CATEGORY

Pharmacovigilance Services

Evaluation of patient outcome to mange drug adversities.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Pharmacovigilance Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoPharmacovigilance Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPharmacovigilance Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Pharmacovigilance Services category is 5.40%

Payment Terms

(in days)

The industry average payment terms in Pharmacovigilance Services category for the current quarter is 73.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Pharmacovigilance Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPharmacovigilance Services market report transcript

Global Market Outlook on Pharmacovigilance Services

MARKET OVERVIEW

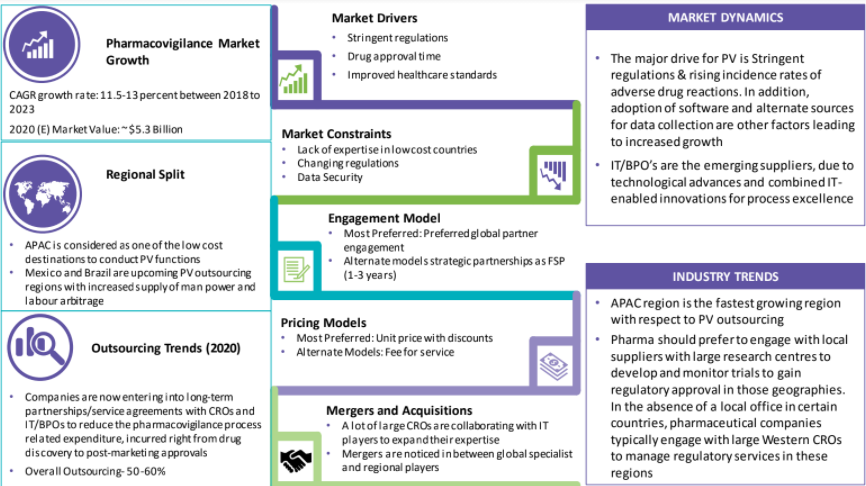

Global Pharmacovigilance market: $ 6.9 Billion

Global Demand CAGR: ~ 11.5–12 percent (2021–2028)

-

The APAC is considered as one of the low-cost destinations to conduct PV functions, while South America, in particular Mexico and Brazil have become the upcoming PV outsourcing regions, owing to increased supply of man power and labor arbitrage.

-

Pharma could prefer to engage with local suppliers with large research centres to develop and monitor trials to gain regulatory approval in those geographies. In the absence of a local office in certain countries, pharmaceutical companies typically engage with large Western CROs to manage regulatory services in these regions

Current Trends

-

Increased emphasis on drug safety and faster submissions for regulatory approval are among the key drivers of the need for innovation in the PV space. Greater dependency is seen on PV tools and software to improve process and drive value for better vigilance.

Global Pharmacovigilance Market: Drivers and Constraints

Drivers

Drug approval time

-

The drug approval is a time, cost, and documentation centric process; thus, buyers prefer outsourcing. This way, they reduce cost and have time to work on their core competencies.

Improving Standards

-

Frequently improved regulations including medical device regulatory systems, drug price control, and GMP standards are expected to drive the regional market growth over the next few years.

Increased incidence of ADR (Adverse Drug Reaction):

-

As per the data released by FDA, between 2014 and2019, the number of adverse events reported increased by over 91 percent.

Constraints

Data Security

-

High risk associated with data security along with the hidden costs and huge price fluctuations offered by various CROs might hamper the market growth.

Unforeseen Events

-

The current pandemic situation and other trade related issues would generally have an impact on the growth of the market.

Quality Issues

-

Lack of skilled labor in the ever changing automated and analytics driven requirement hinders the market growth.

Cost Structure of Pharmacovigilance

-

As an FTE driven industry, labor costs contribute to a larger section of the pie (around 40–45 percent), also suggesting a volatile market with unpredictable work flow. Avoiding sourcing to the local experts for well established and near-shore markets one may curb the money spent on these field experts.

Regional Analysis: Pharmacovigilance Services

-

Currently, North America is still the leader in pharmacovigilance services outsourcing as most pharmacovigilance labor force is widely available and CROs are based in the U.S. North America dominates the global market with an approx. market share of 54 percent

-

Pharmaceutical companies in North America and Europe have also been outsourcing pharmacovigilance services to a significant degree over the last decade. IT companies based in India providing pharmacovigilance service, is a key sourcing location to watch out

Why You Should Buy This Report

The report on the pharmacovigilance market trends provides the industry overview of different geographies, including North America, Latin America, APAC, Europe, and the Middle East. The research study underlines the key drivers and constraints that affect the global pharmacovigilance market forecast and offers Porter's Five Force Analysis for developed and emerging regions. It discusses the best acquisition and innovation practices and the primary factors for successful sourcing. Furthermore, it elucidates the key performance indicators (KPI) with pricing structure assessment in the global pharmacovigilance market.

Methodology for Writing This Report

Beroe gathers intelligence through primary sources that include industry experts, researchers, and consultants, as well as current suppliers, producers, and distributors. Secondary sources can include business journals, newsletters, magazines, market research data, company sources, and industry associations. Following data collation, analysis, and strategic review, the Final Research Report is published on Beroe LiVE.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.