase in the coming years

Engagement Outlook

-

Buyers from the US and Europe should try to lock the contracts at the start of the year to minimize supply risk

-

Buyers should engage in the spot pricing mechanism for a maximum period of one year in Asia, owing to highly volatile upstream market and to revise their pricing formula and level of discounts

-

Continuous capacity additions in China are likely to reduce the imports of PP during 2022–2025. Hence, surplus capacity will be directed towards Europe, Latin America, and the US market

Polypropylene Global Demand by Application

-

The application of PP in caps and closure (4.5-5.0 percent CAGR) has been on rise and is expected to drive the market in North America and Europe

-

Demand from Fibre grade is on the rise due to Coronavirus outbreak and its usage in personal protective equipment.

Downstream Demand Outlook

-

Matured markets, such as the US and few European countries (Germany, UK, France, Italy, and Spain), with a robust automotive segment, have a greater demand for the injection molding grade of PP

-

Demand from the beverage industry and the pharmaceutical sector is expected to dominate the demand for caps and closures, and it is expected to account for more than 70 percent of the total demand

-

Key regions that will drive the global caps and closures growth will be Asia (especially, China), due to rapid industrialization and improvement in living standards

-

Economic uncertainties in the UK will result in lower growth of co-polymer grade, due to unavailability of the product in the region

-

Demand from Fibre grade is on the rise due to Coronavirus outbreak and its usage in personal protective equipment.

Global Trade Dynamics : Polypropylene

-

North America: Net exporter for more than 10 years.

-

Europe: Net importer with a trade deficit of 0.6 MMT/year, due to zero capacity additions, and Europe is expected to remain a net importer in the short term. The EU 28 has traditionally remained a net importer of PP, excluding Russia

-

MEA: Leading exporter with a trade surplus of around 2.63 MMT/year in 2020. The net exports have decreased by 13 percent Y-o-Y in 2021, due to bearish demand from SE Asia

-

LATAM: Net importer for more than 10 years. Brazil and Colombia are the only self-sufficient countries in Latin America. Net imports from Mexico have reached at 954 Thousand MT in 2021 (up by 7.5 percent Y-o-Y in 2021)

-

Asia: Net importer with a trade deficit of approx. 0.8 MMT/year in 2021

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.