CATEGORY

Polycarbonate

Polycarbonate is a widely used resin in the electronic/electrical industry across the globe and is now gaining attention across other segments as well.Hence to understand the overall PC market across the North America, Europe and Asia, this report analyses the main drivers of a market.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Polycarbonate.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Covestro expands sustainable PC films production in Thailand

March 23, 2023European PC markets to be highly influenced by high imports

February 01, 2023Demand for PC in Asian markets to remain weak in H1 2023

January 05, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Polycarbonate

Schedule a DemoPolycarbonate Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPolycarbonate Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Polycarbonate category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Polycarbonate category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Polycarbonate market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPolycarbonate market frequently asked questions

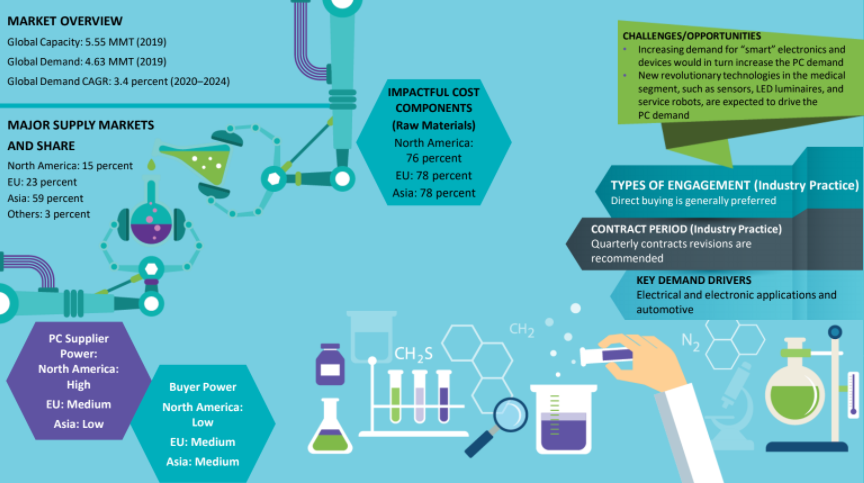

As per Beroe's analysis, the global capacity of the polycarbonate market stands at 4.95 MMT, while the global demand came around 4.02 MMT.

The global demand of the global polycarbonate market is expected to grow at a rate of 3.4 percent CAGR till 2022 to reach a valuation of $14.83 billion.

As per the polycarbonate market analysis done by Beroe, the major supply markets for polycarbonate include: North America (15 percent) EU (23 percent ) Asia (59 percent ) Others (3 percent )

Following Beroe's report and its insights, it can be said that ' the PC supplier power is the highest in North America, followed by Europe, and Asia has the lowest PC supplier power. On the contrary, the buyer power seems to be lowest in North America while both Europe and Asia fall in the medium category of buyer powers.

As per Beroe, the following five are known to be the global suppliers in the polycarbonate market: Covestro SABIC Teijin Trinseo Mitsubishi

The most preferred engagement model in the polycarbonate model is of direct buying. It's also worth noting that consortium buying isn't a common practice for CPG players.

In the market price contract, the supplier delivers the commodity at the market/benchmark price. However, in a fixed-price contract, the margin of the supplier gets fixed throughout the contract period or a fixed price is locked for the entire contract period. The contracts are generally revised after every quarter.

As per Beroe's analysis, the increasing demand for 'smart' electronics and devices is the primary challenge/opportunity as it will trigger the demand for PC. Again, the presence of different technologies within the medical segment like ' sensors, LED luminaries, etc. too will drive the PC demand.

The price of the polycarbonate is determined based on either of the two parameters: Based on the monomer contract price P (PC) = monthly contract price for feedstock + fixed component + premium Based on the index price P (PC) = Resin price quoted in the index for the month [CMAI/CDI/Platts] +/- margin% Another formula that calculates polycarbonate price is: P (PC) = Resin index price for the month + Conversion cost + Margin

As per Beroe's analysis, producer margin is highest in North America (20 ' 25 percent), followed by Europe (15 ' 18 percent), and is the least in Asia (12 ' 15 percent).

