CATEGORY

Pharmaceutical Distribution in Europe

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Pharmaceutical Distribution in Europe.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

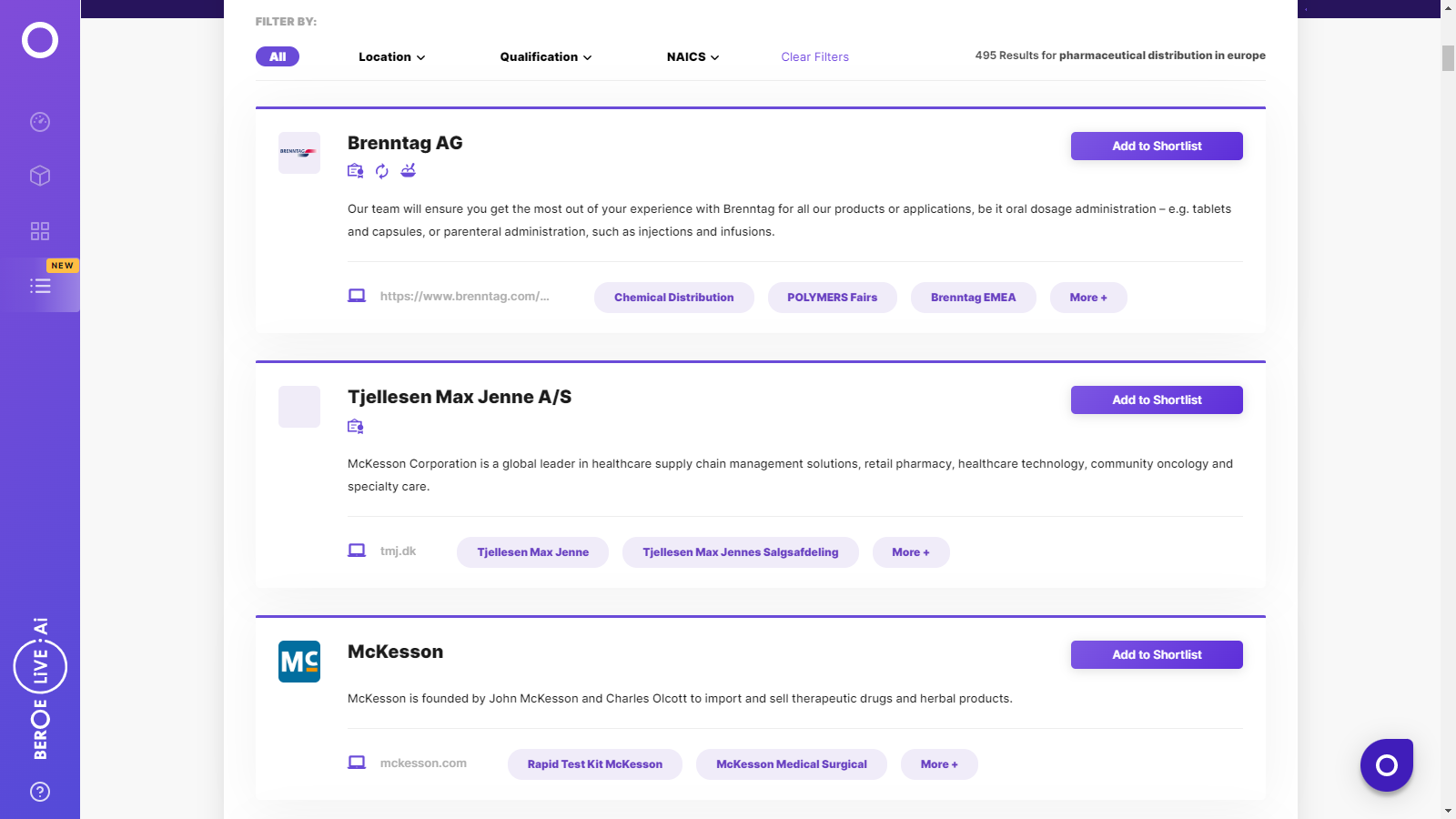

Pharmaceutical Distribution in Europe Suppliers

Find the right-fit pharmaceutical distribution in europe supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Pharmaceutical Distribution in Europe market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPharmaceutical Distribution in Europe market report transcript

Regional Market Outlook on Pharmaceutical Distribution in Europe

Pharma Distribution: Austria

Industry is expected to have low bargain and negotiation power, as the pricing mechanism is regulated (average margin of 10 percent) and a consolidated supply market (the top three wholesaler's share is about 77 percent).General practice is to engage with a single wholesaler; however, international manufacturers deal with more than one wholesaler, based on the product portfolio.

Engagement Model

- Single wholesaler for pharmaceutical products is usually adopted

- Majority of the pharmaceutical distribution is through the channel of full-line wholesalers

Distribution Services

- Fee for service is the prevalent pricing model

- Pharmaceutical companies are charged on a fixed commission basis by pharmaceutical wholesalers

Wholesaler/Distribution Margin

- The average margin for wholesalers is 10 percent

Sales Incentives

- Non-monetary incentives include training and business education

Pharma Distribution: The Netherlands

Industry is expected to have medium bargain and negotiation power, as the pricing mechanism is negotiable by wholesalers (average margin of 8–12 percent), with a fragmented supply market (the top two wholesaler's share is 40–45 percent).Distribution to hospitals happens through either wholesalers or directly by manufacturers. For direct distribution to hospitals, pharmaceutical companies use wholesaler as logistics service providers.

Engagement Model

- Manufacturers engage with one to two full-line wholesalers for the distribution of products, and the minimum contract period of engagement is three years

- Wholesalers act as a pre-wholesaling distribution partner for direct DTP and hospitals

Distribution Services

- Fee for service is the preferred pricing model

Wholesaler/Distribution Margin

- Wholesaler's margin is unregulated and has no statutory markups on wholesale level, like other EU countries. Wholesalers have entered into a private negotiation with manufacturers

- Wholesaler's margin is 8.5–11.8 percent.

Sales Incentives

- Sales incentives paid to wholesalers is around 10–15 percent of the sales volume

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now