CATEGORY

Phenol

Phenol also known as carbolic acid is an organic compound widely used in manufacturing of Bisphenol A that finds its application in plastics for automobiles and solvents for paints & coatings. . This report captures the key market and industry trends of phenol with insights on major drivers and constraints.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Phenol.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Bluestar Harbin in China is set to shut down its phenol plant due to plant maintenance activity

July 27, 2022Bluestar Harbin in China is set to shut down its phenol plant due to plant maintenance activity

July 27, 2022Bluestar Harbin in China is set to shut down its phenol plant due to plant maintenance activity

July 27, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Phenol

Schedule a DemoPhenol Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPhenol Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Phenol category is 10.00%

Payment Terms

(in days)

The industry average payment terms in Phenol category for the current quarter is 52.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Phenol market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPhenol market frequently asked questions

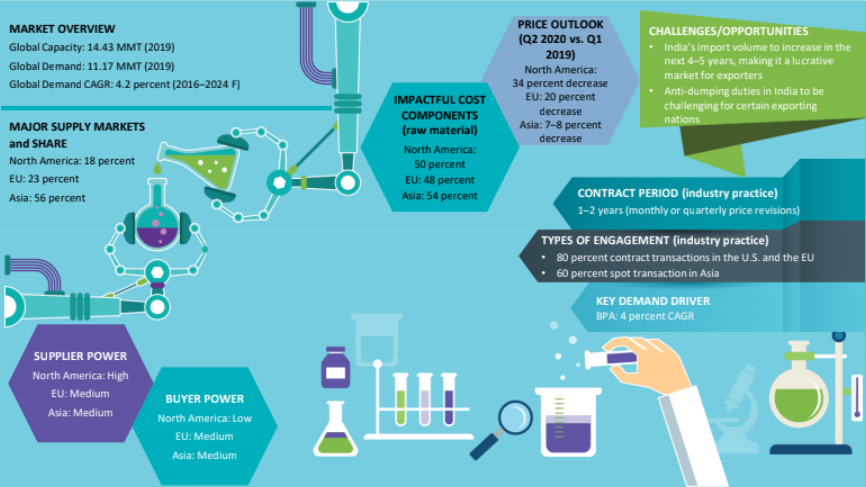

The global phenol market is expected to be valued at over $14 billion by the end of 2022. The phenol market is expected to grow at a CAGR of 3 percent over the forecasted period according to industry specialists until 2024. By 2023, the phenol derivatives market is expected to grow at a faster pace at 3.7 percent. The North America phenol market production size is 2.6 MMT while that of the EU is 3.3 MMT. The production size of the Asia-Pacific region of specialty solvents is 8.3 MMT. According to market share, the phenol market is dominated by Asia with 56 percent while the EU and North America have a share of 23 percent and 18 percent respectively.

In the phenol market, US exports to certain parts of Europe. The EU exports from Finland and Belgium. The regions that import in the hydroxybenzene market include Germany, India, China, and the Netherlands.

The phenol and resins market is likely to see growth until the forecasted period. According to experts phenolic resins, carbolic acid, and phenol formaldehyde resins will drive the market. The construction, automobile, chemicals, and manufacturing industries will drive the growth of the phenol market. Additionally, BPA usage increase is another driver of the phenol market. In terms of regions, Asia will drive the growth of the phenol market.

Stringent regulations in certain regions such as the EU and North America can slow down the growth of the phenic acid market.

The aromatics and chemicals price trend indicates that the price might decrease due to excess supply that has been consistent for the past few years. Another price trend involves phenol procurement. When the Beroe experts looked into the price difference, they found that there was a price decrease in most regions such as the EU and North America. According to experts, this can continue provided there is an oversupply of phenol in the market. When this seizes to be, then the price will rise.

Phenol market report transcript

Global Market Outlook on Phenol

-

The global phenol market is expected to grow at the CAGR of 3 percent during 2018–2025F

-

The growth is driven by demand from Asia, which is expected to grow at 4.1 percent, due to an increase in the usage of BPA (used to make polycarbonates and epoxy resins)

-

The BPA demand is expected to be driven by automobile (3–4 percent) and construction (2–3 percent) industries for the next 2–3 years

Demand Market Outlook

-

The global phenol market has excess capacity, and it is expected to increase over the next 2–3 years, due to capacity additions, mainly in Asia

Industry Best Practices

-

The top buyers and sellers negotiate monthly phenol contract prices based on benzene contract prices, which are usually fixed at the start of a new month. These are later released via public domain or IPROs, which are used as reference by other market participants for further negotiations.

North America

-

In the US, the contract period lasts for 1–2 years, with a scope for monthly and quarterly price revisions

-

Benzene contract prices are used as a starting point to arrive at phenol prices

EU

-

Being a balanced market and a key trade destination, importers (usually, small volume) engage in spot buying, while large-volume buyers are in contract ties with domestic producers

-

In the EU, similar to the US, benzene contract prices are used to arrive at phenol prices

APAC

-

Both spot and contract buying are followed; large number of distributors and traders import material from the US, which has increased the inclination of buying patterns toward the spot

-

Contract buying is prevalent in China, South Korea, and Japan, where both large-volume buyers and large capacities are installed throughout Asia

Global Market Size: Phenol

-

The global phenol market was estimated to be ~$21.4 billion in 2021, indicating a rise of nearly 2.8 percent Y-o-Y

-

Steep increase in the downstream demand was identified in 2021, due to a resurgence in consumer activities

-

The phenol market was driven primarily by the robust demand from the construction and household durable sectors for phenol formaldehyde resins and polycarbonates in 2021

-

In 2021, the demand remained high for downstream bisphenol A, increasing from the automotive sector, as consumer activities were boosted due to resurgence of economies

Global Capacity–Demand Analysis

-

Current market scenario (supply market): Phenol supply was observed to be tight, as suppliers have reduced their operating rates since March 2022. The supply in Europe is anticipated to stabilize by end of Q4 2022

-

Key trends in downstream demand: Rising disposable income values in the Asian population have improved the demand for the automotive and construction sectors, subsequently increasing the demand for phenol and its downstream derivatives, like BPA, polycarbonates, epoxy resins, and phenol-formaldehyde resins

Global Demand by Application

-

High demand growth in Asia: The rising income and the increased purchasing power of people in the developing countries of APAC are expected to attract more investments in automotive, construction, and chemical industries, thus improving phenol growth

-

In Europe and North America, the demand is expected to grow at a steady rate, as a result of stringent government norms regarding downstream BPA and epoxy resins, owing to its harmful effects against the environment

Global Imports

-

The Netherlands and Germany have been net importers of phenol for the past five years, mainly due to lack of domestic production units in the Netherlands and insufficient capacities in Germany (both the countries have the largest downstream epoxy resin production units installed)

-

China was found to be the largest importing country in Asia, owing to the presence of a strong downstream demand compared with other countries

Global Exports

-

South Korea and Belgium have been the net exporters in 2020 with South Korea trading with Asian partners, while Belgium was primarily involved in intra-trade with Germany and the Netherlands

-

Most of the countries in the EU are small-volume buyers, whose requirements are being met by Belgium, Finland, and Netherlands, which have less phenol downstream capacity

Cost Structure Analysis

-

The average operating costs are high in the EU, due to less phenol producers being backward integrated to benzene

-

Asia is the cost-effective region, due to cheaper feedstock and labor, and it has one of the lowest electricity prices

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.