Polycarbonate market report transcript

Global Market Outlook on Polycarbonate

-

The global demand is expected to grow at 3.4 percent CAGR through 2022–2025

-

Blends of PC with other polymers, particularly ABS, polyester, and thermoformed PC films are expected to be the demand drivers during the period

Demand Market Outlook

-

Even though the global PC market is currently oversupplied, the absence of required additions inline with the expected improvement in demand may lead to higher operating rates within the suppliers during the forecast period.

Industry Best Practice : Polycarbonate

Engagement Models

-

Direct buying is the preferred engagement model in the industry

-

CPG companies outsource its packaging requirements to the converters, as it helps to focus on its core business

-

Consortium buying is not a common practice for the CPG suppliers in the resin market

Contract Models

-

Market Price Contract: The supplier supplies the commodity at a market price or benchmark price

-

Fixed Contract: The margin of a supplier is fixed throughout the contract period or fixed price is locked for the contract period

-

Contract Revisions: Quarterly contracts are generally preferred in this industry

Pricing Formula

- Based on Monomer Contract Prices

P (PC) = Monthly contract prices for feedstock + Fixed component + Premium

- Based on Index Prices

P (PC) = Resin prices quoted in the index for the month [CMAI/CDI/Platts] +/- margin%

Producer margins are observed to be the highest in North America (20–25 percent) followed by Europe (15–18 percent) and Asia (12–15 percent)

P (PC) = Resin index prices for the month + Conversion cost + Margins

Global Market Size: PC

-

The global PC market is forecasted to grow at a CAGR of 3.1 percent over 2022 to 2025 to reach $17.6 billion by 2025

-

Major drivers, such as applications in automobile, electrical and electronics segment, etc., help in the development

-

Growth in consumer goods applications is anticipated to remain modest during the period

-

The COVID-19 pandemic had an impact on the global polycarbonate market in 2020, as the lockdown measures and supply chain disruptions caused a decline in demand. However, the market is expected to recover in 2021 and beyond as the global economy recovers from the pandemic. In 2021, the demand for polycarbonate increased due to the growing demand for lightweight and durable materials in various end-use industries, especially in the automotive and electronics sectors.

Polycarbonate Global Capacity–Demand Analysis

PC demand during the forecast period is projected to witness a CAGR of 3.4 percent, owing to growth in electronics, packaging, and medical applications

Market Outlook

-

The global PC market had a total capacity of 6.58 MMT as of 2021.

-

There has been a high-capacity rationalization of PC in the US and Europe in the past, which had created some deficit in production, especially in Europe

-

Recently, China witnessed PC capacity addition of 0.10 MMT.

-

Capacity additions planned in Asia during FY 2020 are pushed to FY 2021. Capacities of about 0.93MMT is expected to have come online during 2021

Engagement Outlook

-

European and Asian buyers are recommended to engage in contractual buying.

-

For imported materials, the buyers may look for imports from the US, South Korea, and Saudi Arabia, as these regions are likely to remain as a net exporter during the forecast period

Cost Structure Analysis : Polycarbonate

-

Feedstock phenol is the major cost driver in the prices of PC. Any price change in Phenol will have a major impact on the prices of PC.

-

North America continues to have cost advantage on raw material front

-

Utility cost includes electricity, steam, water, and fuel/gas. Among these, electricity is the main utility that accounts for most of the cost incurred

-

Utilities and labor costs were observed to be low across all the geographies

Why You Should Buy This Report

The polycarbonate market research report gives the cost structure breakdown, polycarbonate price trends and forecast analysis. It gives the regional capacity share by suppliers and does a SWOT analysis of major players like Covestro, Sabic IP, Trinseo, etc. It details the polycarbonate industry drivers, constraints and technological innovations.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.