CATEGORY

Pipes, Valves & Fittings

Pipe- A pipe is a long, round, hollow object, usually made of metal or plastic, through which a liquid or gas can flow. Valves- A valve is a device that regulates, directs or controls the flow of a fluid (gases, liquids, fluidized solids, or slurries) by opening, closing, or partially obstructing various passageways Fittings- It is a machine component, piping or tubing part that can attach or connect two or more larger parts

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Pipes, Valves & Fittings.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoPipes, Valves & Fittings Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Pipes, Valves & Fittings category is 7.30%

Payment Terms

(in days)

The industry average payment terms in Pipes, Valves & Fittings category for the current quarter is 72.9 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Pipes, Valves & Fittings Suppliers

Find the right-fit pipes, valves & fittings supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Pipes, Valves & Fittings market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPipes, Valves & Fittings market report transcript

Global Industrial Pipes, Valves & Fittings Outlook

-

The global industrial PVF market is estimated at around $72.3 billion for 2022E*, and the market is expected to grow at a CAGR of 4–5 percent between 2020 and 2024

-

The oil & gas industry is one of the major end-users for PVF, and it is estimated to be around $7.8 billion for 2021*

Global Industrial PVF: Drivers and Constraints

-

Recovering shale gas production in North America will drive the demand for OCTG pipes, capable of sustaining greater tension, compression, and torsion.

-

Growing the oil & gas industry in Australia will boost the demand for PVF in this region.

Drivers

Market growth

-

Large-scale inter-regional oil & gas projects will drive the demand for high performance corrosion-resistant steel and plastic pipes

-

Replacement of manual valves with smart valves drives the market in the developed regions

-

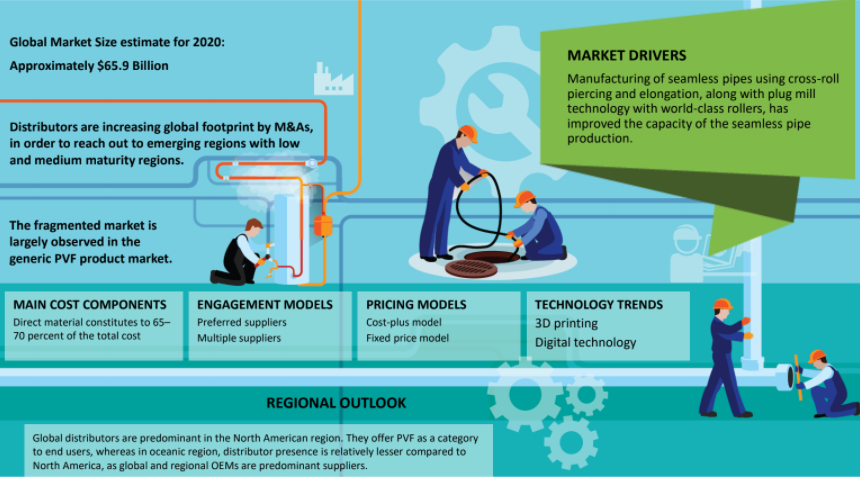

Manufacturing of seamless pipes using cross-roll piercing and elongation, along with plug mill technology, with world-class rollers, has improved the capacity of the seamless pipe production

Stringent environmental and safety regulations

-

Environmental, health, and safety regulations, such as VOC limitations, require end-user industries to upgrade to newer and better PVFs

Constraints

Duplication of technology

-

Patent violations and copies of the original by local suppliers would hamper the growth of the valve market, due to the copies being relatively cheaper

Labor disturbance

-

The labor market in emerging countries is mostly unorganized, and there are increasing occurrences of shutdowns, leading to loss of productivity

Industrial PVF: Cost Structure

-

Labor costs have a minimal increase in many developed economies, where highly engineered castings are made

-

Raw material prices are sensitive, and any upward movement of price is transferred to the buyers, as future trading or hedging of essential raw material is a rare practice among PVF manufacturers

-

Material is the major cost driver of PVF, and it accounts for approx. 65–70 percent of the total cost. The application of PVF determines which material should be used, as different materials have their own unique properties

-

Based on application of PVF, the following factors determine the cost:

–Material of body and trim

–Size of PVFs

–Pressure rating

–Temperature rating

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now