CATEGORY

Plant Equipment

Plant equipments are used in warehouses and storage location to move the goods in and around the facility. Plant equipment comprises of forklifts, cranes and small loaders

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Plant Equipment.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Mitsubishi Logisnext parent company buys stake in Arizona capacitor maker

April 19, 2023Clark Expands Electric Forklift Series With Li-ion Technology

April 12, 2023Konecranes' new Zero4 program to receive EUR 70 million from Business Finland to unlock industrial productivity

April 05, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Plant Equipment

Schedule a DemoPlant Equipment Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPlant Equipment Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Plant Equipment category is 6.70%

Payment Terms

(in days)

The industry average payment terms in Plant Equipment category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Plant Equipment market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPlant Equipment market report transcript

Global Market Outlook on Plant Equipment

-

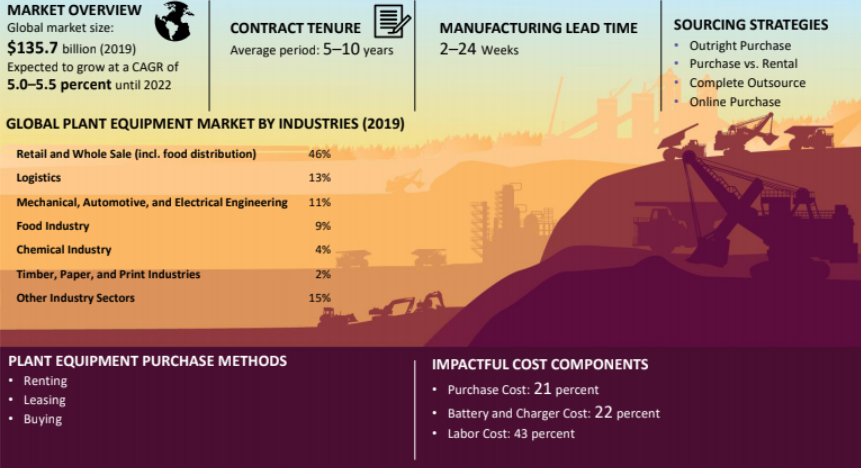

The global plant equipment market is estimated to be valued at $25.6 billion in 2022, and it is expected to grow at a CAGR of 5.7-6.1 percent between 2019 and 2024, driven by globalization and expected infrastructural growth in key developing countries

-

Global plant equipment demand is expected to be driven by emerging countries (that accounts for 40 percent of the global order), such as China, Japan, and India, due to ongoing industrialization and increasing global trade activity in these markets

-

Growth in mature markets, such as Europe and North America, is expected to increase, but at a slower rate of 4 percent, whereas APAC is expected to grow at a CAGR of 6-8 percent until 2024

Market Overview : Plant Equipment

-

APAC is the major market for plant equipment, followed by Europe, the Middle East and Africa, and the Americas

-

Europe and America were the early adopters of plant equipment for different industries and the trend caught up across different countries, leading to the region’s dominance in the global plant material handling market

-

The plant equipment market is estimated to be valued at approx. $25.6 billion in 2022, and it is expected to grow at a CAGR of 6 percent during the next 3 years.

-

The market for fork-lifts contributes to nearly 75 percent of the plant equipment market and is expected to grow at 6 percent and 7 percent, respectively

-

The major end-user industry for plant equipment is retail and whole sale (including food distribution), logistics, mechanical industries, holding 70 percent of the market

Market Overview :Supply Landscape (Forklift)

-

The most dominant market for forklifts constitutes APAC, followed by Europe, North America, the Middle East, and Africa.

-

The class 4/5 is the largest segment in the forklift market with a market share of over 35% as of 2022.

-

The major end-use industry of forklifts involves automotive logistics, warehousing, and manufacturing.

-

The forklift market is valued at approx. $19.84 billion in 2022, and it is expected to grow at a CAGR of 6.43 percent during the next 2 years until 2024.

-

Forklift remains the largest market for plant equipment, due to the presence of emerging economies, predominantly in China, and Japan.

-

This segment's growth is being driven by benefits such as minimized product/equipment damage, increased productivity, fewer workplace accidents, and better traffic management in warehouses. The expansion of warehouses and industrial production facilities is projected to provide several chances for market expansion in the future.

Cost Drivers : Plant Equipment

-

Raw material constitutes 60–70 percent of the cost structure of the plant equipment categories, namely forklifts, cranes, and small loaders

-

The prices of HRC steel and aluminum are expected to increase during Q1 2023, owing to surge in raw material prices and increase in feedstock activities

-

Energy prices are expected to increase 4–6 percent, owing to the increase in industrial power demand in the US and the EU, whereas in China, energy prices are expected to relax, due to reduced consumption by the mills as a result of lockdown activities

-

Industry players are expecting an increase in sales of forklifts during 2023 from the logistics and warehousing industry, owing to an increase in demand for online shopping. Sales for electric forklifts and use forklifts are expected to increase, due to cost savings initiatives taken by the companies

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.