CATEGORY

Plunger Pumps

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Plunger Pumps.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

New subsidiary established by Netszch in Korea

October 17, 2022Sulzer will supply pumps for Shell's new biofuels facility in Rotterdam.

June 30, 2022New subsidiary established by Netszch in Korea

October 17, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Plunger Pumps

Schedule a DemoPlunger Pumps Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPlunger Pumps Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Plunger Pumps category is 6.60%

Payment Terms

(in days)

The industry average payment terms in Plunger Pumps category for the current quarter is 71.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Plunger Pumps Suppliers

Find the right-fit plunger pumps supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Plunger Pumps market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPlunger Pumps market report transcript

Global Market Outlook–Plunger Pumps

-

The global pump market is estimated to be $1.45 billion in 2023. The market is forecast to grow at a CAGR of 4.1 percent to $1.64 billion by 2026

-

APAC is the highest demand-generating geography with strong growth, followed by North America, MEA, and Europe

Global Market and Demand for Plunger Pump

-

The plunger pump market in 2022 stood at $1.30 billion globally. The market is projected to grow steadily at a CAGR of 4.1 percent between 2023 and 2026

-

The highest growth, in terms of application, is expected to be registered from the segments, such as water treatment, oil & gas, and chemicals & petrochemicals

Market Insights

-

The global plunger market is estimated to reach $1.45 billion in 2023, with an average growth rate at a CAGR of 4.1 percent during 2023–2026

-

Strong oil demand due to import ban on Russia will drive growth especially in Europe, as the region is boosting domestic production to lower its reliance on external sources of oil and gas as part of improving its supply chain. Overall global economy is set to dip in 2023; however, manufacturing sector, public infrastructure and oil & gas sectors are expected to grow in 2023 with strong investments. Public infrastructure investments are on the growth as a part of prior announced stimulus plans by various governments will improve the demand

-

Increasing awareness and shifting demand toward the green energy and clean fuel technologies are expected to weight down on the performance for plunger pumps from the oil & gas industry. Higher input costs for suppliers, due to hike in raw materials, such as steel and energy cost surges, are set to reflect as higher cost of products to buyers

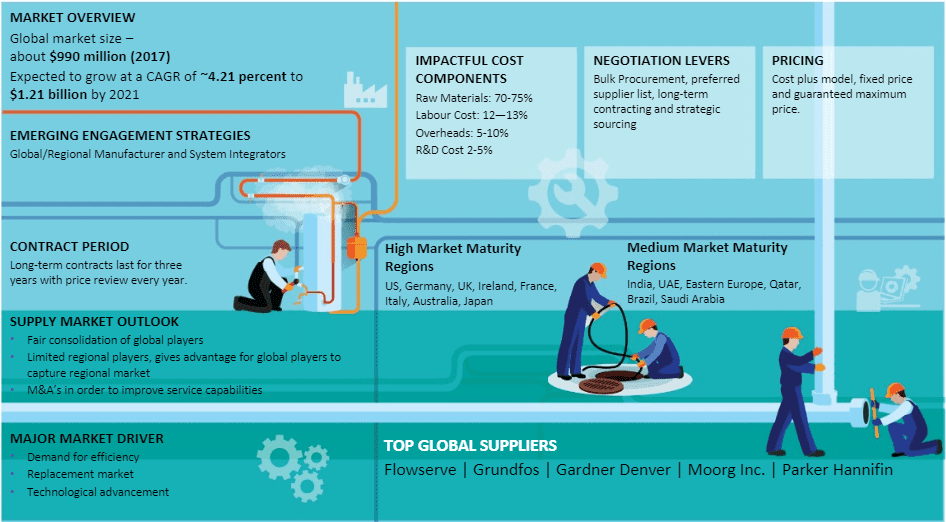

Global Pump: Market Maturity

-

The pump market is extremely fragmented and competitive, catering to a variety of industries with vast end-user segments and suppliers

-

APAC accounts for approximately 36 percent of the global plumber pump market. High maturity service providers are located in North America and Europe

Global Market Drivers and Constraints : Plunger Pumps

-

The demand for plunger pumps varies by region: In regions, such as North America and Europe, the demand is expected to be driven by the increase in oil price. In developing regions, such as Asia, the Middle East, and Africa, urbanization and investments on infrastructural development are expected to imply a major surge in demand

-

Key raw material such as steel price increases, energy cost increases and logistics issues are key constraints for the category, leading to higher product costs

Drivers

Higher efficiency

-

Unlike the piston rod pumps, a plunger pump has a stationary high pressure seal and a smooth cylindrical plunger mechanism

-

Consequently, plunger pump has an advantage over other pumps to operate efficiently at high pressure and high density fluid medium

Strong demand from the replacement market

-

As the pumps are invariably at operation all the time, the scope for aftermarket parts and services are solid. The replacement market for pump is also expected to contribute significantly to the growing demand

Technology advancements

-

Demand for specialty pumps with remote monitoring systems and efficient metering systems is also expected be a sturdy growth driver

Constraints

Input cost hikes

-

Steel price hike compared to pre-war levels will reflect high product costs. High energy costs for manufacturers will also be transferred to product prices

Regulations

-

Stringent environmental laws and regulations with regard to water and waste disposal and air emission

-

Non-industrial pump manufacturers in developing countries enter the attractive industrial pump segment by taking advantage of their low-cost manufacturing base and distribution network. It indicates a major threat to the global industrial pump manufacturers

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now